Table Of Contents

What Is A Sole Practitioner?

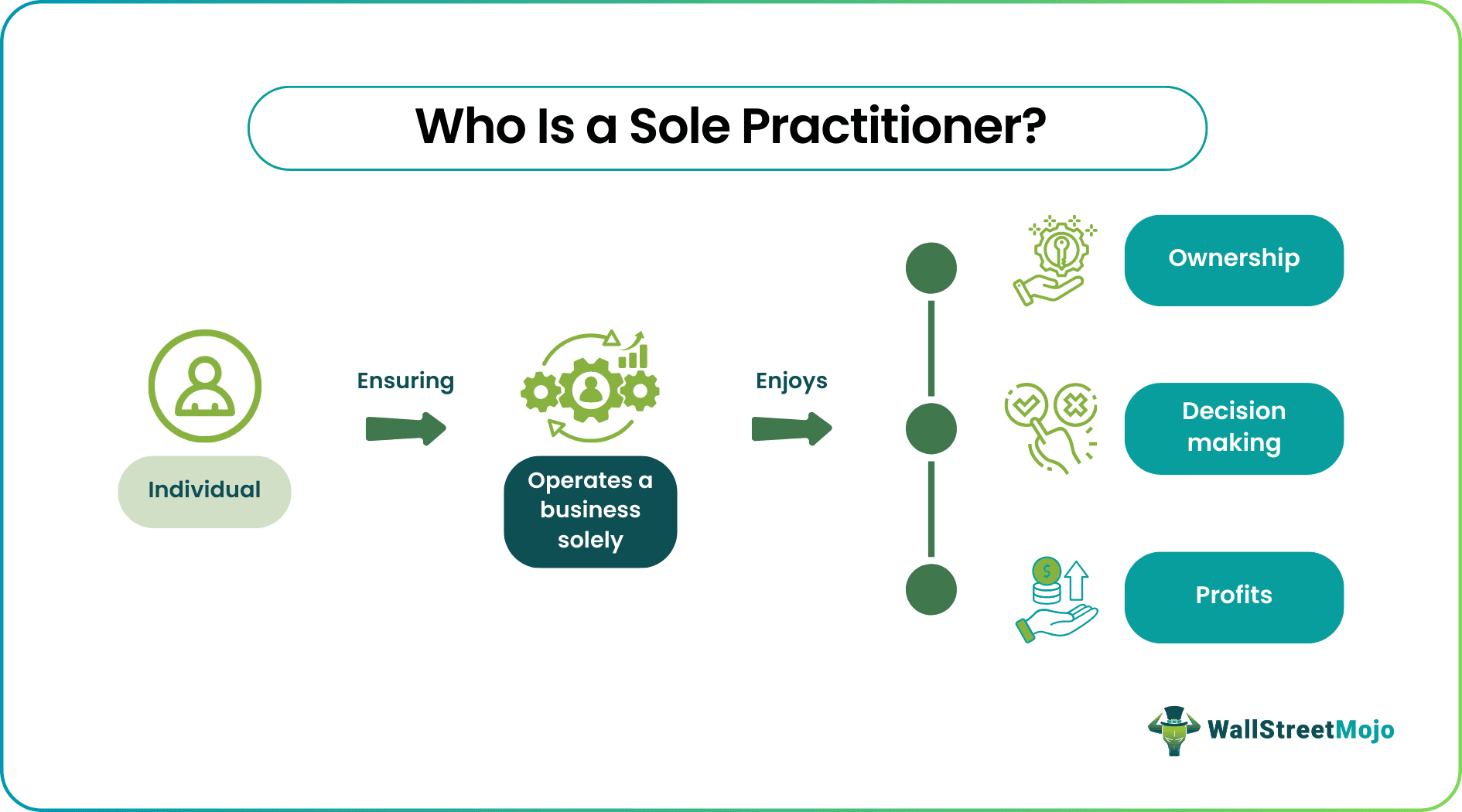

A Sole Practitioner, or solo practitioner in business or professional contexts, is an individual who independently operates and manages a business or professional practice without partners. The purpose of being a solo practitioner is to have complete autonomy and control over the operations, decision-making, profits, and overall direction of the venture.

They hold vital significance for their autonomy, direct profit control, and efficient decision-making. These individuals manage a business or professional service independently, as per personal preferences. While fostering direct client relationships, the solo practitioner bears both responsibilities and risks, embodying a unique blend of independence and accountability in their venture.

Key Takeaways

- A sole practitioner refers to an individual who operates and manages a business or professional practice alone, without any partners.

- The key attributes of a solo practitioner include single ownership, liability, control, profits and losses, and a simple process involving lesser formalities.

- It emphasizes the individual's independent role and responsibility in running their business or providing professional services.

- Solo practitioners center on the individual professional, while sole proprietors encompass the broader business entity, acknowledging both the primary professional and supporting staff.

Sole Practitioner Explained

A sole practitioner is a business structure where a single individual owns and manages the entire enterprise. This owner is personally responsible for the business’s profits and losses, and they report the income on their tax return. Commonly known as a sole trader or proprietorship, this structure is straightforward to establish, often requiring minimal paperwork and government regulations.

Due to their simplicity, solo practitioners are popular among sole owners of businesses, freelancers, and consultants. The lack of formalities, such as creating a separate business name, streamlines the startup process. Thus, many small businesses initially adopted this structure due to its ease and continue to operate as solo practitioners. In contrast, others may choose to transition to more complex entities like limited liability companies (LLCs) or corporations as they grow, seeking additional liability protection or attracting potential investors.

Key attributes of a solo practitioner include:

- Single Ownership: The business is solely owned by one individual.

- Liability: The solo practitioner risks personal assets if financial obligations aren’t met, bearing unlimited personal liability for the business’s debts.

- Control: Full decision-making authority rests with the solo practitioner, who manages and operates the business independently.

- Profits and Losses: The solo practitioner bears the impact of all the profits and losses, which the government taxes as personal income.

- Simplicity: Setting up as a solo practitioner is generally straightforward, involving fewer formalities than establishing a corporation or partnership. However, adherence to local regulations and obtaining necessary licenses may still be required.

- Lack of Continuity: The business typically ends upon the death or incapacitation of the sole practitioner unless specific provisions are made for its continuation.

How To Become?

To become a solo practitioner, an individual should first select the type of business or professional service they wish to offer.

They must then determine the appropriate legal structure, often opting for a sole proprietorship due to its simplicity. The individual can choose to operate under their name or register a business name, adhering to local regulations.

Registration with local authorities and obtaining any required licenses or permits are essential. Additionally, acquiring a tax identification number (TIN) or employer identification number (EIN) may be necessary. Establishing a separate business bank account, complying with industry regulations, and considering insurance coverage are crucial steps.

Developing a marketing strategy, networking within the industry, and maintaining accurate financial records are also integral to the process. Seeking guidance from legal or business professionals ensures adherence to relevant laws and regulations.

Examples

Let us look at the solo practitioner examples to understand the concept better:

Example #1

Imagine Alex, a professional lawyer, decides to become a sole practitioner lawyer. Operating under the name ALX, it offers legal advice to clients. As a solo practitioner, Alex is the sole owner and enjoys complete control over business decisions. However, this autonomy comes with unlimited personal liability. He registered the business, obtained the necessary licenses, and set up a dedicated bank account. ALX thrived as a legal firm, and while Alex enjoys direct profits, he also bears full responsibility for any debts.

Example #2

Consider Sarah, a freelance writer, opting for a solo practitioner called WordCrafters. Specializing in content creation, Sarah operates independently, making all business decisions herself. While the simplicity of this structure suits her, it means she bears unlimited personal liability. Sarah registers WordCrafters, secures the required permits, and manages finances through a separate business account. Along with enjoying direct profits, she is also accountable for any debts incurred. WordCrafters became known for its quality writing services, showcasing the viability of a solo practitioner model in the creative industry.

Sole Practitioner vs Sole Proprietor

The differences between a sole proprietor and a sole practitioner are as follows:

| Sole Practitioner | Sole Proprietor |

|---|---|

| It refers to an individual professional, like a lawyer or accountant, operating independently without partners. | A sole proprietorship is a business structure in which a single individual owns and operates an entire business, including professional services. |

| Highlights the person as the key figure in the business, emphasizing their role as the sole licensed professional. | It includes making decisions, assuming all responsibilities, and being personally liable for the business’s financial obligations. Sole proprietors are often involved in various aspects of their business, from day-to-day operations to strategic planning. |