Table Of Contents

What is a Stop-Limit Order?

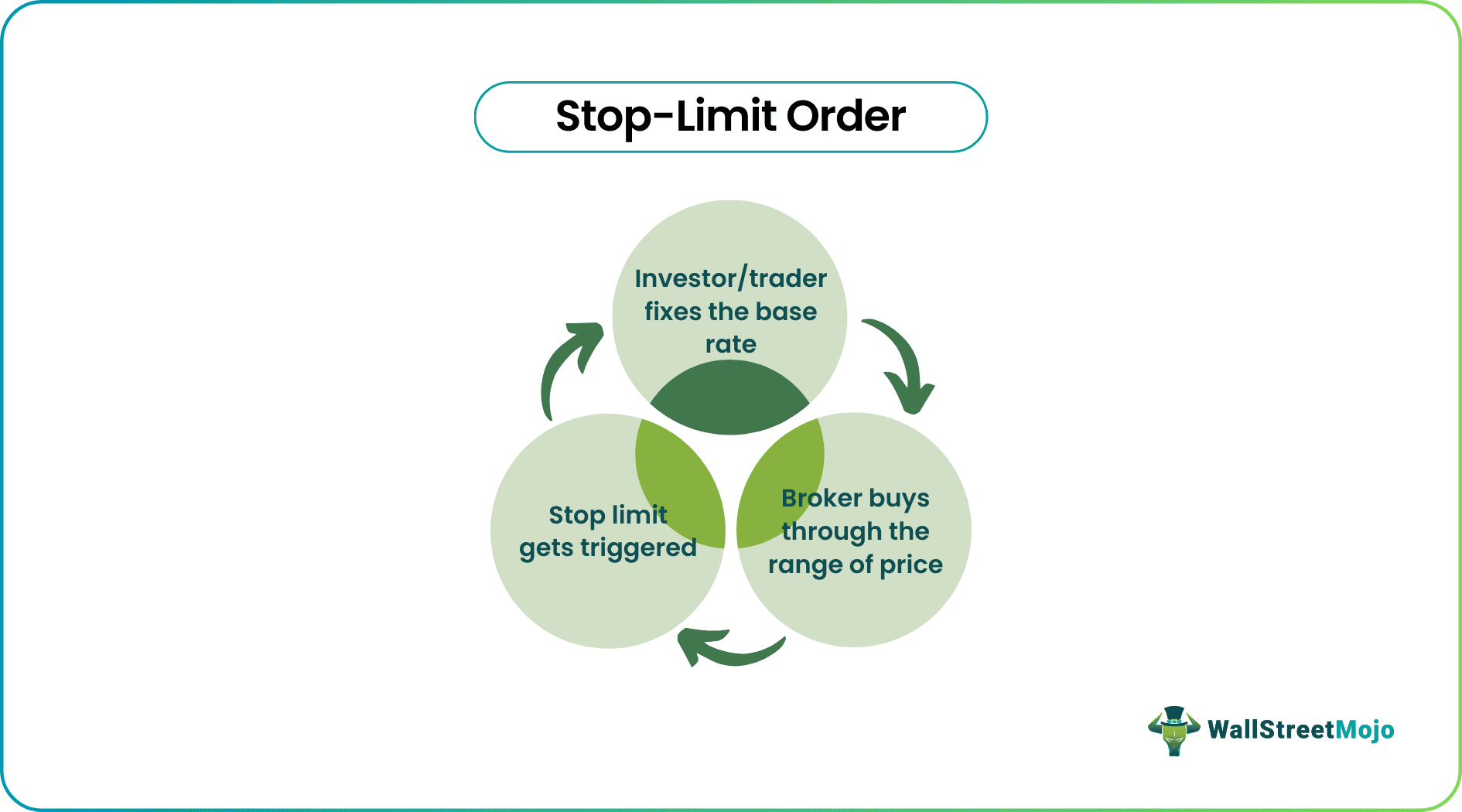

Stop-Limit Order is a combination of Stop and Limit order, which helps execute trade more precisely wherein it gives a trigger point and a range. Say the investor want to buy when the stock price reaches $50, and you buy till it is $55. So, the Stop-Limit order gets triggered when the price reaches $50.

The buy stop limit order helps investors find stocks at a value far lesser than they would initially want to invest. The order does not get executed until the target price is reached. It also gives the investor the time to focus on their other activities rather than spending endless hours waiting for the stock to reach their desired prices.

Table of contents

- What is a Stop-Limit Order?

- A stop-limit order is a type of order that combines both stop and limit orders. It allows for more precise trade execution by setting a trigger point and a price range.

- A stop-limit order has two main features: the stop and the limit. When the stock price reaches the trigger point, the stop order is triggered, and a buy/sell order is placed for the stock, with the limit price acting as the maximum price for the trade.

- Proper judgment and prediction are necessary when using stop-limit orders, as there may be scenarios where the order is not triggered or executed.

Stop Limit Order Explained

A stop limit order is a function in the open market where an investor predicts that a price would reach a certain level above or below the current market price. Once the limit set by the investor or trader is achieved, the stop limit order stock gets purchased or sold according to the instructions given.

In many cases, the purchase or sale order does not get triggered at all as the price either hovers around the current market price or moves in the opposite direction than anticipated by the investor or the trader.

When an investor finds that a particular stock is trading in the market and they feel that the stock price will rise in the future, then they tend to buy it. They can’t buy it at any price; then, it may happen that you are buying it at a price that will not give enough margin during the sale, and the investor will end up with a lower profit or even loss. For this, a trigger point is decided, which is the Stop. Then a closing point is decided, which is known as a Limit. Two prices are provided for Stop-Limit Orders.

Once the price reaches the trigger point, Stop gets activated, and either BUY/SELL starts happening for the stock to the point where the limit is placed.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features

A stop limit order stock comprises of two main features. Let us discuss them in detail through the explanation below.

- Stop:- It is the trigger point where the order will be activated. It will have to be set outside the market price, or else it will be triggered immediately after placement.

- Limit:- Limit means range; will indicate the starting point of the trade, and limit will indicate the closing point of the trade.

When to use?

The buy stop limit order is a tool that must be used at a situation that favors benefits more than other options. It is vital to understand the timing, the stocks and the overall movement in the market before entering such a deal. Let us clearly understand when to enter or such the feature for best results through the discussion below.

In Bulk trading, especially for Mutual Funds and Institutional Investors, the stock price tends to move with the order. Say a mutual fund plans to sell its position on a particular stock. Usually, they hold huge positions, and when they sell them, the price moves in the market, making the later trades at unfavorable prices.

To prevent trades happening at unfavorable prices, we put a Stop-Limit order. It will stop the trade when the price becomes unfavorable, either BUY or SELL.

Example

Let us understand the concept in detail with the help of an example.

Alibaba Group Holdings is trading on the NYSE at $200. Say an HNI is planning to buy 100,000 shares of Alibaba. The HNI thinks the share price will increase, but is unsure about this. Therefore, the plan to start buying the shares if it shows movement and reaches $205 is plotted.

The share price after reaching $205 may start to grow tremendously and reach $280. Hence, it will be a loss for the HNI to buy the share at such a high price of $280. Therefore, a stop limit must be set at $205.

To safeguard himself from buying at such an unfavorable price, he will have to combine Stop Order with a Limit order, limiting the buying price to a range, say he puts a limit order at $215. So the order will stop if the share price crosses $215 and will again resume trading when the share price reaches $215 or below.

Risk

In the case of a highly volatile stop limit order stock, if the investor has put a Stop price and a limit price. It may happen that the Stop price will be triggered, and due to high volatility, it will cross the limit price too quickly; this, in turn, will leave them with a partially filled order or with no fill order.

Benefits

Let us understand the benefits of investing by placing a buy stop limit order in the open market.

- Helps to execute orders only at favorable prices

- It helps break the trade, and hence too much SELL/BUY pressure is avoided.

Drawbacks

Despite the benefits as mentioned above, stop limit order stocks can be a risky deal. Let us understand its drawbacks through the points below.

- Price may move too quickly, and order may not be fulfilled at all

- Favorable price may not return ever

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A stop-loss order is placed with a brokerage to sell a security when it reaches a specified price level to limit potential losses. A stop-limit order, on the other hand, combines elements of both a stop order and a limit order, allowing investors to set both a stop price and a limit price to control the execution of the order.

A stop limit order will trigger a limit order to buy or sell a security once it reaches a specified stop price, with a limit on the maximum or minimum price at which the trade can be executed. On the other hand, a stop market order will trigger a market order to buy or sell a security once it reaches a specified stop price without any limit on the price at which the trade will be executed.

A trailing stop-limit order allows investors to set a trailing stop price, which is a dynamic stop price that adjusts as the market price of a security moves. The order combines elements of a trailing stop order and a limit order, allowing investors to set a trailing stop price as a percentage or dollar amount and specify a limit price for the trade.

Recommended Articles

This has been a guide to what is Stop Limit Order. Here we explain its features and example, how it works along with its risk and drawbacks. You can learn more about finance from the following articles –