Table Of Contents

Stocks Definition

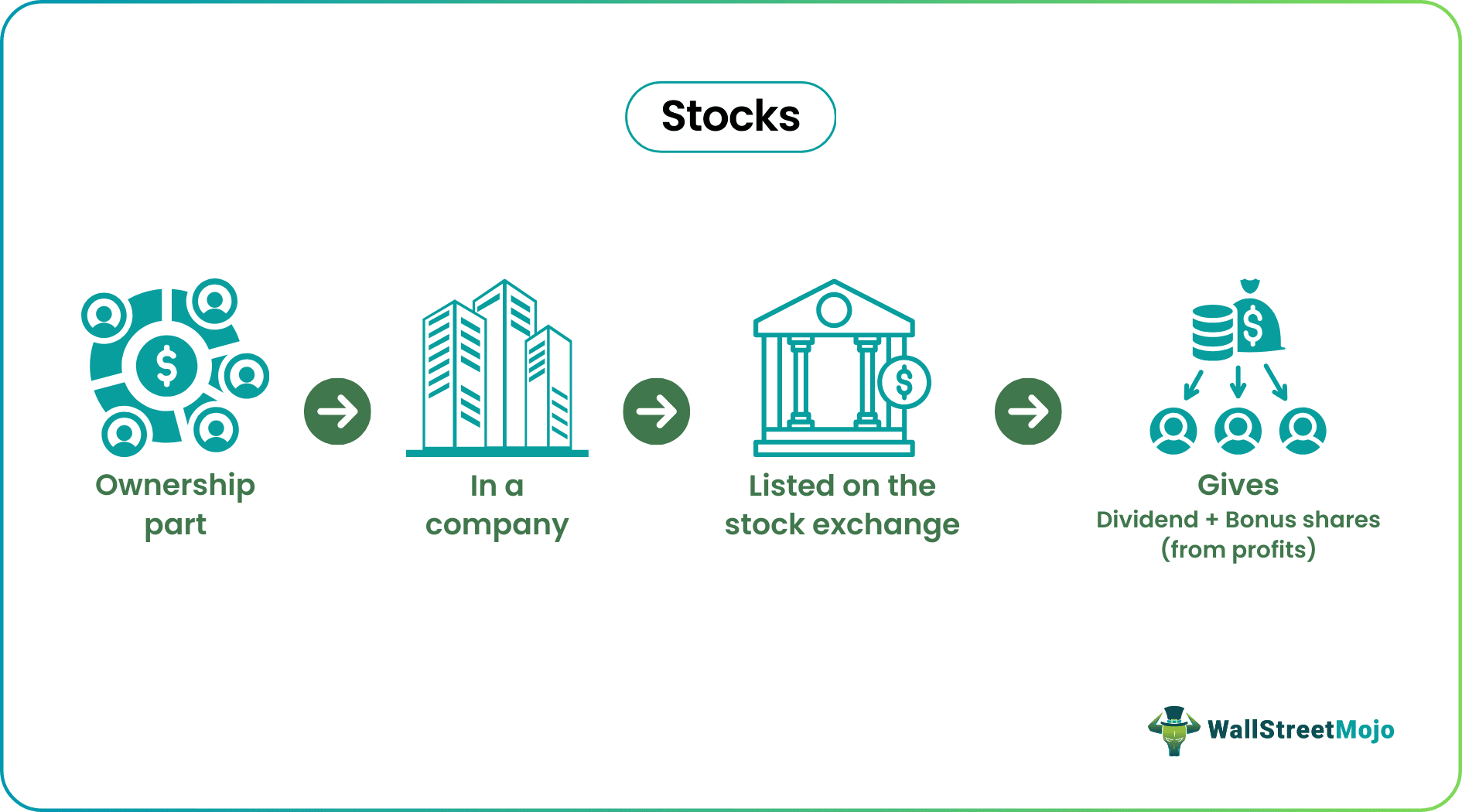

Stocks, equities, or shares is a financial instruments representing a certain percentage of ownership to a buyer in a company. The primary purpose of buying stocks is capital (money) appreciation and earning huge profits in the form of dividends.

Equities may be of different types based on their nature. Investors invest in them to increase their wealth. Also, they get dividends and bonus shares. The value of shares grows as the economy grows. Anyone with a minimum financial amount can start equity trading. However, one has to bear a considerable investment risk in trading or short-term investing than any other investment form.

Table of contents

- Stocks Definition

- Stocks, or shares, is a security that refers partly to ownership in a company. Individuals buy equities to earn massive profits. Historically it has given massive returns as compared to other asset types.

- Equities try to improve capital appreciation along with inflation. In addition, they also get dividends and bonus shares in return.

- In the 17th century, Christoffel and Jan Raphoen were the first to trade the Dutch East India Company stocks. It accelerated the prices of the equity by a good percentage.

- Market sentiments and unforeseen factors affect stock prices. It may include high market volatility, risky nature, and others.

Stocks Explained

Stocks represent an individual's stake in a company, like a pastry piece from a chocolate cake. This security is liquid. In other words, the trader can sell and encash them in short durations. Examples include Amazon and Apple stocks. Also, individuals holding them for the long term earn huge profits. However, they need an analytical mindset to pick the right profit-yielding equities.

The history of shares travels back to the 1200s when merchants anticipated the prices of goods. The earlier business merchants used to pool their funds to ship their goods overseas. In 1602, Amsterdam was the first stock exchange established that allowed traders to buy and sell equities. In all this, the Dutch east company was the first firm to issue equities to the public. And the only intention of the issue was to protect their spice trade.

Business people like Siblings Christoffel and Jan Raphoen were the first to trade their equities. Businessman Jan Allertsz's trade purchases increased the share prices tremendously. Later, in the 1700s, the New York stock exchange was established. Likewise, the Dow Jones stocks index came into existence in 1896. By the late 1930s, people started betting on equities and earning huge profits in return.

Apart from company equity, growth, gold stocks, dividend stocks, and many other share types are present. However, the asset type, process, and intention remain the same. While equities allow ownership to individuals, companies get equity capital to expand their businesses. Companies tag them as stockholders. The stockholders invest their money, hoping for an appreciation (increase) with inflation, and make profits.

Certain factors do influence the share's price, making them highly volatile. Examples include political, economic, social, and cultural factors. Besides, a company's quarterly reports or annual reports, revenues, profit margins, and mergers also affect factors.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

According to their class and performance, equities are divided into many other types apart from the big-cap, mid-cap, and small-cap. Let us look at the equity type and their categories in detail:

#1 - Common And Preferred Stock

While common and preferred shares hold equal ownership, the latter gets more preference. It is because the preferred stockholders will receive their profits before other investors while distributing income or dividends. However, they do not hold any voting rights, unlike common stockholders.

#2 - Growth And Value Stock

Growth stocks usually target companies expanding revenues, sales, and profit. The main goal while investing in such equities is capital appreciation over time. However, it does come with immense volatility. Besides, value stocks are undervalued in the market. Therefore, investors observe and analyze different liquidity, debt, and profitability ratios before selecting them.

#3 - Dividend And International Stock

Dividends allow an individual to earn a significant dividend on it. In addition, such equities might attract some tax benefits. Thus, people holding them get a low-taxed passive income from dividends. In contrast, international shares are shares held in foreign companies. For example, a person buying United States equities while based in Italy. However, a decrease in the exchange rate can fluctuate the prices.

#4 - Penny And ESG Stocks

Penny stocks, from the name itself, depict low-priced shares. However, it does warn the investor before investing. Low-priced equities often indicate bankruptcy or fraud cases. Also, they might prove to be scammers. At the same time, ESG (Environmental, social, and governance) are company shares in corporate responsibility.

#5 - Defensive And Cyclical

Defensive equities are less affected by any of the equity market news. Also, they are defensive towards any ups and downs in the market. These include healthcare, utility, and essential stocks. However, cyclical stocks are susceptible to market sentiments.

#6 - Industry Or Sector Stock

Industry stocks depend on a particular industry, like the manufacturing industry. In contrast, sector shares depend on sectors like the food financial sector.

How To Invest In Stocks?

Let us look at the steps on how to invest in stocks for a clear understanding:

#1 - Decide the investment goals

It is necessary to decide the investment goals. For example, a person who wants to buy a house five years from now will probably choose a long-term investment plan type. Likewise, shorter goals, like a vacation plan, require short-term investment.

#2 - Determine the investment amount and risk tolerance

Before investing in either equity or gold shares, it is necessary to determine the risk level. Investors must perform fundamental analysis and technical analysis as stock trading may bring losses. Thus, traders must be strongly risk-tolerant. They need to find out their risk appetite and invest accordingly. For example, if a person is investing an amount of $4000, they might have a lower risk tolerance level. Likewise, investors investing a higher amount may have a higher risk tolerance.

#3 - Determine the investment strategies

After deciding the investment goals, the next step is to determine the investment strategy. In other words, one needs to find a trader's long or short position. Then, finally, one determines and uses the bullish or bearish strategy while stock trading.

#4 - Select the type of stock

The next step is to determine the type of stocks mentioned above. For example, traders can decide among gold stocks, Dow jones stocks, equity, and other shares. Also, it includes the equity sector, industry, or category. In addition, they can also appoint a broker to monitor their portfolio.

#5 - Analyze the stock thoroughly

After choosing equity, investors need to perform fundamental and technical analysis. But, first, it is essential to look at the risks and opportunities of the same. So, for example, if you want to buy Apple's shares, it is necessary to look at its news, annual reports, sales figures, and other things that affect the company's revenue and profit.

#6 - Open an investment account

Finally, the last step involves opening an investment account with any brokerage account/platform. Recently, it has been easy to do so by using investment apps on one's smartphone. Examples include Charles Schwab, Fidelity Investments, and others.

Example

According to the SSA.gov data analysis and comparison, stocks have given the highest average investment return from 1985 to 2020. So, the U.S. share market outperformed all the other asset types. After that, real estate, mutual funds, bonds, and gold investment follow. Researchers also observed that equity had the highest than average volatility. Adjusted to inflation, savings account and cash gave a negative return.

For example, two hundred dollars invested in the S&P 500 Index (Standard & Poor's 500 Index) would have crossed more than $1400,000 by 2021. In contrast, the same amount invested in treasuries for ten years would have seen a low worth of only around $17,000

Stocks vs Mutual Funds vs Options

Although all three look the same and play a significant role in an investor's portfolio, a vast difference exists between them. For example, stocks can be single ownership; a mutual fund includes ownership in many companies with a joint return. In short, it is a basket of shares that an investor could avail of.

In contrast, an option can be either equity, index, or even commodity. However, the expiry differs among all. In the former case, the expiry depends on the trader's sell-off. At the same time, mutual funds' expiry depends on maturity. At the same time, the expiry of an option depends on the contract's maturity.

Let us observe the differences between stocks vs mutual funds vs stock options in the following table -

| Basis | Stocks | Mutual Funds | Options |

|---|---|---|---|

| Meaning | Represent ownership in the company. | A collective fund of different stocks and bonds. | A contract where a buyer and seller deal in goods at a pre-decided price and time. |

| Pricing | Depends on the market sentiments | Depends on the performance of the securities and stocks. | Depends on market volatility |

| Expiry | Expires until the stockholder sells off. | It expires at the maturity of the investment. | It can expire either early or on maturity, depending on the contract and type of option. |

| Risk/ Volatility | There is a high risk with the possibility of losing investment. | It is similar to shares. | Limited to the premium amount. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

No. Although both are financial instruments in the market, as an asset class, they differ hugely. While the former's value fluctuates as per the market, bonds are a fixed-income instrument. The private sector issue the former, while the government sector issue the latter.

The only reason why equities fluctuate is the bullish and bearish traders. In other words, the price will fall when there are more sellers than buyers. Likewise, more buyers will accelerate (increase) the prices. Recession estimates, political instability, and illegal practices may also decrease the stock price.

Every country has a specific tax percentage on stock trading. However, it is applied when the equity gets sold off. As per the Federal (U.S) tax policy, taxes are applicable only on the profits earned.

During a recession, stocks do not perform well. During this economic cycle, the prices of equities fall, reacting to the market sentiments (factors). Since a recession is a critical stage of the economy, people lose confidence in shares. However, a solid and stable government may help to stabilize the prices.