Table of Contents

What Are Strategic Options?

Strategic options refer to the various alternatives or plans undertaken by a business entity to attain its long-term objectives. Such strategies help companies survive in the market while providing them with a competitive edge. Moreover, it aids the business in efficiently dealing with the external environment situations.

With the development of new technologies, the business world is evolving rapidly, which necessitates companies to innovate and adopt strategies that make them more competitive and sustainable. Moreover, such initiatives help organizations manage the risks and challenges of the external environment while creating value in the long run to drive business growth and success.

Key Takeaways

- Strategic options are the various alternatives that a company can consider to achieve its long-term business objectives.

- Such a well-planned course of action makes a business more competent, sustainable, and thriving in the long run.

- The different kinds of strategic options available to businesses include diversification, integration, divestiture, joint venturing,

- restructuring, product development, harvesting, turnaround, innovation, liquidation, and market development.

- Some of the prominent techniques of strategic options analysis are the Ansoff matrix, BCG matrix, SWOT analysis, Porter's generic strategies, innovation matrix, balanced scorecard, and Pareto analysis.

Strategic Options in Business Explained

Strategic options in strategic management refer to the development of various alternatives or plans of action that meet the long term organizational goals. Such decisions aim to capitalize on new opportunities and address the challenges of the external environment to foster growth and success in the long run. Companies need to be careful while implementing significant decisions since they impact the overall organization, including its profitability, operations, finances, and even existence (positively or negatively). Therefore, strategic options analysis plays a critical role in planning such decisions for positive outcomes.

Strategic management is required everywhere, whether in human resources, finance, marketing, or management. While strategic implementations often involve considerable capital, resources, and efforts, they must be systematically planned and executed in a timely manner. However, such decisions are often situational, and different problems require different strategies. Therefore, it is essential to interpret the prevailing circumstances clearly. Thus, considering various strategic options is an indispensable part of an organization that thrives on becoming competent and expanding its operations globally.

Types

The strategic options undertaken by a company frame its present and future. Indeed, most of these decisions are irreversible. The prominent strategies a business can adopt include:

- Diversification: The business entities diversify their product line to expand their operations into new markets and increase their market share.

- Product Development: A firm can research, design, test, and launch an innovative product or service that solves a significant problem pertaining to the market.

- Liquidation: As the company ceases to operate or shuts down due to bankruptcy or any other reason, it can sell off its assets.

- Restructuring: Sometimes, companies need to revise their complete organizational structure, operations, and processes with the changing business environment to become more efficient and profitable.

- Divestiture: The organization can sell off one or more of its subsidiaries or units (the underperforming ones) to remain profitable and maintain its competitiveness in the market.

- Turnaround: During the phase of financial distress, the companies can divest some of their assets or curtail their expenses to a certain extent for their existence or survival.

- Innovation: Companies that remain creative and innovate new products and services can remain sustainable and competent in the long run.

- Harvesting: Such a strategy aims to run a business with minimalistic resources, capital, and assets by selling off unnecessary assets, thus ensuring more cash flow for new investments.

- Joint Ventures: One of the strategies is to partner with another company to fulfill shared financial and business objectives.

- Integration: The horizontal or vertical integration strategies like mergers and acquisitions enable corporate expansion across different markets and product segments.

How to Develop?

The development of strategic options at the corporate level requires proper planning and a systematic approach. It begins with identifying the various threats and opportunities possessed by the external environment. The next is prioritizing a particular situation and devising potential strategies in response, for which the companies need to perform the strategic options analysis. Last is determining and following the most suitable plan of action.

Let us now go through the various techniques that aid in developing various strategic options:

- SWOT Analysis: One of the direct ways is to assess the Strengths (S), Weaknesses (W), Opportunities (O), and Threats (T) of the company for planning a strategy that employs its strengths and overcomes the weaknesses to capitalize on potential opportunities and deal with the various threats.

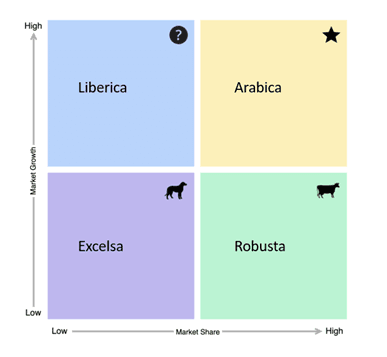

- BCG Matrix: The matrix developed by the Boston Consultancy Group (BCG) evaluates the company's products or services on the basis of their market growth rate and market share into four categories, I.e., cash cows, stars, dogs, and question marks.

- Ansoff Matrix: The Ansoff matrix analyzes the need to change the product portfolio based on four quadrants, including market penetration, market development, diversification, and product development.

- Porter's Generic Strategies: It is a strategy to accomplish a competitive edge in the market by becoming the market leader.

- Innovation Matrix: The idea here is to innovate new products or services by a simple process of think, strategize, and act.

- Canvas Strategy: Also known as the Blue Ocean strategy canvas, this technique evaluates whether the strategic moves adopted in the existing markets would be feasible in the new market as well.

- Pareto Analysis: In this technique, the researcher analyzes various possible strategic alternatives for the advantages it offer in a particular situation.

- Balanced Scorecard: This measure centralizes the organizational vision to frame strategies in that direction.

Examples

As we move ahead, let us now have a look at some real-life scenarios that require brainstorming and implementing strategic options for organizational growth:

Example #1

Suppose ABC Co. Ltd. Is a coffee bean processing company. The management performed a BCG matrix analysis of its various product categories to decide on further business strategies. The matrix so formed is as follows:

Thus, the company plans to divest from the unit producing the Excelsa coffee variant since it has the lowest market growth and share. Thus, the idea is to free up the capital from this segment and invest that money into increasing the market share for the Liberica coffee products that have a high market growth.

Example #2

According to an article in TradingView, on March 11, 2024, OncoZenge AB announced its partnership with Eurosin Capital AB to explore strategic opportunities for introducing BupiZenge™ in China, driven by a significant market potential. With over 4 million annual cancer diagnoses in China, the demand for non-opioid pain relief solutions such as BupiZenge™ is evident. The recent filing of a patent extending protection until 2045 strengthens OncoZenge's global positioning for partnerships. Eurosin Capital specializes in Nordic-Asia transactions; it aims to identify the ideal partner for BupiZenge™ in China, considering potential collaborations such as divestment of rights, joint ventures, or licensing agreements. This collaboration expedites BupiZenge's entry into the Chinese market, offering improved pain management options and potential commercial benefits.

Importance

In the present era of intense competition, the organizations need to plan their course of action for the following reasons carefully:

- Long-Term Goal Achievement: Companies often develop strategic options to realize their long-term objectives.

- Competitive Advantage: Such plans differentiate a business entity from its competitors, enabling it to capture a larger market share.

- Informed Decision Making: A well-planned strategic move provides a clear direction to the teams and eases the business decision-making process.

- Innovative Approach: Such initiatives drive innovation and creativity by developing unique plans, ideas, and solutions.

- Risk Management: The organizations devise suitable strategies to mitigate the potential risk arising due to excessive competition, changing market dynamics, and external environment threats.

- Critical Problem Solving: It further aids in solving complex problems or dealing with external threats to ensure business sustainability and existence.

- Change Management: The businesses function in a dynamic environment, and therefore, adopting different strategies makes them adaptable and flexible to such changes.