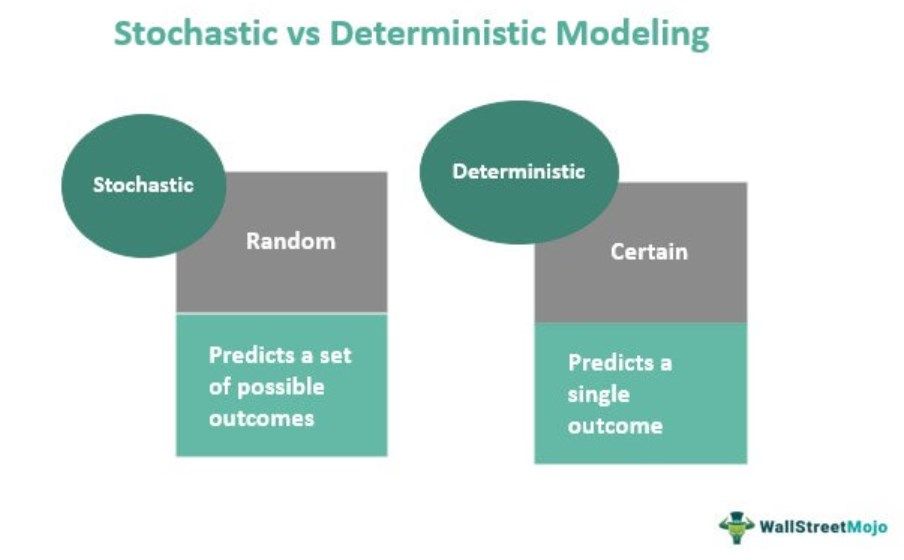

The stochastic modeling definition states that the results vary with conditions or scenarios. The modeling consists of random variables and uncertainty parameters, playing a vital role. It brings the probability factor in the calculation, which determines every possible outcome. For the probability determination of each result, the inputs are given variation from time to time. Thus, it contributes to the computation of probability distributions which are mathematical functions that reflect the similarity of different outcomes.

The model stands on many criteria to ensure accuracy in probable outcomes. Therefore, the model must cover all points of uncertainty to showcase all possible results for drawing the correct probability distribution. Furthermore, every probability is related to one another within the model itself and collectively contributes to computing the randomness of the inputs. These probabilities are further used for predictions and forecasting relevant information.

The stochastic prototype provides several outcomes, and it is applied commonly in analyzing investment returns. First, it studies the market volatility based on the uncertain input and probability of various returns. Thus, stochastic modeling in finance helps investors discern the unknown outcomes that usually do not consider in the analysis. The variable is generally time-series data depicting the difference between historical data, and the final distribution result describes the inputs' randomness.