Table Of Contents

Stockholder Meaning

A Stockholder is a person, company, or an institution who owns one or more company shares and whose name share certificate has been issued by the company. They are the company owners, but their liability is limited to the extent of their value of shares.

They are also known as shareholders. Fund generated from stockholders is reported in a balance sheet of organizations as paid-up capital under shareholder’s fund. Their influence in the business depends on the percentage of stock that they own out of the total share capital. They get the shares from either the primary or secondary market.

Key Takeaways

- A stockholder refers to a person, company, or institution who possesses one or more company shares and whose name share certificate has been issued by the company.

- The shareholders are considered company owners, but their liability is limited to the value of the extent of the share.

- Equity shares and preference shares are the two types of shareholders.

- They can choose the company’s Board of Directors and perform an essential role in any company decision-making, such as acquisitions, mergers, or other critical decisions.

Stockholder Explained

Stockholders are individual or corporate investors who subscribe to the share capital of a company. They are legal owners whose influence in the business is limited to their contribution.

Generally, stockholders are the company's owners, but they are treated separately from the company, and their liability is limited to the extent of their shareholding. However, they have some stockholders rights like voting rights. In addition, they can select the company’s board of directors and play a vital role in any company decision-making, like acquisitions, mergers, or any other important decisions. The main benefits for these shareholders is the increase in their share value and dividend of the company when the business grows and profitability increases regularly. Similarly, if the company is not doing good and not generating profit, the value of shares will decrease, and shareholders will lose their money.

Types

There are two types of stockholders:

#1 - Equity Share

Equity stockholders are the actual owners and members of the company with voting rights and control over the company's operations. Equity shareholders get dividend payments after paying them to the preferred stockholder. The equity stockholder is the leading investor of the company, and this is a natural source of funds. These stocks are also known as ordinary shares.

#2 - Preference Share

These shareholders have a preference over equity stockholders. Preference shareholders or preferred stockholders generally receive a fixed dividend and are compensated or paid before equity stockholders. In bankruptcy, preferred stockholders are entitled to be paid off from company assets before equity stockholders. Preference stockholders do not have any voting rights.

Formula

There are two methods for the calculation of stockholders' equity.

- Stockholders Equity = Total Assets – Total Liabilities

- Stockholders Equity = Paid-Up Share Capital + Retained Earning + Accumulated other Comprehensive Income – Treasury Stock

Thus, from the above formula we can calculate stockholders' equity.

Example

Let's take an example.

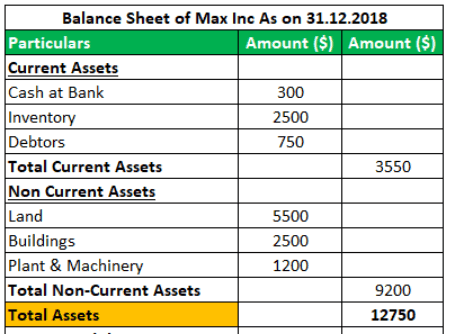

Given below is the balance sheet of Max Inc as of December 31, 2018. In this example, we will try calculating stockholder's equity using the above two formulas.

In the below examples, the company has a bank balance of $300, an inventory of $2,500, and debtors of $700. These come under the company’s current assets. Therefore, the total existing holdings of the company are $3,500. On the other hand, the Non-Current Assets, company has land worth $500, buildings worth $2,500, and plant & machinery at $1,200; therefore, the total non-current assets of the company are $9,200.

- Total Assets = Current Assets + Non-Current Assets

- Total Assets =$3,500 + $9,200 = $ 12,750

Now we will calculate the total liabilities of the company.

The company has a creditor of $ 1100 and short term borrowings of $400. These come under current liabilities. Therefore, the total recent liability of the company is $1,500. The company has long term borrowings, i.e., non-current liabilities of $7,000.

- Total Liability = Current Liability + Non–Current Liability

- Total Liability = $1,500 + $7,000 = $8,500

According to stockholder’s equity 1st formula:

- Equity Stockholders = Total Assets – Total Liability

- Equity Stockholders= $12,750 – $8,500 = $4,250

Now we will calculate equity of common stockholders as per the 2nd Formula:

- Equity Stockholders = Paid-up capital + Retained Earnings + Other Comprehensive Income – Treasury Stock

- Equity Stockholders= $1,000 + $2,500+ $750–$0 = $4,250

Advantages

Some of the advantages are as follows:

- Both equity and preferred stockholders are the actual owners of the company.

- Equity stockholders rights include voting rights. They can vote on any board meeting of the company.

- It doesn’t create any obligation to pay a fixed rate of dividend.

- Funds generated are a permanent source of the company fund.

- Shareholders gain the dividend only in case the company earns profit.

- Holders of equity shares have limited liability; their liability is limited to the extent of their investment.

- If the company performs regularly, then the value of shareholder investment increases.

Disadvantages

Some of the disadvantages are as follows:

- Investors who desire to invest in safe securities with a fixed income do not invest in equity stockholders.

- They have voting rights; they can create an obstacle for management to decision.

- In liquidation, equity stockholders get their investment after payment of creditors, debentures holders, and preference shareholders.

- The cost of equity is high.

- The excessive use of equity shares is likely to result in the overcapitalization of the company.

- If the company does not perform, then there is a chance that shareholders will lose their investment.

Stockholder Vs Stakeholder

- All stockholders are stakeholders of a company but the opposite is not always true.

- All stakeholders do not possess the right to vote. Only common stockholders who own stocks have the right to vote for management decisions.

- All stakeholders are not entited to get dividend. Only who own shares will get it.

- In case of company dissolution or bankruptcy, shareholders will get their share only after all other stakeholders like creditors, bondholders, employees, etc get their share.

- All stakeholders are not owners of the business. Only the ones who own shares are owners.