Table Of Contents

What Is A Standstill Agreement?

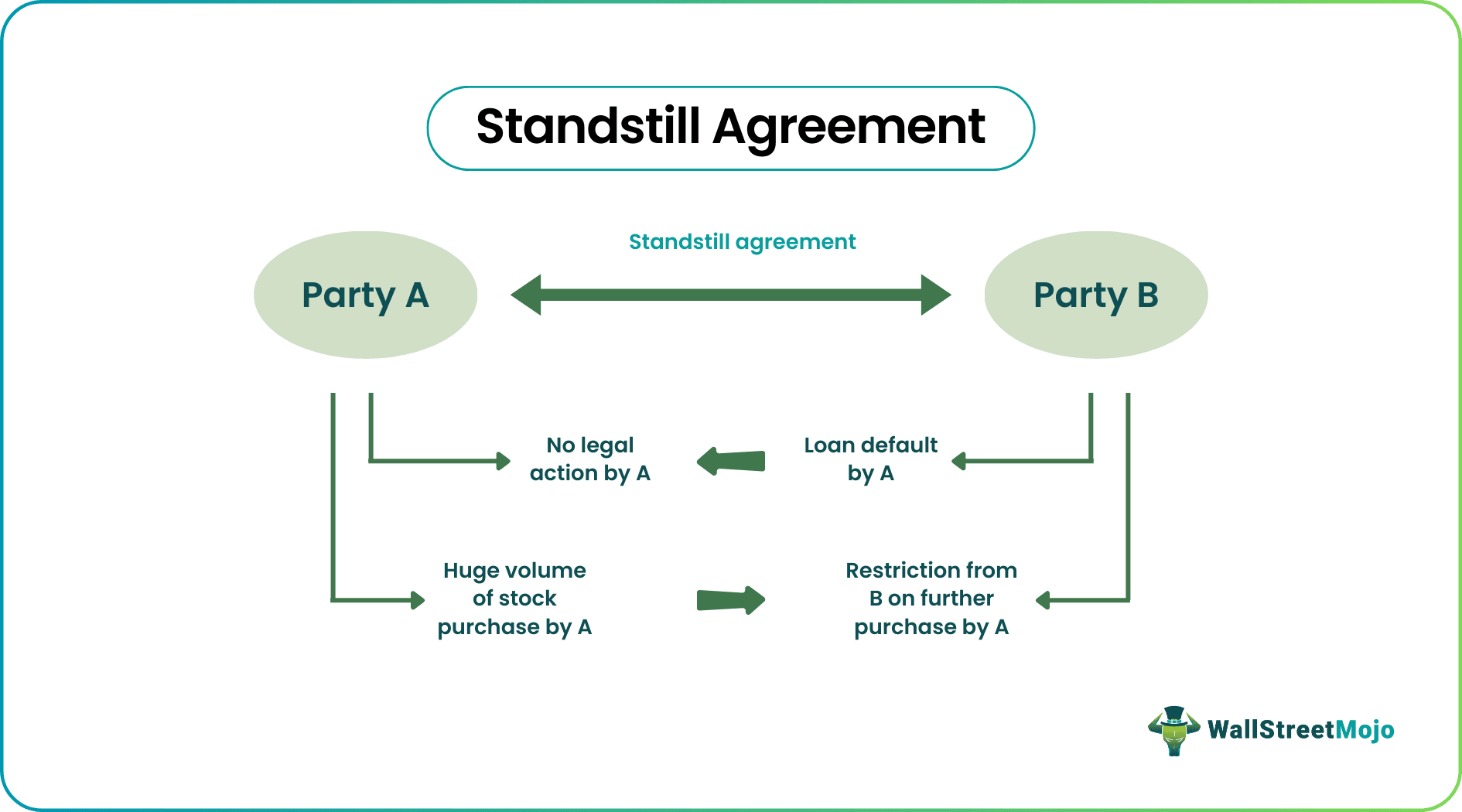

A standstill agreement is a deal between two parties with restrictions on the bidder’s or lender’s power to trade on stocks or initiate legal proceedings on the target company. It helps stop the process of a hostile takeover if the parties cannot negotiate a deal peacefully.

This type of agreement is essential because, while acquiring any company, the purchaser has access to confidential information about the target company, which can be misused. Thus, by using this agreement, it is possible to put a stop to any unwanted approach from an aggressive investor or bidder from taking any step to acquire control or initiate litigation.

Key Takeaways

- A standstill agreement is a type of contract in which the purchaser or investor has restrictions regarding buying, selling, or voting for the target company’s stocks or taking legal action during default.

- It prevents any strong investor or bidder with access to the target company’s confidential data from performing a hostile takeover.

- It also stops an acquirer from approaching the target company in an unwanted way or pressuring it to come under its control.

- It helps the target company to stop or delay litigation against a hostile buyer.

Standstill Agreement Explained

A standstill agreement is a deal in which an acquiring company or lender comes under some constraints regarding transacting or voting for the target company’s stocks, so there is no forceful takeover through confidential information.

It is essential to draft a standstill agreement so that it is possible to dilute a bidder's unwanted or hostile approach. The bidder commits not to pressurize the target company during the purchase deal or debt repayment. However, the agreement conditions can vary, depending on the parties, the type of contract and the condition put up by each party.

The agreement terms will vary depending on some situations as follows:

1. Purchase of shares

Suppose it comes to the notice of an organization that a shareholder is trying to buy shares that will be enough to control the organization’s decision process. In that case, it is better to undertake this agreement to stop the shareholder from acquiring additional shares beyond a point. The target company must offer some standstill agreement consideration in exchange for the above restriction.

2. Debt restructuring

In this case, the borrowing company might want to stop the lending company from enforcing them to pay the debt. Thus, litigation can be avoided through a standstill agreement, not allowing the borrowing company the required time to formulate the restructuring strategy. The creditor or the lender might seek standstill agreement consideration in return for the benefit the borrowing company gets.

3. Handle a business limitation

Suppose a business cannot fulfill the demands or provisions mentioned in a contract. In that case, it can use this agreement to pause the negative consequences of not meeting the terms of the deal and go for better negotiation.

Examples

Some examples related to the standstill agreement are as follows:

Example #1

Choco Industries is a world leader in the chocolate and bakery products market and is headquartered in California. Choco Industries is notified that another company in the bakery market, Bake Food, located in Los Angeles, has purchased 48% of the shares of Choco Industries.

Choco Industries decides to enter into a standstill agreement which will prevent the investor from buying more stocks because more purchases by Bake Food means the control of Choco Industries will shift into Bake Food’s hands.

Bake Food agrees to use standstill provisions under consideration that they will get a seat in the company’s management which will give them the power to influence policies and procedures followed in Choco Industries.

Example #2

A few months ago, Ozon Holding PLC, Russia’s largest e-commerce platform, issued an update regarding its convertible bonds of $750 million. They are senior and not backed by security, with a 1.875% coupon payment maturing in 2026.

A few months back, the company signed a standstill agreement with its bondholders. The agreement restricts bondholders’ capacity to take action in case of default. Bondholders also agreed not to act against any debt that the company or its subsidiaries may bear in its books.

Example #3

A few years back, Abengoa, a Spanish MNC in green energy, water, and the infrastructure sector, approached the United States Bankruptcy Court to get approval for a standstill provision. This arrangement would help them acquire more time to restructure the company's financial position. Thus, through a standstill agreement, litigation was avoided, which helped to recapitalize the company through various means.

Template

Let us look at a sample template to understand how to draft standstill agreement:

The above template gives a detailed description of how the document is drafted. However, a standstill agreement limitation like a lengthy negotiation process, difficulty in reaching an agreement regarding the considerations for both parties, clear and correct language reflecting the intention, etc., should be kept in mind. Else the borrower, lender, client, solicitor, and all parties suffer the consequences of the standstill agreement limitation leading to massive loss.

Subordination And Standstill Agreement

In a subordination process, one property can be mortgaged for two loans, and one loan is placed at a lower rank than another. In contrast, in a standstill agreement, some restrictions are put on the stronger party to prevent any aggressive approach and take control of the other. Now, let us look at their differences in detail.

| Subordination | Standstill Agreement |

|---|---|

| It is the process there are two loans, and the ranking of one loan is below the other. | It is a contract in which one party allows time to the other before taking any legal action in case the contract conditions are not met. |

| One party’s claim becomes subordinate to the other. | It prohibits the stronger party from making any claim or litigation against the other till the agreement is valid. |

| Among the two loans, the senior-ranking lender can initiate legal proceedings against the borrower in case of default. | If there are two loans, the agreement stops the lower-ranking lender from acting against the borrower in case of default. |

| It is initiated if a borrower needs more funds and has to borrow against the same mortgage. | It is initiated if the borrower needs more funds to pay two loans together. |

| The subordinated loan has to be paid higher interest as compensation for the default risk. | The lender demands a valuable consideration in exchange for restriction on the ability to take legal action. |

| It is applicable only for borrowing and lending. | It is applicable for loans, company takeovers, production, or other arrangements. |