Table of Contents

What Are Soybean Futures?

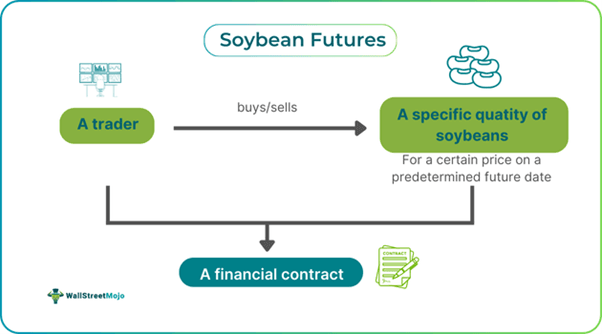

Soybean futures refer to regulated derivatives denoting an agreement to sell or buy a certain quantity of soybean for a predetermined price on a specific date in the future. These financial contracts serve as a hedging tool. Moreover, one may use them for speculation.

The trading of these contracts takes place on commodities exchanges, like the Chicago Board of Trade or CBOT and the Chicago Mercantile Exchange. Various factors impact the price of soybean futures, for example, global market demand, government policies, and currency fluctuations. Individuals looking to trade this financial instrument must understand these aspects to make well-informed decisions.

Key Takeaways

- Soybean futures are legally binding financial agreements involving two parties where one commits to purchasing or selling a specific amount of soybeans on a preset date in the future for a specific price.

- One can use these contracts to speculate on the price direction of the underlying asset or for hedging purposes.

- An individual may also add these financial instruments to their portfolio for diversification.

- The price of soybean futures may increase or decrease because of various factors. Some of them are trade disputes, the strength of the US dollar, and global tensions.

Soybean Futures Explained

Soybean futures are financial contracts that involve buying or selling a particular amount of soybean on a particular future date for a preset price. Individuals often trade these assets to hedge against price fluctuations or gain exposure to the underlying asset, i.e., soybean, without actually having ownership of the physical soybeans. Alternatively, they may allocate funds to these assets to diversify their portfolio or increase their portfolio’s liquidity.

As noted above, various factors can influence the price of these contracts. Let us look at them:

- Global Demand: China accounts for a large portion of the global soybean imports. Hence, it serves as a key driver concerning global demand. Apart from China, multiple emerging economies influence global demand because of their imports.

- Currency Fluctuations: The US dollar’s weakness or strength has a key influence on soybean prices. Considering that commodity trading globally predominantly takes place in USD, a weaker dollar means foreign purchasers would need to pay a lower amount for the soybeans. This would lead to increased demand and higher soybean prices. On the contrary, a stronger USD would typically lead to higher soybean prices.

- Geopolitical Tensions: Trade disputes can result in significant fluctuations concerning soybean prices. For example, talks of tariffs between nations can affect the price of the asset. Hence, when trading these financial contracts, one must take geopolitical tensions into account.

- Producing Regions: The environmental, economic, and political scenario in major soybean exporting countries, like the USA and Brazil, significantly influences the price of soybeans.

- Harvesting: Usually, harvesting takes place in the month of October or November. Any delays in harvesting, smaller yields, or diseased crops can have a significant impact on price.

Specifications

Some noteworthy specifications of such contracts are as follows:

- Exchange: It is the commodity exchange on which the buying and selling of these futures occur.

- Multiplier: This refers to a figure one multiplies at the time of computing the overall contract value.

- Symbol: It is a one-of-a-kind combination of numbers and letters that identify the futures product on an exchange. For example, on the CBOT, the symbol is ZS on the CBOT.

- Trading Hours: This refers to the hours in a day during which the trading of the futures contract occurs. It varies across exchanges.

- Settlement: This specification indicates whether the settlement of the contract would be via physical delivery or liquidation.

- Minimum Tick Size: It denotes the smallest increase in the price of the contract that the exchange it trades on allows. For example, in the case of soybean futures traded on CBOT, it is $12.50

- Contract Size: This means a standardized size unique to individual contracts. For instance, in the case of the CME Group exchanges, it is 5,000 bushels.

- Last Trading Day: This date indicates the last for trading the contract.

How To Trade?

Individuals might want to keep the following things in mind for trading soybean futures contracts effectively:

- First, they must open a trading account with a broker. For selecting a broker, individuals must consider certain elements like reputation, brokerage fees, facilities, etc.

- Next, they must complete the formalities required for account activation and transfer funds into the trading account.

- Individuals must carry out extensive research concerning the aspects influencing soybean prices, including geopolitical factors and global demand.

- After that, individuals must evaluate their risk appetite and formulate trading strategies that can help them make financial gains.

- Lastly, one must identify a contract to enter a position and place the trade. One must ensure to check the contract’s specifications before making the decision.

When trading these contracts, individuals can utilize stop loss to minimize their losses in case unfavorable price movements materialize. Also, they must keep themselves updated with the latest news regarding soybeans so that they can adjust their strategy accordingly. One may also consider using take-profit orders to realize the gains when trading.

Examples

Let us look at a few soybean futures examples to understand the concept better.

Example #1

Suppose John is an experienced trader who thinks that the price of soybeans would increase. To gain exposure to the crop, he decided to buy a soybean futures contract. Its size was 5,000 bushels, and the price was $10 per bushel. Within a month, the price of the commodity increased because of trade disputes. When the price touched the $15 mark, John sold the contract, pocketing significant gains.

Example #2

According to a report published on February 6, 2024, despite the surging demand for soybeans, soybean futures closed at a lower price on February 2, 2024. The March 2024 futures closed at 1186.75 ¢/bu owing as a result of the concerns regarding the supply of soybeans from Argentina and the lackluster export demand. Per analysts, the market considered export demand and supply forces to have the potential to make more impact than the domestic demand.

Benefits

Let us look at some key benefits of these financial contracts.

- Diversification: These financial contracts can be helpful in diversifying an investment portfolio to mitigate risk and improve the overall performance.

- Leveraged Instrument: These futures enable one to have significant exposure to the underlying asset even if they have a small capital. This is because the trader has to deposit a percentage of the total contract value with the broker as a margin.

- Liquidity: Generally, the futures market is highly liquid. As a result, individuals can enter and exit positions easily.

- Hedging And Speculation: As noted above, individuals can utilize the financial contracts for hedging and speculation purposes.

Risks

Some noteworthy limitations of soybean futures contracts are as follows:

- High Risk: In the case of unfavorable market movements, one may lose more than the amount of initial investment.

- Price Volatility: Various factors influence the price of the underlying asset. Hence, these financial instruments are volatile and are not suitable for people with a low-risk appetite.