Table Of Contents

What Is A Special Endorsement?

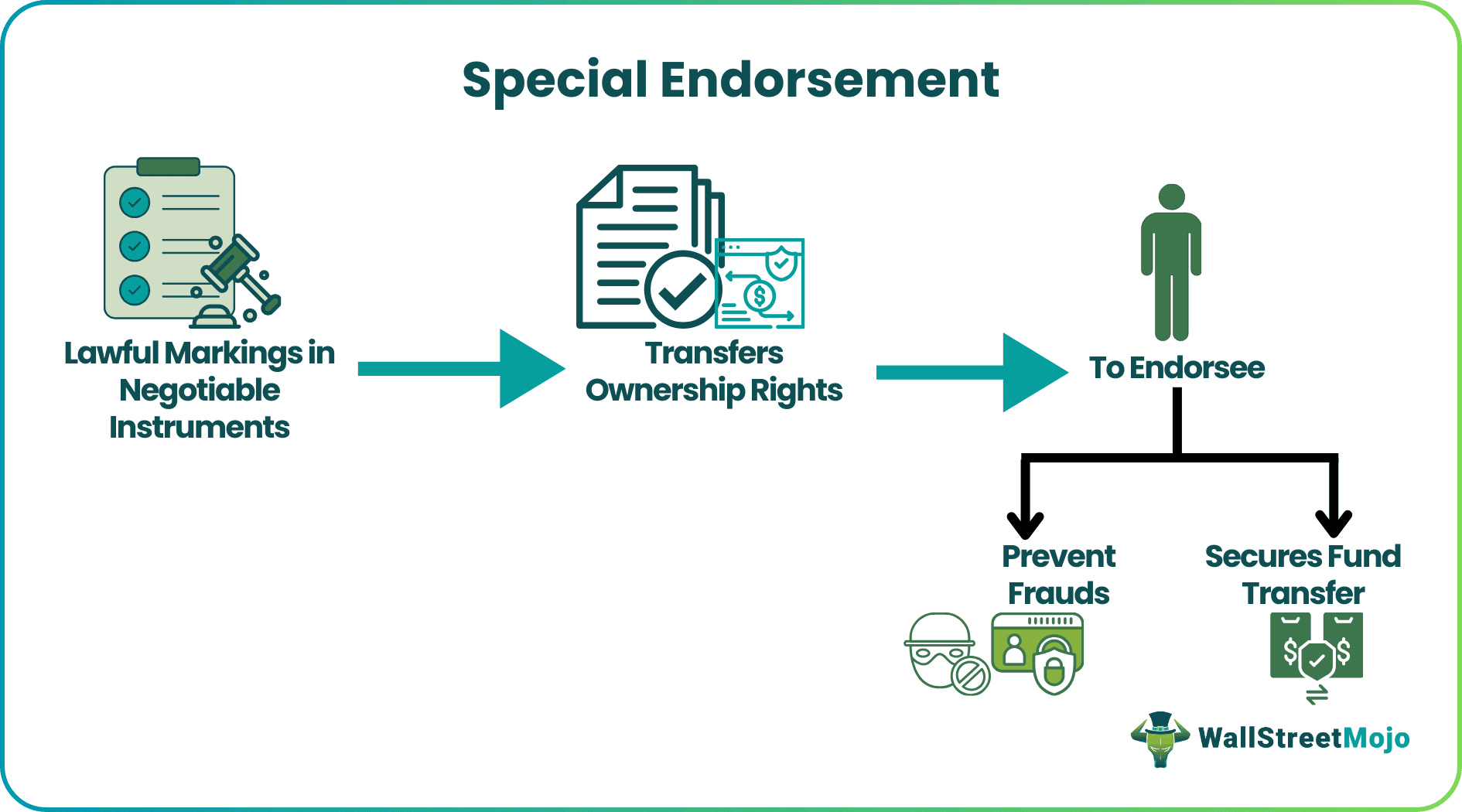

A Special Endorsement refers to the signing by the payee at the back of a check specifying the person's name to whom the check can be paid on presentation. It restricts check usage against fraudulent encashing, aids transaction fluidity in businesses, and secures fund transfers to the designated person.

It creates an order paper requiring endorsement and delivery concerning its negotiation. The endorsement must comply with the bank of the recipient of the check. It helps in debt collection of businesses owing money to third parties. It facilitates check transfer to legal heirs or beneficiaries in estate settlements.

Key Takeaways

- A special endorsement involves the payee signing the back of a check, indicating the recipient's name for payment upon presentation.

- It aims to limit fraudulent cashing and ensure secure fund transfers, enhancing transaction fluidity in business settings.

- It enhances security, reduces theft risk and legal standing, streamlines banking transactions, brings clarity to financial transactions,

- specifies recipient designation, facilitates secure transactions, mitigates risk, and enhances legal and transactional clarity.

- Its limitations are - potential fraud risk, legal implications, limited flexibility, scrutiny by financial institutions, limited negotiability, complex control, reduced flexibility, conditional nature, and potential coverage constraints.

Special Endorsement Explained

A special endorsement is a legal inscription on a negotiable instrument, such as a check, to transfer its ownership and payment rights to a particular person or entity called an endorsee outside of the original payee. It clarifies the individual to whom or by whose order the instrument has to be paid. Moreover, by endorsing a negotiable instrument, the endorsee takes on the legal payment responsibilities towards its holder and all subsequent endorsers.

It can be done by writing - Pay to the order of and then putting the payee's name and signature on the back of the check. Banks require additional verification of specially endorsed checks as they contain the elements of fraud and risk. Hence, they do not easily get encashed without the presence and identification of the payee. Although it looks simple, it has legal implications, such as making the check secure in case it is stolen, misused, or lost, as the endorsee can negotiate it.

It also implies that a business partner can collect eh payment. One can also deposit the check into a joint account. It reduces disputes, streamlining the banking transactions. Furthermore, courts usually uphold the right of the endorsed party over their exclusive right to the funds.

Businesses use it for these financial transactions to endorse and receive checks for suppliers, vendors or clients. Moreover, Special endorsement missing can lead to issues in check processing. However, authorized agents, equipped with a power of attorney, can deposit checks on behalf of the principal. Specially endorsed checks or instruments have increased financial transactions' speediness, security and efficiency.

Consequently, it has enhanced the confidence and trust of customers and businesses in the financial system. It may contribute to the overall growth of businesses, the economy, and infrastructure.

Examples

Let us use a few examples to understand the topic.

Example #1

Imagine Auroria Blacke, who is a well-known artist, resided in the charming village of Lumina, which is tucked away amid undulating hills. Renowned for her captivating paintings, Auroria was given a special endorsement for a charity event at Lumina Bank one chilly morning. The holographic stamp on the Lumina Bank check was Auroria's trademark dragonfly, a representation of optimism in her artwork.

A surprise that is an exclusive display place for her artwork at the bank's headquarters was revealed due to this special endorsement. Therefore, the bank's hallways would adorn Auroria's works of art, leading to a fusion of art and business into an eye-catching show for the locals.

Example #2

As per an article published on December 16, 2023, it is crucial to keep in mind the legal ramifications of depositing a check made out to someone else while working with special endorsements. There may be severe repercussions if a third-party check is cashed without the required endorsement. These may include possible legal action for check fraud or forgery. If the check is cashed without the payee’s express consent, there is also a chance of delayed payments, possible overdraft fees, and damaged relationships.

One must have the payee’s explicit consent before depositing the check to avoid misunderstandings or relationship dent. Ideally, one should have the payee accompany to the payor’s bank or offer a written declaration. Hence, while working with special endorsements and third-party checks, these hazards are vital to account for.

Benefits

It has multiple benefits in personal as well as business domains, as listed below:

- Enhanced Security: Specifying the recipient improves security by reducing check use and lowering the possibility of unlawful cashing.

- Reduced Risk of Theft: The danger of theft is decreased when the payee is designated since it stops unauthorized people from cashing or negotiating the check.

- Legal Standing: Specially endorsed documents protect the interests of the endorsed party, confirming their financial entitlement and strengthening their position in the legal system.

- Streamlined Banking Transactions: The effectiveness of special endorsements helps financial institutions by expediting fund transfers, simplifying procedures, and lowering administrative burdens.

- Clarity in Financial Transactions: By guaranteeing transparent financial transactions, special endorsements improve transaction clarity and benefit both issuers and beneficiaries.

- Specific Recipient Designation: Fosters accountability and transparency by making sure that the designated person or organization receives money alone.

- Facilitation of Secure Transactions: Permits secure transfers between parties, particularly for insurance and salary settlements.

- Risk Mitigation: Compliance with deposit bank regulations reduces risks by averting complexities and possible conflicts.

- Enhanced Legal and Transactional Clarity: For all parties concerned, special endorsements help ensure that financial transactions are transparent and enforced by law.

Limitations

Understanding the risks and legal aspects of special endorsements is necessary to stay safe from financial complications. Hence, those limitations must be looked out for as stated below:

- Potential Fraud Risk: Banks examine special endorsements closely in spite of security in order to stop fraud and identify possible hazards.

- Legal Implications: Inadequate endorsements have legal ramifications. Therefore, it's important to have sophisticated knowledge to stay out of trouble.

- Limited flexibility: hard to revoke once granted and has little room for discretion.

- Scrutiny by Financial Institutions: Banks examine carefully these endorsements which might delay processing.

- Limited Negotiability: Prohibits the use of the instrument by limiting further negotiation.

- Complex Control: Restricted ability to affect the outcome of the future negotiation.

- Reduced Flexibility: Reduces negotiability compared to blank endorsements, affecting transaction flexibility.

- Conditional Nature: Endorsers' obligation or commitment might be restricted by specific endorsements that are qualified or conditional.

- Potential Coverage Constraints: This may limit some coverage features in some insurance circumstances, potentially resulting in coverage gaps.