Table of Contents

What Is Structured Deposits?

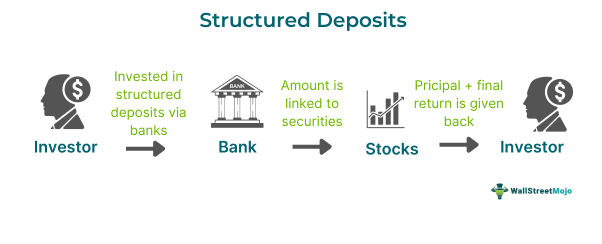

Structured deposits are an amalgamation of deposit and investment structures forming a single indivisible financial product. The return of such products depends on the market performance of the underlying financial products. In a nutshell, it can be understood as a structured product with features of both deposits and equities.

The main objective of a structured deposit account is to ensure the investor's initial investment principal. Hence, it operates as a term deposit linked to an underlying asset, which is typically currency, stock securities, or commodities. The initial investment is guaranteed at the end of maturity, but the final return is based on the underlying asset's market performance.

Key Takeaways

- Structured deposits are investment products that are a combination of deposits and equities. The money is linked to securities for potential returns.

- At maturity, the principal amount is guaranteed, but the final return depends on the market performance of linked assets, commonly stocks, currencies, and commodities.

- Due to guaranteed total principal repayment and the potential for higher returns, investors are more attracted to structured deposits than to structured notes, fixed deposits, and other financial instruments.

- If the underlying assets do not perform as expected, investors may face credit risk, liquidity risk, and early termination risk, which can lead to a loss of capital and lower returns.

Structured Deposits Explained

Structured deposits are hybrid investment products because they unify multiple types of investment instruments in one single financial product. When an investor chooses a structured deposit, they buy in through a bank or financial institution by depositing the money with them. The bank further links the money to a couple of securities, indices, commodities, stocks, and currencies. It turns the structured deposit into a derivative because now its value relies on the performance of the underlying asset in the market over time. Typically, the structured deposits accounts have a duration range from two weeks to ten years. The money gets locked in for the maturity period.

Once the maturity period is over, the investor receives the principal amount back with a final return based on how well or poorly the underlying assets performed during the lock-in period. If an investor decides to withdraw funds before the maturity date, they may face lower returns, and such activities are subject to market, liquidity, and credit risk.

Although the minimum deposit value for such deposits is higher than for fixed deposits, it is highly possible that if an investor waits until maturity, they can gain higher returns compared to fixed deposits. These products are good for people who cannot monitor different financial markets. They also help with portfolio diversification, letting people explore the markets.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples

Here are two examples to understand the concept better:

Example #1

Suppose David is looking for an investment product that will not only reap him good returns but also allow him to avoid constantly monitoring his portfolio. Upon research, he came across structured deposits and liked the investment product.

David currently has $27000 with him. He goes to a bank and invests his money in this deposits with a nine-year long-term maturity period. The money invested by David will be linked to different financial indices, securities, commodities, and currencies, and the return will depend on how all these perform.

After nine years, David visits the bank again; he not only receives the main principal amount back but also learns that he has earned an 18% return on his investment during these nine years. So, David receives the initial $27000 back at maturity along with $4860 (18% return) from his structured deposit investment.

It is a simple example; it is possible that if the underlying assets had not performed well, David would not have earned good returns or even realized losses in times of recession or bank crisis.

Example #2

According to a 2020 Reuters article, China was heavily curbing company-structured deposits. During the period, China's insurance and banking watchdog suggested banks reduce the marketing of high-yield structured deposits by firms. In the first quarter of 2020, outstanding deposits hiked 26% to $1.72 trillion, partly driven by companies that borrowed cheaply from banks and used the proceeds to invest in high-yield deposits.

Chinese banks aggressively marketed structured deposits as a hybrid of traditional deposits and high-return investment products to attract funds. However, the promised returns damaged their profitability, and the banks became reluctant to minimize lending rates. Some of the mid-sized banks received verbal orders to reduce their structured deposits by year-end.

Advantages And Disadvantages

The advantages are as follows:

- Structured products aim for potentially higher returns compared to fixed deposits.

- It does not require any annual management feed or front-end charges.

- The deposit is used for portfolio diversification into a variety of underlying assets.

- As a whole, these deposits have low to medium risk appetite.

The disadvantages are as follows:

- There is no certainty for returns; if the underlying asset does not perform well, no yield is gained.

- The bank guarantees an investor's deposit balance, but if the bank goes bankrupt, the investor may face the risk of losing the deposit balance.

- The deposit may get linked to the underlying asset’s value, so if the asset falls, it may result in capital loss.

Structured Deposits Vs Structured Notes

The main differences between structured notes and deposits are:

| Structured Deposits | Structured Notes |

|---|---|

| Receives full principal back at maturity. | Investors may lose a portion of the principal in case the linked underlying securities perform badly. |

| They mostly have variable returns, but they can be fixed as well, depending on the structure. | There is a capital appreciation based on the underlying asset’s performance. |

| These are considered safer compared to structured notes, given that principal repayment is guaranteed. | They need to be safer. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.