Table Of Contents

Stock Market Crash Definition

A stock market crash is a phenomenon when stock prices across all sectors start falling rapidly and are often the result of global factors like war or scams or the collapse of a certain sector. Panic works as the catalyst as all the investors start to sell simultaneously, leading to the crash.

The stock market crash poses a great threat to the economic condition of any nation. There have been multiple instances where the market crashed drastically, the major reasons being panic selling, out-of-control investments in one particular sector, and a natural phenomenon.

Table of contents

Stock Market Crash Explained

A stock market crash occurs as a result of an unexpected drastic fall in stock prices. While the market ups and downs are quite normal, the collapse is marked by something very serious. It could be anything from human sentiments influencing the market negatively to a natural calamity, disturbing an economy. Some of the most well-known instances of stock market crash history include the 1929 Great Depression, 1987 Black Monday, and 2008 Financial Crisis. The effect was significant even during the COVID-19 pandemic.

The Stock Market mostly runs on sentiments. Suppose people believe that the newly elected government will bring a massive change in the economy. In that case, investors feel confident, and they start investing in the country's equity market. Similarly, if any event causes the investor to lose faith in the market of a particular country, investors start to dump stocks of the country frantically, leading to a crash. Rational thinking will never lead to a crash. The crash is always caused by panic.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Reasons

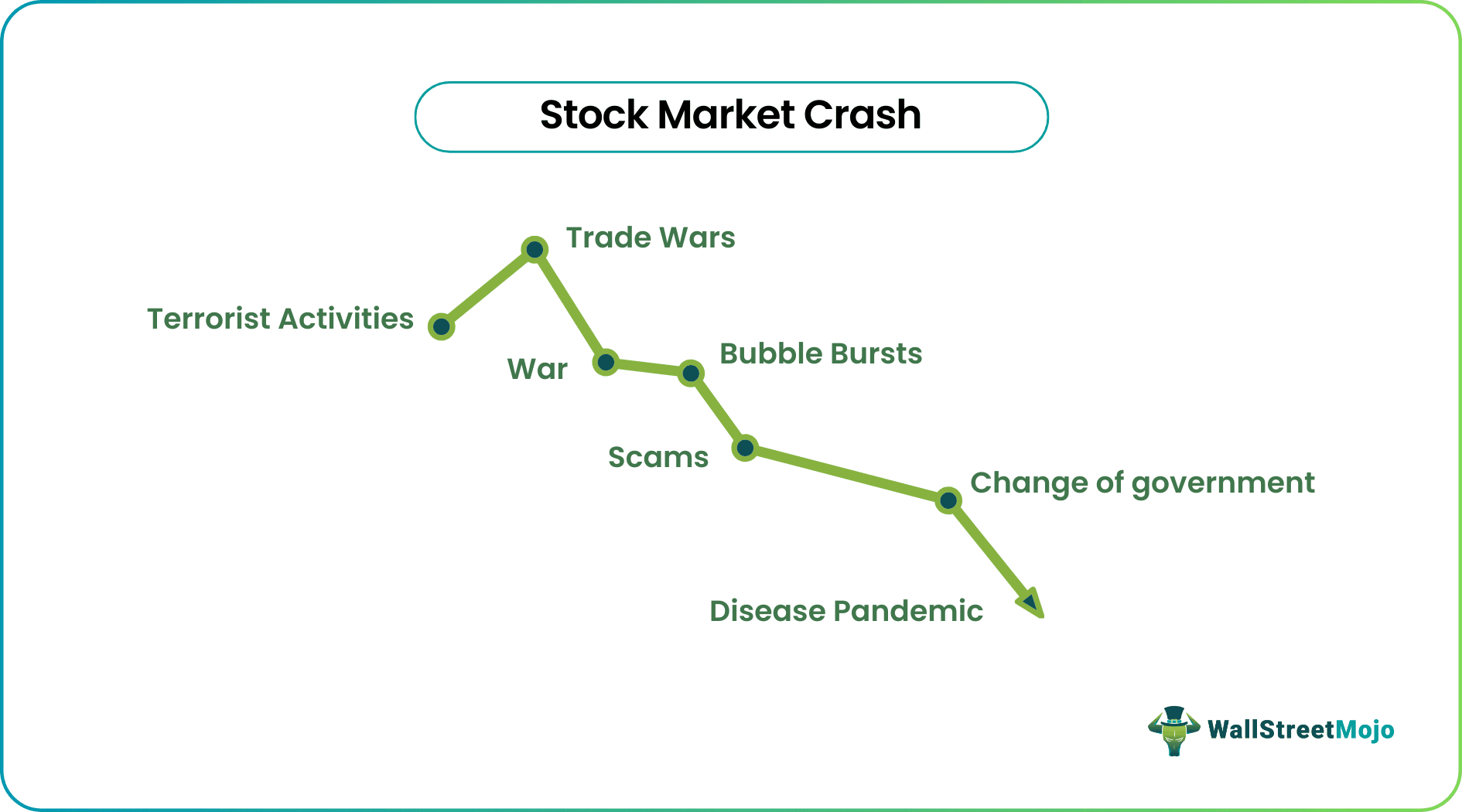

There are multiple causes of a stock market crash. Let us have a look at a few of them:

#1 - War

War is the most critical issue that leads to a market crash. Whenever countries go on WAR, the faith in those countries decreases. War is very expensive to continue, so the government of the country in war starts to deviate resources from all sectors to the only defense sector. War hysteria creates panic, and investors start to dump stocks.

#2 - Terrorist Activities

Terrorism is a global issue now. The World Trade Center crash in America led to this crash worldwide. So if there is any terrorism threat, it creates panic, and the stock market can crash. Several intelligence reports are available suggesting that terrorists plan to attack stock exchanges so that there is a crash and the whole economy of that country suffers.

#3 - Trade Wars

At times countries go into trade wars. Suppose suddenly a European country goes into a trade war with an OIL exporting nation. The OIL exporting nation says that they will no longer export crude to that particular European nation. In that case, it will lead to this crash. Crude is an essential commodity of the modern economy. Any country runs on oil. If OIL is stopped, then the entire economy will come to a standstill. It will create panic, and investors will start dumping stocks.

#4 - Bubble Bursts

A bubble is a scenario when the stock prices of a particular sector or across sectors start to rise limitlessly. The Price/Earnings ratio crosses the all-time high, and the index reaches an all-time high. So all this put together is like a bubble as so much money has been poured into the market, and the market has crossed its intrinsic value by many folds. At this moment, single negative news causes panic and the whole bubble bursts. This bubble burst leads to this crash.

#5 - Change Of Government

Investors invest in countries with strong and ethical governments. If there is a change in the government and the new government is not liked by the investors. Then there will be a panic, and the market may crash.

#6 - Scams

There have been crashes in stock markets due to scams several times. Scams lower the confidence that investors have in the economy. It creates a tremendous negative impact and can lead to crashes that may take several months to recover.

#7 - Disease Pandemic

The outbreak of a Global Pandemic such as the CoronaVirus (Covid-19) that spreads much faster than anticipated causes uncertainties in the investor market as countries take measures to prevent this disease from spreading further. Such a pandemic causes fear and distrust leading to stock market crashes.

Effects

The stock market crashes do not only affect the investors or traders or the market but also throw a significant impact on the lives of the normal population, who may or may not be related to trading. Some of the effects of such crashes have been listed below:

- Reduced confidence in the stock market. Investors who have invested systematically for years in the stock market and have built up a certain amount of wealth and are planning to retire, suddenly, if there is a crash, all their wealth will be washed out within days. It will lead to reduced confidence in the market, and the upcoming investors will be shaky and will stop making systematic investments.

- At times, the stock market crash of a particular country has a global reach as all the markets are connected now. The US real estate market crash leads to a chain reaction in several other countries, so these crashes lead to a chain reaction.

- It leads to an economic slowdown as most of the wealth gets washed out. It gets challenging to cover it up.

Timeline

Tracing the history of stock market crashes is crucial. However, here is a timeline, displaying the period, the crash type, and the reasons causing them for a ready reference.

| Time Period | Stock Market Crash | Possible Reasons |

| 1929 | Wall Street Crash (Blank Thursday) | Decreasing consumer demand, combatted market speculation |

| 1987 | Black Monday | Congress refused to pass a bank bailout bill, which was likely to improve the American financial scenario. This refusal led to a fall in stock prices and the market crashed. |

| 2000 | Dot-com Bubble | The dot-com bubble burst, given the technological startups raising funds to go public. The huge investments in tech and internet startups led to this crash. |

| 2008 | Financial Crisis | Congress refused to pass a bank bailout bill, which was likely to improve the American financial scenario. This refusal led to the fall in stock prices and the market crashed. |

| 2020 | Coronavirus Stock Market Crash | Panic selling during Covid 19 pandemic. |

Examples

Let us consider the following examples to understand the reasons behind and effects of a few stock market crashes that have occurred to date:

Example 1

From 2002 to 2007 Real Estate Market in the United States was at its Boom. Real Estate prices were going up like crazy, and every year, prices were moving up by approximately 40%. All the banks gave house loans, with the house being the mortgage. They were the most secure loans because if anyone failed to pay back the loan, the bank could easily recover the money by selling the house.

Banks then started coming up with a new kind of product called Mortgage-Backed securities. They clubbed the loan papers into several tranches and started issuing them bonds. Rating agencies gave the highest ratings to these bonds as they were the most secured loans backed by real estate. It slowly led to a bubble that finally collapsed in 2008. The event was so huge that several stock markets across the globe faced its impact.

Example 2

The year 2023 has witnessed an adverse fall in the stock prices of some of the most renowned entities. While JP Morgan, the financial giant thinks that the market will be in a better position in the later half of the year, popular bear Jeremy Grantham finds it difficult to believe that the situation will be any better than what it is at the moment. According to a recent report, the latter observes patterns similar to what caused the 2000 dot-com crash and predicts the scenarios to take the same turn, causing the stock market crash in 2023.

The possible reasons that seem to cause the crash include inflation, recession, debt-ceiling crisis, rising interest rates, etc.

How to Prevent?

Though a stock market crash is rare but should be prevented. Faith in the economy is dependent on the proper functioning of the Stock Markets. Therefore, the government should be very careful and take proper measures to prevent such crashes.

If there were a set formula by which market crashes could have been prevented, there would have been no crashes. But there are still a few signals by which you can predict a crash.

- If a country's index reaches an all-time high and doesn't stop there and keep increasing, then there are chances that it will crash. A market can't keep increasing without correction. The market will always grow at a steady rate, not at an exponential rate.

- The government shouldn't indulge in wars with other countries as it impacts the market.

- Strong monitoring should be placed by the government to prevent scams.

Stock Market Crash Vs Recession

While the stock market crash is a phenomenon that affects an economy drastically, the recession is one of the causes behind such crashes. Let us have a look at the differences between the two terms below:

- A recession is an economic slowdown. It is a general term when a country's GDP portrays negative GDP for two consecutive quarters. So it is when a particular country has stopped consuming at a faster rate.

- The Stock Market Crash is due to panic. It creates a massive impact on existing wealth and takes a lot of time to recover. A recession can be controlled if proper steps are taken, and the government starts to do more expenditure for economic growth.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Recommended Articles

This article has been a guide to Stock Market Crash & its definition. Here we explain its reasons, effects, its timeline, examples, vs recession & how to prevent it. You can learn more from the following articles –