Table Of Contents

What is Sole Proprietorship?

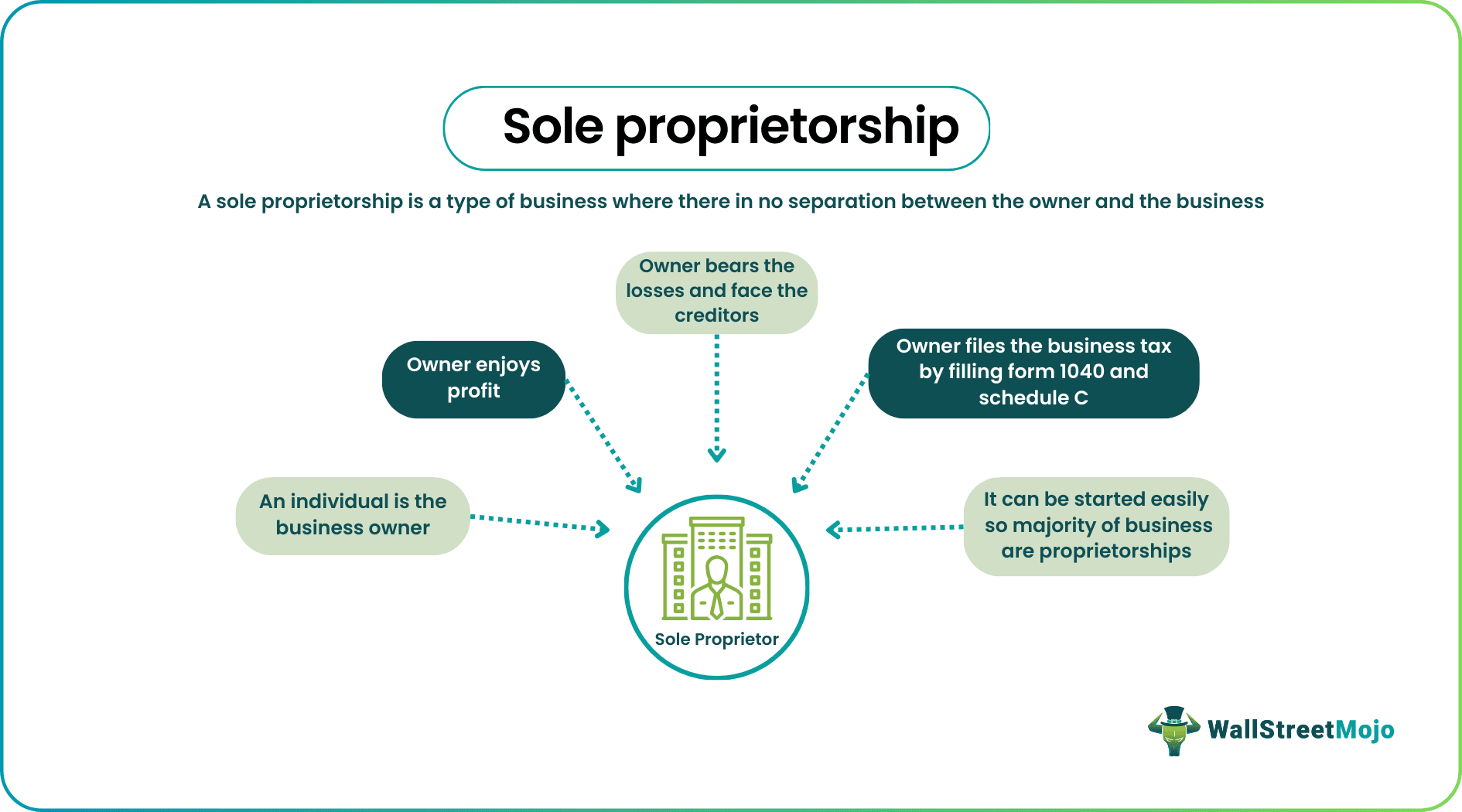

Sole proprietorship (or sole trader or proprietorship) means an unincorporated business operated by an individual with no separate legal existence. As a result, owners receive all profits from the business but are personally liable for all losses. It is widely popular for starting small businesses as it is easy to set up and manage.

Unlike a corporation, a proprietorship is a pass-through entity, i.e., business income is taxed as the owner's personal income. Proprietors can start the business in their own name or have a trading name and get it registered locally. Due to negligible paperwork involved in its establishment, it is the most preferred type of business structure. All freelancers fall under proprietorship.

Key Takeaways

- A sole proprietorship is a type of business where there is no legal distinction between the owner and the business entity.

- It is the easiest form of business to start as minimal legal formalities are involved.

- A sole proprietor enjoys all profits from the business and bears unlimited personal liability for all business losses.

- A sole proprietorship is a pass-through entity for taxation.

- All profits and losses of the business are reported on Schedule C of the owner’s personal income tax return (Form 1040).

Sole Proprietorship Explained

A sole proprietorship is a business entity that isn't legally separate from its owner. Any individual can start such a business as it is not governed by any statute. It can be thought of as an extension of the owner. Therefore, its continuity is solely dependent on the owner.

Proprietors exercise total control over their businesses and have the freedom and flexibility to operate according to their preferences. This gives them the right to keep all the profits of the business. However, at the same time, they have to incur all losses of the business unconditionally.

Business creditors can hold the owner personally liable in case of unsettled debts. In addition, any public harm caused by the product or any major accident at the business site is the personal responsibility of the proprietor. Thus, any damage to or by the business can bring a bad name to the proprietor or result in legal issues.

A proprietorship firm can file a legal suit against their suppliers or customers if they default. Likewise, customers and suppliers can also initiate legal proceedings against the sole trader.

Furthermore, the owner is also responsible for all the tax obligations of the business as it is a pass-through entity for taxation. Therefore, the proprietor has to report profits and losses of the business in Schedule C of Form 1040 while filing federal income tax for any given year.

How to set up a sole proprietorship?

To start working as a sole proprietorship, individuals can set up the business in their name without any legal paperwork and commence trading. However, if the business is not using the proprietor's name, the owner must register it with the local authority by filing a "Doing Business As" (DBA) form. DBA ensures that the business has a distinct name assigned and that the nature of the business is known to the authority.

Note that filing a DBA is not mandatory. It depends on the nature of the business and the proprietor’s preference. After filing DBA, the proprietors can employ staff and rent commercial premises for operating their business. On hiring employees, the proprietorship must apply for an employer identification number (EIN) from the Internal Revenue Service (IRS).

Before commencing business, sole traders can also open a business checking account with a bank to accept payments from customers, give payments to suppliers, and credit salaries to their staff. However, it is not compulsory. Now, the business is ready to take off. Owners can contract with suppliers and manufacturers and begin selling goods to customers.

Sole proprietorship Characteristics

The following are the key characteristics of a sole proprietorship:

- Individual ownership - The owner of a sole proprietorship is the whole and soul of the business. From contributing capital to managing its affairs and making decisions, all rests with a single individual.

- No distinction between the owner and the business – Since the business is not a separate legal entity, the owner must bear any profit and loss from business operation.

- No independent taxation – There is no separate taxation for the business as it doesn't have a distinct legal existence. Therefore, proprietors report all business profits and losses on their personal income tax returns. Thus, the owner shoulders all tax obligations. Proprietors only pay the tax on their total income to the IRS without paying any corporate tax.

- Unlimited liability - Any loss by the business is a personal loss to the owner. Owners have to assume all debts and liabilities of the business and offset them using their personal income or property.

- Limited legal formalities – Sole proprietorship is the most common form of a business structure due to the minimum paperwork required to establish it. Any individual with the requisite capital and necessary license or permit can start a business with almost no government intervention.

- No minimum capital investment – There is no set minimum investment to start a proprietorship business. Any individual can commence with available capital. Thus, small businesses usually use this business structure.

- Easy commencement and closure – Owners can start or close a proprietary business at their discretion as its total control rest with them. They need not consult with any other person or government for the same.

Examples

Here are some sole proprietorship examples to understand the concept of a sole trader better.

Example #1

Let us assume a person called ABC wants to start a gym. He has little education and a small amount of capital. He is planning to start the business immediately and run it himself. Since a sole proprietorship comes without too many legal complexities, ABC opts for this business structure.

ABC gets its sole trading firm registered by filing DBA at the local authority. After this, he gets a business checking account opened to transact with suppliers and customers. Next, he rents a business premise, hires employees, obtains DBA, and starts the business easily in a short time with minimal capital investment.

Example #2

Suppose there is a lawyer Mr. D who is an independent law practitioner in a court. He is earning and filing taxes as an individual. However, he intends to start a law firm where he will hire junior lawyers and accountants to offer legal services to the public.

In this case, the lawyer files the DBA with the local administration and starts his law firm as a proprietary firm. Now, he can hire the staff for his firm and enjoy all the profits of the firm.

Since the proprietory firm is a pass-through entity for taxation, he is liable to personal income taxes on the firm's income. Therefore, he must report all profits and losses of the firm in Schedule C of Form 1040. Note that though all the gains of the firm will be his own, the firm's loss will affect his reputation in the market.

Advantages

Most of the businesses in the US are proprietorship firms. This is because there are numerous advantages of a sole proprietorship:

- Minimal legal paperwork required

- Easy to establish and wind up

- Maximum freedom and privacy in operation

- Simplified banking through business checking accounts

- Considered a pass-through business for taxation

- No separate taxation of the entity; owners report business profits and losses on their personal income tax returns

- No corporate tax charged

- Complete control over the business

- Quick decision making possible

- Sole beneficiary of all business profits

- Minimum government regulation

- Easy switching to other business structures

Disadvantages

A sole proprietorship also has several disadvantages, as discussed below:

- No segregation of the business from the proprietor

- Unlimited liability for the owner

- Difficulty in obtaining credit or finance

- More income taxes for the proprietor in case of high profits from the business

- No unemployment benefits for the owner if the business suffers losses

- Employer identification number (EIN) required from the IRS for hiring employees

- Business image affects the personal image of the owner and vice-versa

- Trouble finding buyers for the business