Here's a comparison between strategic analysis and intuitive thinking:

Table Of Contents

What Is Strategic Analysis?

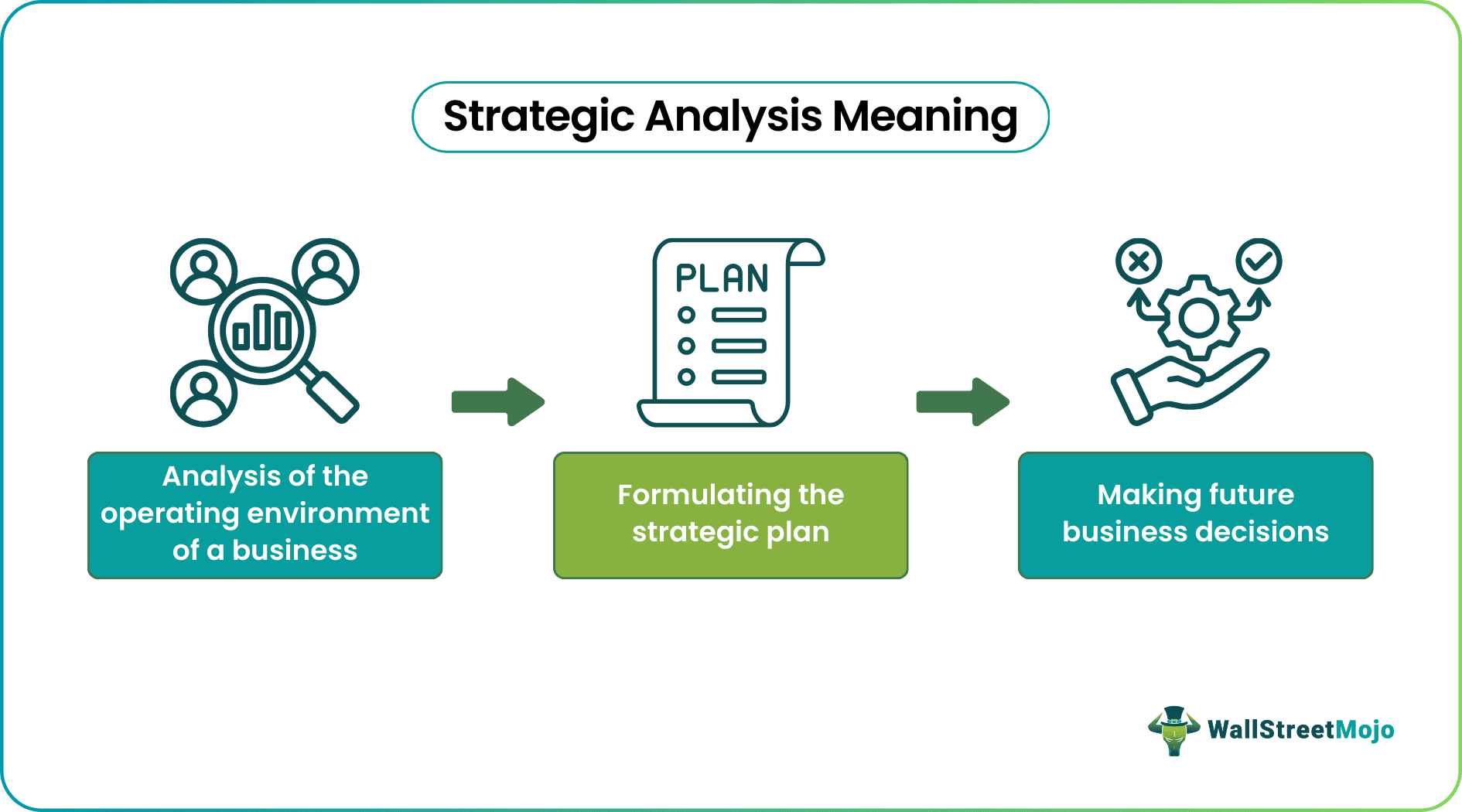

Strategic analysis in finance refers to the process of evaluating and assessing the financial health, performance, and outlook of a company or organization from a strategic perspective. It involves analyzing financial data, competitive dynamics, and other relevant factors to make informed decisions about the company's future direction and potential growth opportunities.

It helps management and stakeholders make informed decisions about resource allocation, investment strategies, growth initiatives, and risk management to enhance the company's financial performance and achieve its strategic objectives. Shareholders, investors, lenders, and other stakeholders rely on a company's financial health to indicate its stability.

Key Takeaways

- The strategic analysis provides a structured framework for making informed financial decisions by analyzing data and information.

- It offers a comprehensive view of a company's financial health, market dynamics, opportunities, and risks.

- The strategic analysis identifies and assesses various risks, helping companies develop strategies to mitigate potential challenges.

- Analyzing market trends and industry dynamics helps companies identify growth opportunities and areas for expansion.

- It guides efficient resource allocation, ensuring that resources are directed towards initiatives that align with the company's goals.

How Does Strategic Analysis Work?

Strategic analysis can be considered the careful dissection and examination of a company's financial landscape to decipher its past performance, current position, and future prospects. This involves scrutinizing financial data, industry trends, competitive dynamics, and external influences to devise a comprehensive roadmap for the company's financial decisions and actions.

Strategic analysis in finance operates as a navigational compass for businesses, helping them chart their course through the complexities of the financial world. Here's how it works:

- Gathering Data: The process starts with collecting a wide array of data, including financial statements, market research, and competitive intelligence. This data forms the foundation for the analysis.

- Breaking Down Financials: Experts delve into financial statements to extract meaningful insights. They calculate various ratios and metrics that provide a snapshot of the company's financial health, like how efficiently it uses its assets, profitability, and ability to meet short-term obligations.

- Contextualizing Industry Trends: Analysts examine the company's performance within the broader industry context. They study market trends, consumer preferences, and technological advancements to identify opportunities and challenges specific to that industry.

- Spotting Strengths and Weaknesses: Analysts identify the company's internal strengths and weaknesses, such as a skilled workforce or outdated technology, through tools like SWOT analysis. They also assess external opportunities (like a growing market segment) and threats (like regulatory changes).

- Comparative Analysis: A comparative analysis is performed to understand where the company stands in relation to competitors. This entails benchmarking financial metrics against those of key rivals to uncover relative strengths and areas that need improvement.

Components

Let's break down the components of strategic analysis:

- Risk Assessment: Financial risks come from various sources, such as market volatility, credit defaults, or operational disruptions. A thorough risk assessment identifies potential vulnerabilities and helps develop strategies to mitigate or manage these risks.

- Forecasting and Projections: Analysts use historical data and trends to create financial forecasts. These projections aid in making strategic decisions, such as resource allocation, budgeting, and long-term planning.

- Stakeholder Analysis: Understanding the expectations and needs of various stakeholders—shareholders, creditors, customers, and employees—helps shape financial strategies that align with their interests.

- Capital Budgeting: This involves evaluating potential investment opportunities and projects. Analysts assess the expected returns, risks, and alignment with the company's strategic goals to make informed decisions on allocating capital.

- Long-Term Financial Planning: Developing strategies to ensure the company's financial sustainability over the long term. This includes decisions related to financing options, capital structure, dividend policies, and investment in growth initiatives.

Tools

Some tools used in the strategic analysis:

- Financial Ratios: These are mathematical relationships between economic variables used to assess a company's financial performance. Examples include liquidity ratios (e.g., current ratio), profitability ratios (e.g., return on equity), and leverage ratios (e.g., debt-to-equity ratio).

- SWOT Analysis: This tool helps evaluate the firm’s strengths and weaknesses, as well as external opportunities and threats. It provides a holistic view of the company's position in the market.

- Porter's Five Forces: Developed by Michael Porter, this framework analyzes the competitive forces within an industry, including the threat of new firms, the bargaining capacity of buyers and suppliers, the threat of substitutes, and the rivalry among competitors.

- PESTLE Analysis: This tool examines the external macro-environmental factors that can impact a company—Political, Economic, Social, Technological, Environmental, and Legal.

- Scenario Analysis: This involves creating scenarios to understand how various factors could impact a company's financial performance. It helps in preparing for other potential outcomes.

Process

A concise description of the strategic analysis process is as follows:

- Data Collection: Gather relevant financial statements, industry reports, market trends, competitor information, and economic data.

- Financial Statements Analysis: Scrutinize financial statements, calculate critical ratios for liquidity, profitability, efficiency, and solvency, and identify trends.

- SWOT Analysis: Assess internal strengths, weaknesses, external opportunities, and threats to understand the company's position.

- Industry and Market Analysis: Study industry trends, growth areas, competitive forces, and regulatory factors impacting the company.

- Competitor Analysis: Compare financial performance and strategies with competitors to identify market position.

- Macro-Environmental Analysis: Use tools like PESTLE analysis to evaluate external factors like politics, economics, society, technology, environment, and legal aspects.

- Risk Assessment: Identify potential risks, including market, credit, and operational risks, and evaluate their impact.

- Scenario Analysis: To anticipate outcomes, develop multiple scenarios based on economic conditions, regulations, or technological changes.

- Financial Forecasting: Create projections using historical data and analysis insights to set realistic goals.

- Strategic Planning: Develop financial strategies aligning with company goals, considering resource allocation, investment priorities, and growth initiatives.

- Stakeholder Alignment: Ensure strategies match stakeholder expectations, including shareholders, lenders, customers, and employees.

- Long-Term Planning: Make decisions for financial sustainability, such as funding sources, dividend policies, and research investments.

- Implementation and Monitoring: Implement strategies, continuously monitor performance, and adjust as needed.

- Review and Adaptation: Regularly update analysis based on changing conditions, new data, and evolving goals.

- Communication: Share findings and strategies with stakeholders to ensure understanding and collaboration.

Types

Here are some types of strategic analysis

- Scenario Analysis: This analysis creates scenarios to explore how various factors might impact the company's financials. It helps in preparing for different potential outcomes and planning accordingly.

- Value Chain Analysis: This type dissects the company's activities into primary and support activities, helping to identify areas where the company can create value and gain a competitive advantage.

- Sensitivity Analysis: This analysis examines how changes in specific variables, such as interest or exchange rates, could impact the company's financial performance. It helps in understanding the sensitivity of economic outcomes to different factors.

- ESG Analysis: Environmental, Social, and Governance (ESG) analysis evaluates how the company's environmental impact, social responsibility, and corporate governance practices could influence its financial performance and reputation.

- Financial Modeling: This involves creating mathematical models to simulate different economic scenarios. It helps in making predictions about the company's future financial performance.

Examples

Let us understand it better with the help of examples:

Example #1

Imagine a fictional company called "TechFuture Inc.," which specializes in producing consumer electronics. The company's management team conducted a strategic analysis to make informed financial decisions.

SWOT Analysis:

- Strengths: TechFuture Inc. has a highly skilled R&D team, innovative products, and a strong brand reputation.

- Weaknesses: The company relies heavily on a single supplier for a critical component, which poses a supply chain risk.

- Opportunities: The demand for smart home devices presents a significant growth opportunity.

- Threats: Intense competition in the consumer electronics market and rapidly changing technology trends could impact profitability.

Market and Industry Analysis:

The analysis reveals that the consumer electronics market is experiencing a shift toward eco-friendly products. This aligns with TechFuture Inc.'s strengths in innovation and R&D. There's also a trend toward subscription-based models for software services, which could provide a stable revenue stream.

Example #2

A report published in 2023 by ResearchAndMarkets.com presented a strategic analysis of the North American shared mobility market. The report, covering the period from 2023 to 2030, highlights that ride-hailing will continue to be the largest segment within this industry. The dominance of Uber in this sector is expected to persist.

The analysis delves into the dynamics of shared mobility, considering factors such as changing consumer preferences and technological advancements. The report provides insights into the market's growth potential, opportunities, and challenges.

With the rise of urbanization and a growing emphasis on sustainable transportation solutions, the shared mobility sector is anticipated to witness considerable evolution. The comprehensive analysis is a valuable resource for industry stakeholders, investors, and decision-makers seeking to navigate North America's evolving landscape of shared mobility.

Importance

Here are several reasons why strategic analysis is crucial:

- Informed Decision-Making: Strategic analysis provides a solid foundation for making well-informed financial decisions. By thoroughly understanding a company's financial health, market dynamics, and potential risks, decision-makers can make choices that align with its goals and enhance its financial performance.

- Risk Management: Effective strategic analysis identifies and assesses various risks that could impact a company's financial stability. By anticipating potential risks and challenges, businesses can develop strategies to mitigate or manage them, minimizing possible losses.

- Opportunity Identification: Strategic analysis helps identify growth opportunities within the market and industry. Businesses can take advantage of favorable conditions by understanding market trends, consumer preferences, and emerging technologies.

- Resource Allocation: Companies often have limited resources, and strategic analysis helps allocate these resources optimally. Whether it's deciding where to invest, which projects to prioritize, or how to give capital, the strategic analysis provides insights into the most promising areas.

- Competitive Advantage: Understanding a company's strengths and weaknesses relative to its competitors is essential for gaining a competitive advantage. Strategic analysis helps identify areas where a company can differentiate itself and excel.

Difference Between Strategic Analysis And Intuitive Thinking

| Aspect | Strategic Analysis | Intuitive Thinking |

|---|---|---|

| 1. Approach | Systematic examination of data and information to make informed decisions based on analysis and facts. Data-driven and systematic. | They make decisions based on gut feelings, instincts, and personal experiences. Based on feelings, hunches, and instincts. |

| 2. Process | Involves gathering data, conducting analyses, and using structured frameworks. | Involves relying on personal insights and immediate perceptions. |

| 3. Data and Information | Relies on quantitative and qualitative data, financial metrics, market trends, and industry analysis. | Draws from personal experiences, emotions, and perceptions. |

| 4. Decision-making | Informed by analyzed information and insights from a structured process. | Relies on the individual's inner sense and perception. |

| 5. Objective | They are making decisions based on gut feelings, instincts, and personal experiences. | Relies on the individual's intuition and personal perspective. |