Table Of Contents

What Is Standard Cost Formula?

Standard Cost Formula refers to the formula used by the companies to calculate the manufacturing cost of the product or the services produced by the company. According to the formula, the product's standard cost is calculated by adding the value of the direct material costs, the value of the direct labor costs, the value of the total variable overheads, and the value of the total fixed overheads during the period.

Every business has to calculate and maintain a budget for the entire financial year. This formula is used to find the cost incurred, create provisions for meeting such costs in the future, and also design strategies to control them. This ensures funds are channelized for useful purposes and profitability increases along with efficiency.

Standard Cost Formula Explained

The standard cost formula helps in calculating the amount of cost incurred in production, through collection of financial data related to relevant cost item, and following the steps to arrive at the cost figure. This calculation is followed in every business who has to formulate a budget and make financial planning to ensure optimum usage of resources at minimum cost.

The formula for the same is as follows:

Standard Cost = Direct Material Cost + Direct Labor Cost + Variable Overhead + Fixed Overhead

In the above formula, we need to understand the following:

Direct material cost = Number of units x Price of each unit

Direct labor cost = Total units x hours worked x rate for each labor

Variable overhead = Variable manufacturing cost x total units

Fixed overhead = Fixed cost of production

The above is a very detailed and unique process that helps business to decide how much cost is incurred for each type of product lines and whether it is possible to reduce them. This will help in using the financial resources in areas where they are actually required. The analysis of standard cost helps in enhancing profitability and efficiency. It is also a method of taking pricing decisions that will help in increasing revenue and achieving sales targets.

Companies can set financial goals based in this standard cost formula accounting, check for any variation from the target, and revise the strategies for production through cost cutting. In this manner, clear records are also maintained, which is useful while planning for funding through loans or equity for growth and expansion.

Calculation Of Standard Cost

Standard costing is more prevalent in the manufacturing industry, and to calculate the standard cost per unit formula, we need to follow the below steps:

To calculate the Standard cost, we need to follow the below steps:

- Identify all the direct costs associated with the manufacturing cost, and if these costs would be if they don't incur, then the manufacturing process would have impacted.

- Calculate the standard quantity and standard hours based on actual output.

- Categorize those costs into three significant buckets: Material, Labor, and Overhead, and then overheads can be categorized into fixed and variable.

- Take the total of the cost you calculated in step 3, which shall be the firm's total standard cost.

Examples

Let us try to understand the concept of standard cost formula accounting with the help of some suitable examples.

Example #1

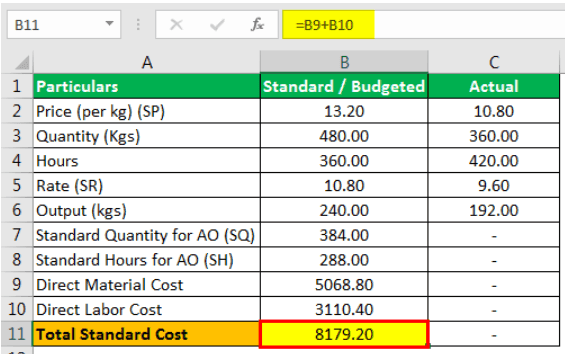

Below is the summary extracted from PQR Ltd., which is in the business of manufacturing cotton. You are required to calculate the total Standard Cost.

- Price (per kg): 13.20

- Quantity(Kgs): 480.00

- Hours: 360.00

- Rate: 10.80

- Output (kgs): 240.00

Solution:

First, we need to calculate the standard quantity and hours and then multiply them with standard rates.

Calculation of Standard Quantity and Standard Hours

Calculation of Direct Material Cost you can do using the below formula,

Direct Material Cost Formula = SQ * SP

- =384*13.20

- = 5,068.80

Calculation of Direct Labor Cost you can do using below formula as,

Direct Labor Cost Formula = SH * SR

- =288.00*10.80

- = 3,110.40

Therefore, the calculation of the total standard cost per unit formula you can do as follows,

=5068.80+3110.40

Total Standard Cost will be -

- Total Standard Cost = 8179.20

Therefore, the total standard cost will be 5,068.80 + 3,110.40, 8,179.20.

Example #2

Khaleel industries operating in the business of manufacturing steel pipes are worried about its rising cost and want to make a budget starting this year. Therefore, it has provided you with the below information and asked you to calculate the total budgeted or standard cost.

| Particulars | Standard/Budgeted | Actual |

|---|---|---|

| Price (per kg) | 660.00 | 500.00 |

| Quantity (in kgs) | 800.00 | 600.00 |

| Hours | 12000.00 | 14000.00 |

| Rate | 500.00 | 540.00 |

| Output (in kgs) | 1000.00 | 1600.00 |

| FOH rate per hour | 240.00 | 220.00 |

| FOH | 60000.00 | 50000.00 |

Solution

We need to calculate the standard quantity and hours and then multiply them with standard rates.

Calculation of Standard Quantity and Standard Hours

Calculation of Direct Material Cost you can do using the below formula,

Direct Material Cost Formula = SQ * SP

- = 1280*660

- = 8,44,800.00

Calculation of Direct Labor Cost you can do using below formula as,

Direct Labor Cost Formula = SH * SR

- = 19200.00*500

- = 96,00,000.00

Calculation of Fixed Overhead Cost you can do using below formula as,

Fixed Overhead Cost = SH * FSR

- =(19200*240)

- = 28,80,000.00

Therefore, the calculation of the total standard cost you can do as follows,

=844800.00+9600000.00+2880000.00

Total Standard Cost will be -

- =13324800.00

Therefore, the total standard cost will be 8,44,800 + 96,00,000 + 28,80,000 which is 1,33,24,800.

Example #3

Gold ltd has been trying to increase its gross profit margin; however, they have remained unsuccessful in doing the same, and now they want to analyze its issue. Hence, it decided to review its manufacturing cost-related matters, if any. Below are the details, and they first want to calculate to check whether the total standard cost is an overestimate?

| Particulars | Standard/Budgeted | Actual |

|---|---|---|

| Price (per kg) | 10.65 | 12.00 |

| Quantity (in kgs) | 3000.00 | 3600.00 |

| Hours | 3600.00 | 3300.00 |

| Rate | 6.00 | 4.50 |

| Output (in kgs) | 7500.00 | 8100.00 |

| FOH rate per hour | 7.50 | 9.00 |

| FOH | 15000.00 | 21000.00 |

You are required to calculate the total standard cost.

Solution

We need to calculate the standard quantity and hours and then multiply them with standard rates.

Calculation of Standard Quantity and Standard Hours

Calculation of Direct Material Cost you can do using the below formula,

Direct Material Cost = SQ * SP

- = 3240.00*10.65

- = 34,506.00

Calculation of Direct Labor Cost you can do using below formula as,

Direct Labor Cost = SH * SR

- =3888.00*6.00

- = 23,328.00

Calculation of Variable Overhead you can do using below formula as,

Variable Overhead = SR * AO

- = 6 * 8100

- = 48,600.00

Calculation of Fixed Overhead Cost you can do using below formula as,

Fixed Overhead Cost = SH * FSR

- =3888.00*7.50

- = 29,160

Therefore, the calculation of the total standard cost you can do as follows,

=34506.00+23328.00+48600.00+29160.00

Total Standard Cost will be -

- =135594.00

Therefore, the total standard cost will be 34,506 + 23,328 + 48,600 + 29,160 which is 1,35,594.00

The above examples clearly explain the concept and how to identify the items within the financial statements and use them to calculate it. However, the examples are about business processes which are quite simple to understand. The actual calculations might be more complex and involve more item to be considered. This will depend on the type, size and nature of business operation.

Relevance and Uses

Let us find out what are the different areas where the concept is useful and relevant.

- It is very useful in inventory calculation and costing. The prices of different components of production can have a lot of difference due to variation in raw materials, time lag between accumulation of raw materials and finished goods, wages and salaries or labor, etc. This formula helps in estimating the inventory cost.

- The selling price can be estimated which should cost the cost and generate profit. So it gives an idea about the minimum price level that will cover cost as well as increase sales and customer base in the competitive market.

- It helps in maintaining cost related financial records for future reference and for budgeting and for accessing overdraft facility or borrowing funds.

- It acts as a benchmark for cost comparison between departments of products and product lines or even among peer companies so that the business is able to assess its own efficiency level and areas of improvement. The company may restructure its production and costing strategies based on it.

It is generally observed that rather than allocating the actual costs of direct labor, direct material, and the manufacturing overhead, whether fixed or variable, to the goods, many producers allocate the standard or the expected cost. It would mean that a producer's cost of goods sold and inventories shall start with the amounts that reflect the standard costs and not the product's actual costs.

On the contrary, the producers still have to bear the actual costs for the products. Consequently, there shall always be differences between the standard costs and actual costs, and those differences can be called the variances; later, management can analyze whether these costs were favorable or adverse.