Table Of Contents

What Is Stock Analysis?

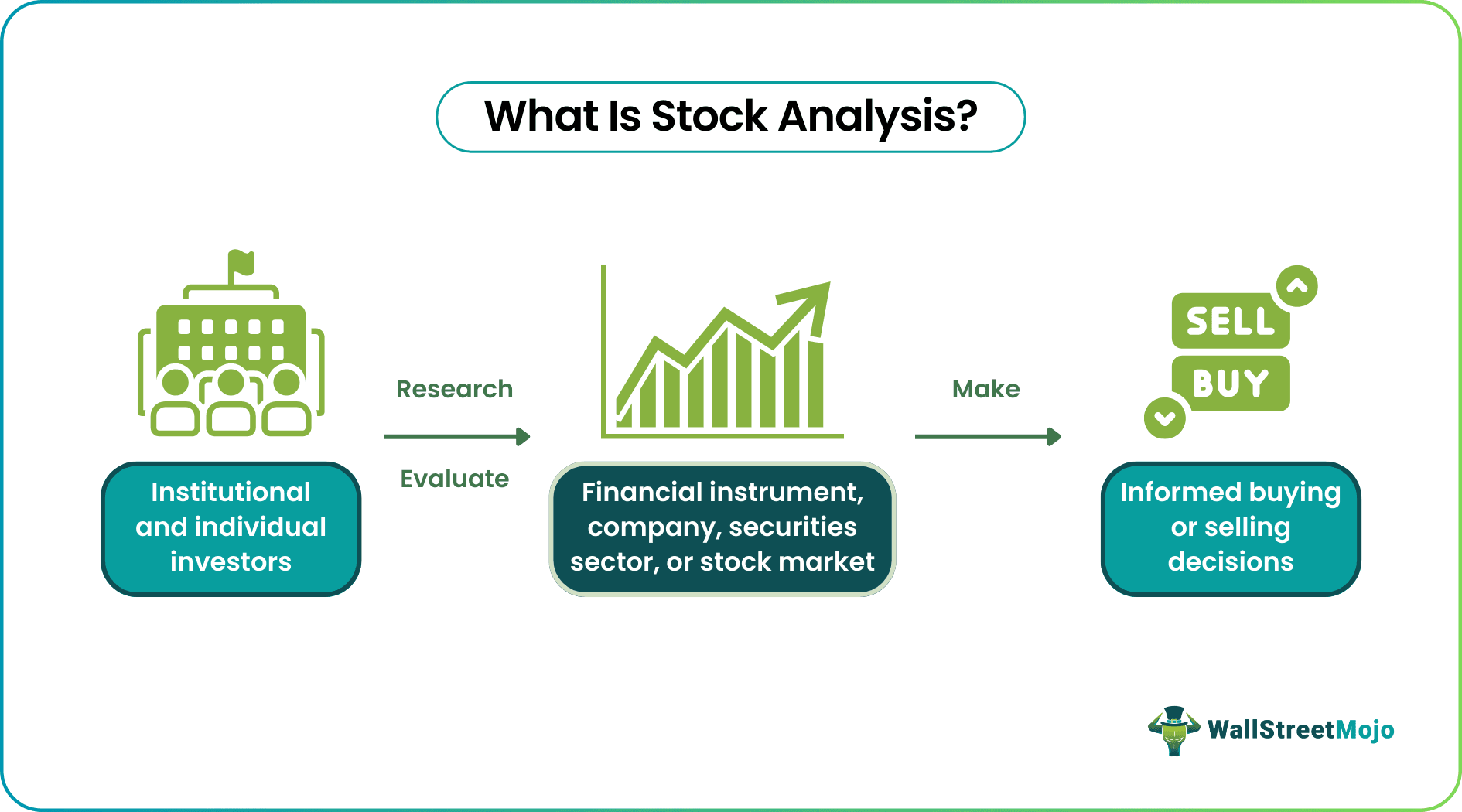

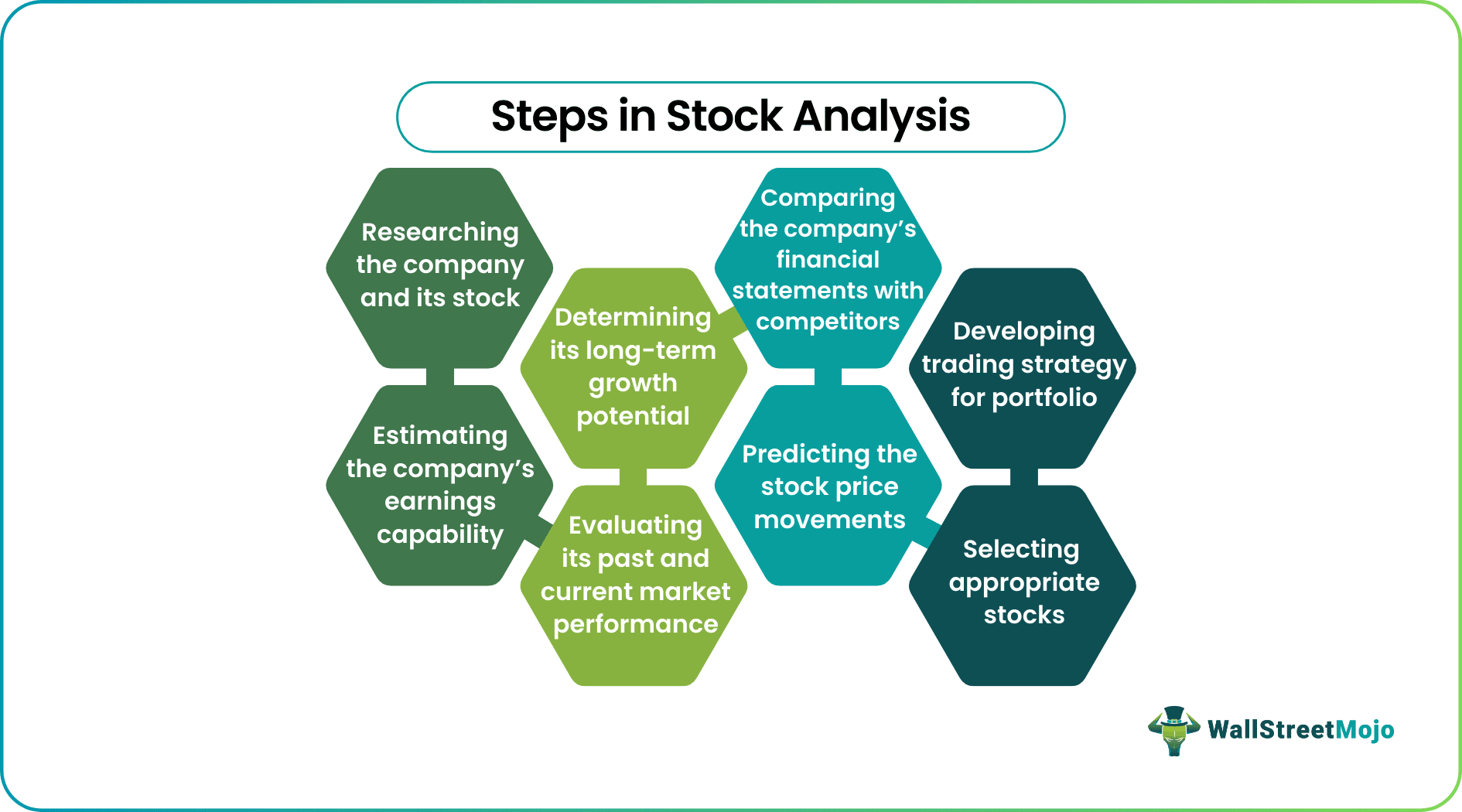

Stock analysis is the process of institutional and individual investors evaluating a specific financial instrument, securities industry, or stock market to make informed buying or selling decisions. It entails researching the company and determining its long-term growth potential based on past and current market performance.

Investors consider several factors to predict a company's earnings capability and stock price movement when conducting stock analysis. Investors can then utilize this knowledge to develop a trading strategy for their portfolio and select appropriate stocks using tools such as the best stock trading app to streamline and monitor their investments.

Table of contents

- What Is Stock Analysis?

- Stock analysis is when investors assess a particular financial instrument, company, securities sector, or stock market to make informed purchasing or selling decisions.

- It includes researching the company and its stock and calculating its long-term growth potential based on past and current market performance.

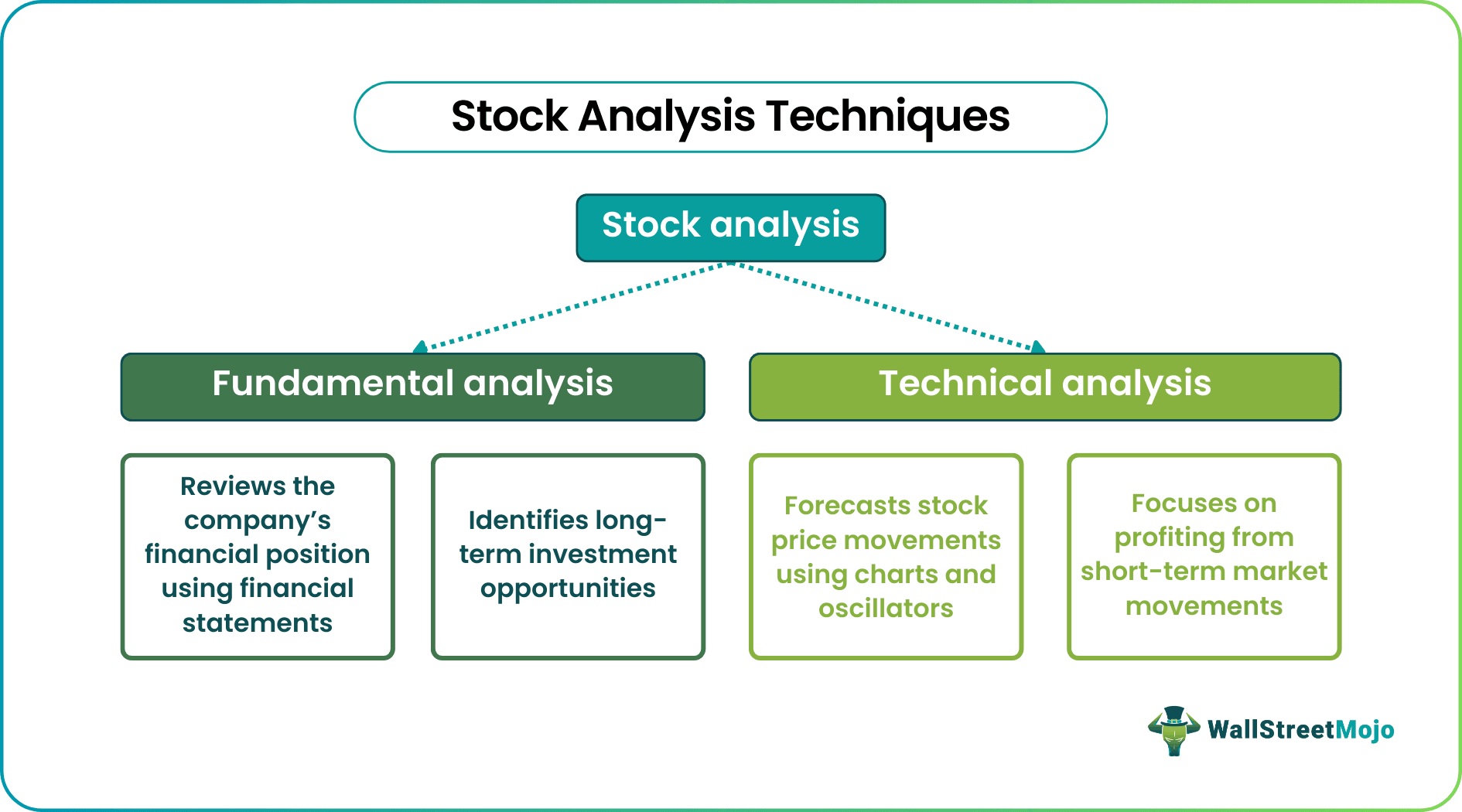

- The fundamental stock analysis reviews the company's financial position using its financial statements, while technical stock analysis forecasts stock price movements using charts and oscillators.

- Investment banks and research firms usually recruit analysts to perform stock analysis. Individual investors can do it on their own, but they may not be able to go too far.

Stock Analysis Explained

Stock analysis fundamentals helps traders and investors assess the stock market situation in a way that helps them make maximum profit. Before investing in a stock, they need to do their due diligence and learn what makes a company unique and why they should invest in it. It is never good to buy a stock because "everyone else is doing it" or "someone told to do so." It is where stock analysis comes in. This phenomenon, also known as equity or market analysis, can be performed using either fundamental or technical stock analysis tools.

Thus, through this technique, an investor can assess the current financial condition and the future activity, plans and growth potential of a business, a particular sector or the market as a whole. It uses past and present financial data to forecast the future, which is the best way to make any investment decision. If the company has limited information or its business is of a unique type, then it is difficult to obtain stock analysis data to analyse stocks. However, in that case investors should follow the performance of peer companies, the sector and the economy trends to understand the stock’s future prospects.

Tools

Stock analysis fundamentals can be an investor's best guide while venturing into securities markets. The company's past and present financial statements and their comparison with competitors can tell a great deal about how well the company is doing. Metrics like operating profit margin can also help analysts estimate the company's revenue, operating expenses, operating income, etc.

Investment banks and research companies typically use similar stock analysis tools. Although individual investors can do it on their own, they may not be able to go too deep. In that case, they can monitor stock trading platforms and other financial information resources to study factors like price targets, earnings, and potential revenue. Thus, it will help them make near-accurate predictions or recommendations about buying, selling, or holding stocks.

Types

The two primary approaches to sector wise stock analysis include:

Both techniques are vital to understanding the stock, including its value and growth potential. They can be either performed separately or in tandem.

#1 - Fundamental Analysis

Investors apply fundamental analysis when reviewing a company's financial positioning, such as evaluating its cash flows, balance sheet, and earnings or income statement. The stock analysis report can reveal a company's operating expenses, profits, and distribution of its revenue.

Furthermore, investors prepare ratios and valuation metrics to determine the company's potential value. It involves looking into its financial records, stock price, market share, and overall assets. This way, it helps investors make long-term investment decisions.

Investors compare the previous and current financial statements to complete a thorough fundamental analysis of a stock, company, industry, or market. These statements are made public by the United States Securities and Exchange Commission and provide the answers to the following questions:

- Is the company growing?

- Is it profitable?

- What is it doing with the profits?

- Is the growth sustainable?

- Can the macro-environment support growth?

Moreover, this comprehensive analysis measures a company's growth, profitability, creditworthiness, liquidity, etc. The current ratio and quick ratio are two metrics used to determine if a company's short-term or current obligations can be met using available assets.

Current ratio = Short-term liabilities/Current assets

In ideal conditions, the ratio should be 1. A ratio of less than 1 implies that the company is experiencing financial difficulties.

- Balance Sheet

It provides information about its total assets, liabilities, and shareholder equity.

- Income Statement

It shows how much money the company makes and at what cost. Its components include the cost of goods sold, gross profit, total expenses, net income, and earnings per share (EPS). ). A higher EPS means the stock is worth purchasing.

- Cash Flow Statement

Statement of Cash Flow provides information on the money flowing in and out from operations, investments, and financing. It also indicates if the company has enough cash to pay its expenses.

Other Helpful Fundamental Tools

Besides financial statements, here are some additional tools used in sector wise stock analysis to understand a company's financial positioning:

- Price to Earnings (P/E) Ratio – Reflects a company's value by dividing the share price by the EPS and then comparing it with competitors. A higher PE ratio shows that investors are willing to pay a premium to invest in the company (it also means the firm is overvalued) and vice versa.

- Price to Book (P/B) Ratio – Price to Book Value compares a company's market values to its fundamental book value or the net value.

- Return on Equity (RoE) – ROE shows a company's profitability from investments made by investors.

- Price to Earnings to Growth (PEG) Ratio – The expected annualized earnings growth of a company, determining the stock value. It results from dividing the stock's P/E ratio by the income growth rate.

- Dividend Payout Ratio – The dividend payout ratio refers to the percentage of the company's earnings given to its shareholders.

- Debt-to-EBITDA Ratio – It is the ratio of total debts and EBITDA. A high ratio indicates a riskier investment.

- Debt Ratio - The debt ratio shows how much debt is weighing on a company's assets. If it is more than one, the corporation has more liabilities than assets.

Debt ratio= Total liabilities/Total assets

#2 - Technical Analysis

Investors and traders perform technical analysis by looking at past price and volume trends, demand and supply variables, etc., to determine where the stock price can go in the future. It is a way of forecasting stock price movements using various stock analysis tools and stock analysis chart. The analysis uses indicators like charts and oscillators to predict future trends. It benefits traders who seek profits from short-term price fluctuations. A few questions to keep in mind while performing technical analysis using stock analysis chart are:

- What trends are taking place?

- Is it a good time to enter/exit a trade?

- What are the price levels hit by stock?

- When the stock hits those levels, where does it tend to go afterward?

- Support – The price level shows previous declines marked well below the current price. The level followed by a break signals the start of a downtrend when the buyer enters the market and places a bid on a stock price.

- Resistance – The level at which the stock price starts to fall due to selling pressure. It shows the previous high points before the current stock price. Breaking through the level signals an optimistic outlook.

- Moving Averages (MA) – Moving averages reflect the average stock price over a specific period. Popular moving averages include the 200-day, 100-day, and 50-day averages.

- Trend Lines (TL) – These display price patterns that enable investors and traders to visualize support and resistance levels. One can create them by connecting the pivot points where the price has reversed during a specific period.

- Relative Strength Index (RSI) – This indicator measures the momentum of a stock price, indicating whether it is overbought or oversold.

- Pivot Points – The price levels in which the stock hits support or resistance.

Examples

Let us look at the Apple stock analysis to understand the concept:

- Fundamental Analysis of Apple Stock

It is a good idea to look at the company's most current financial statements before analyzing a stock. In most circumstances, the earnings of a corporation can be seen on its website. For example, here is Apple's Q4 2020 financial report:

Net sales = $111,439 vs $91,819*

Cost of goods and services sold = $67,111 vs $56,602*

Net Income = $28,755 vs $22,236*

Earnings per share (basic) =$1.70 vs $1.26

– * In millions

– The first number is the most recent quarter (Q4 2020) vs. the same quarter the previous year (Q4 2019)

The fundamental analysis shows that Apple has grown in various aspects, including sales, income, and EPS. It also means Apple is profitable with the investor capital, and investors are willing to pay a premium.

- Technical Analysis of Apple Stock

The above chart indicates that Apple's stock has enjoyed a massive rally in Q1 2021. However, recently the stock has cooled off a bit (possibly due to macroeconomic factors) and is now seeking support near the 200-day moving average. If equity can find it in this area, it will be a bullish sign for the future.

Frequently Asked Questions (FAQs)

The stock analysis evaluates a financial instrument, company, the securities industry, or stock market to determine its long-term growth potential based on historical and current market performance. Investors can create a trading strategy, select appropriate stocks, and make an informed purchase or selling decisions using this information.

It requires investigating the company using numerous tools and resources, such as earnings reports, valuations, and historical price and volume levels. Also, it entails analyzing the company's past and present financial statements and comparing them with its competitors. Finally, the stock analysis data can help estimate a firm's earnings capabilities and its stock price movement in the future.

The two types of stock analysis are fundamental and technical. While the former examines a company's financial status using its financial statements, the latter uses charts and oscillators to forecast stock price movements. Furthermore, fundamental analysis helps identify long-term investment opportunities, whereas technical research focuses on profiting from short-term market movements.

Recommended Articles

This has been a guide to what is Stock Analysis. We explain its various tools along with its types and examples to understand it in details. You can learn more from the following articles –