Smart Investing Tips for Students: Start Building Wealth Early

Table Of Contents

Introduction

To invest is the number one advice that various financial astute persons give us. That said, we all think that it's really hard and we will only lose money. This fear of failure drives us away from parting with your funds. But come to think of it, if you are a student, this is a great time to start investing, as you can make the most of the power of compounding. Moreover, if you start early, you can build a large corpus over time and have a high chance of fulfilling various financial goals that may arise in the future.

Through investing, you will also gain practical knowledge of key aspects related to finance, which, in turn, can help you write better essays given as assignments in college. However, if you are yet to develop a clear understanding of important financial topics and are struggling with such assignments, you may avail of paper writing service providers like Essay Tigers.

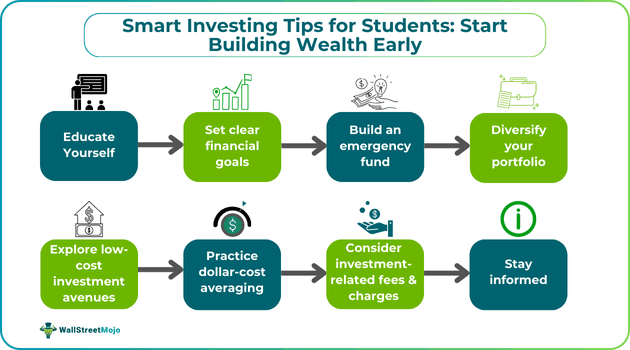

Having said that, in this article, we will decipher some smart investing tips for students to start building wealth early. These tips will also enhance your financial knowledge.

Top 8 Tips

Here are the top 8 smart investing tips for students so that they can work towards building their wealth early:

#1 - Educate Yourself on Investment Basics

Start with the basics, learn the common financial terms, buy books on investing, follow informative YouTube channels, and spend time on the internet reading about investing. Also, ensure to learn about what's going on in the financial world. At first, you may feel bored, and a lot of things won't make sense to you, but never forget why you started in the first place. You cannot just take your money and start making investments; gaining knowledge before allocating funds is essential.

Open a trading account after choosing the right broker and complete the verification process. Add money into the account, and start investing. Remember to start small and learn about the different types of stocks and the key concepts related to trading, for example, pricing, liquidity, volatility, etc., before you make your first investment. You can also explore other investment avenues, like debt securities and mutual funds.

#2 - Set Clear Financial Goals

Before you even begin to invest, ask yourself, why are you doing it? In other words, set clear objectives. It could be anything from a short-term goal to a long-term financial goal. A lot of people don't understand this, but your goals are the foundation of your investments. When you have your goals clear in your head, you can make the right investments based on your risk appetite and hold them accordingly based on what you were planning to achieve.

#3 - Start with the Emergency Fund

This should be a highlight of this entire article. One of the key personal finance tips for students, even if they have little pocket money, is that they need to build an emergency fund for themselves. As a student, you might face financial emergencies. This is where the emergency fund will come in handy, and you will never have to borrow from your friends or ask your parents for extra allowance. In fact, having an emergency fund is a very crucial step toward financial stability, freedom, and discipline.

#4 - Diversify Your Portfolio

"Never put all your eggs in one basket." This one-line statement sums up the entire concept of diversification, which is an essential component in all smart investing strategies for college students. You cannot pick just one favorite stock and put all your money in it. You need to do your research and identify financial instruments across multiple sectors, such as financial services, information technology or IT, and energy for investment. That said, do not over-diversify, as it can negatively impact your returns. It would be even better to diversify across different asset classes, for example, cryptocurrency and commodities.

#5 - Explore Low-Cost Investment Options

Your investments don't have to be expensive. You are a student, which means you will not have substantial funds to allocate. That's why you have to find some investment options that you can easily put money in without having to think about capital. Some good low-cost investment options are mutual funds, fixed deposits, and bonds.

#6 - Practice Dollar-Cost Averaging

Another one of the smart investing tips for students is to make the most of dollar-cost averaging. For those who don't know, dollar cost averaging simply means investing equal amounts of money at regular intervals. When you start your investing journey, this can be a favorable approach as you do not account for the price of the stock. So, in simple terms, you invest a fixed amount of money at regular intervals without paying attention to the securities' price. By doing so, you can reduce the overall impact of price volatility.

#7 - Provide Attention to All Related Costs and Expenses

When you start investing in your 20s, not all your money will go into stocks and assets; there are many different related costs and expenses, such as trading account opening and maintenance fees, brokerage fees, and platform charges. Don't get discouraged by the associated fees. In fact, learn about them and track them to have a clear idea about your returns.

#8 - Stay Informed

Starting to invest means entering financial markets, and once you are in these markets, you have to stay informed and updated about what is happening. Prepare yourself to get accustomed to the dynamic nature of the economic environment. To do so, you can start to read newspapers, follow market-related news, and read blogs.

All these habits shall help you develop a perspective and gain knowledge about the market. Staying updated with the latest market-related news will help you make quick adjustments to your portfolio based on the changing market scenarios. Remember, even seasoned investors also started their journey by adopting such habits.

Now that you are aware of various smart investing tips for students, you can allocate your funds wisely to maximize your wealth over the long term.