Table Of Contents

What Is Stock Warrant?

A stock warrant is a contract between companies and investors that offers the latter the right to trade shares of a company’s stock at a specific price within a specific period. These contracts comprise options that companies issue and trade on exchanges. The holder has the liberty to buy or sell the asset in question.

Traders understand the stock warrant meaning better when they know the forms in which these options work – the call warrant and the put warrants. While a call warrant gives traders the right to buy a specific number of shares from a company at a certain price within a given period, a put warrant allows them to sell a specific number of shares at a specific price within a given period.

- A stock warrant gives the holder the right to buy or sell the company’s stock at a predetermined price in a particular period.

- When the holder exercises it, they purchase the company’s stock, and the company receives the money as its source of capital.

- Investors may choose to exercise it if the market price of shares of the company is more than the price of the warrant. Thus, the investors receive shares lower than the market price.

- Investors must purchase it by paying an amount or fee, a percentage of the company’s share price.

How Does A Stock Warrant Work?

A stock warrant also called a share warrant, is a derivative contract that offers investors the right to sell or purchase the shares of a stock at an agreed-upon price and within a specific period. Every such warrant comes with an expiration date, restricting investors from exercising the financial instrument beyond that specific period. However, the holder has no obligation and can deny purchasing or selling the assets anytime.

The investors purchase the contracts for a small fee and can decide whether to purchase or sell shares based on the performance of the company issuing stocks. It is good for the company as it gets additional capital by selling the stocks for the money. It can use this capital to boost its revenue by deploying the capital in profit-making projects.

These warrants act as an alternative investment for the investors of the company. Here, the investment cost is less than the amount spent on buying the company shares. The market price of warrants is usually more volatile than the company’s share price.

A company may issue a stock warrant list when its capital seems to erode but does not require immediate capital infusion. Thus, the motive is to have enough capital sources for the future. Stock warrants attract more investors to the shares of the company, especially those who do not have enough capital to invest in such purchases. Through warrants, they reserve the right to purchase company shares.

Above all, there will be a dilution impact on the existing shareholders. They observe the dilution in market price and voting rights as the shares also get distributed among the warrant holder, who are not necessarily the company shareholders.

Example

Let us consider the following stock warrant example to understand the concept better:

Suppose the shares of the company trade at $500. The company issues it at $50 to preserve its goodwill among the company’s shareholders. The firm finds it easier to convince the shareholders to pay $50 rather than $500 and, therefore, expects to receive capital while maintaining its reputation among the shareholders.

In such a scenario, issuing shares with other financial instruments will improve the company’s attractiveness while reducing its cost of funding. Plus, if the warrant holders exercise their right to convert them into shares, it will boost the liquidity of the company’s stock in the market.

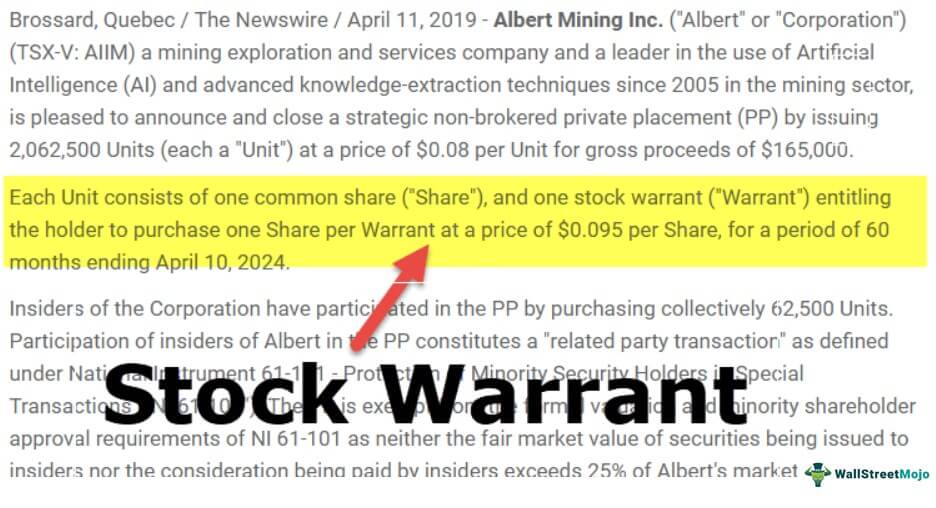

Below is an example of what a stock warrant contract looks like:

Tax Treatment

Though the shareholders enjoy significant tax benefits, the warrant holders remain devoid of many of them. This is how the stock warrant accounting of tax works:

When investors exercise the warrants, the income generated becomes taxable. This means the difference between the stock price and exercise price, after deducting the amount for the warrant, is taxed.

The stock warrant tax is applied to these contracts, which are considered capital gains, given the warrant holder’s non-ownership of the company shares. As a result, the tax levied may be huge if the investors fall under a high tax bracket.

Stock Warrant vs Option

Both these financial instruments give investors a chance to buy or sell shares at a specific price within a specific period. These instruments come with a strike price and a date of expiry. Under warrant and option alternatives, investors get an opportunity to lock an asset for a future price for a small fee, also referred to as a premium. Like options, warrants, as discussed earlier, can be a put or call warrant, depending on how investors want to use these contracts.

Besides sharing similarities, these financial options also differ from each other significantly. So let us have a quick look at the same:

| Category | Stock Warrants | Stock Option |

|---|---|---|

| Issuer | Companies | Market players |

| Use | Hedging positions in various assets | Speculative instrument |

| Term | Long-term (5-10 years) | Short-term (Days, weeks, months, or anything less than a year) |

| Benefit | Raises capital for companies that issue them | No capital gains |

Frequently Asked Questions (FAQs)

When the companies issue shares, the information best lies with the broker. Hence, the best way to invest in the company shares is through a broker who handles the secondary market trade. The investors have to pay a nominal amount to buy a warrant, which gives them the right to purchase shares in the future.

The expiration date of the warrants plays an important role in these dealings. Once the warrants expire, investors can no longer use them. This means they would neither be allowed to buy the asset nor sell it if the specified period gets over.

Warrants are high-reward, high-risk options to invest in. Thus, if investors book profit, they can call it good, while if they lose money and incur losses, it would be a bad investment.

Recommended Articles

This article has been a guide to What is a Stock Warrant. Here, we explain how it works along with an example, tax treatment, and comparison with options. You can learn more about finance from the following articles -