How To Make Smart Financial Decisions For Your Business?

Table Of Contents

Introduction

Running a business is never an easy task. Not only the product or service being sold or offered should solve a problem but at the same time should add value to the lives of customers. Any business owner running an old or new business can carry out a dozen operations and make a series of decisions to grow in the market.

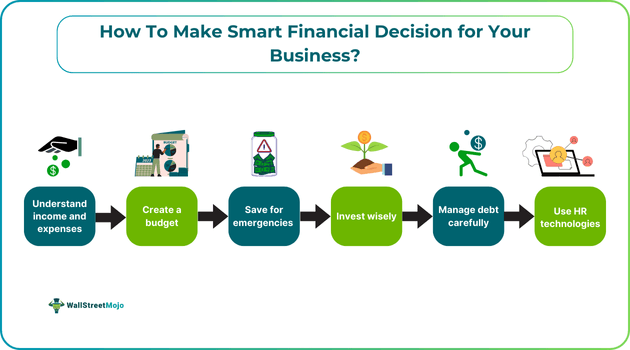

Still, there is one thing that they must do to ensure their existence, survival, and expansion, and that is to make smart financial decisions. In this article, we are going to briefly elaborate on some of the key strategies and steps that will help you improve your decision-making in business.

Understanding Income And Expenses

When running a business, you will have to incur different types of expenses. That said, there are certain unavoidable costs that organizations have to cover to carry out the day-to-day operations and generate revenue. These costs are the general expenses, which include rent, office supplies, overhead costs, and utility bills.

Entrepreneurs can use different online portals, platforms and software to manage these expenses, similar to how they use other tools for legal, data, or HR solutions, like time card apps,

One must note that income and expenses are interlinked to each other. In fact, one cannot exist without another. When you invest, that is when you earn, and what you earn, you again spend a part of it to keep things running smoothly and expand operations.

Therefore, the number one tip or advice we will give you is to pay good attention to your income and expenses. Also, thoroughly understand cash flow management as to where the money is coming from as income and where it is going as an expense. To make smarter financial decisions, businesses should also evaluate their energy expenses regularly, and platforms like Utility Bidder can help compare available options efficiently.

Create A Budget

The simple steps that you can follow to create an effective budget for your business are as follows:

- Identify and understand the business's goals

- Perform an income estimation for a specific period (ideally one year).

- Identify the expenses irrespective of their size and nature

- Implement the budget and monitor the inflow and outflow of funds.

- Determine if there is a budget surplus or deficit.

- Make adjustments to the budget if necessary.

Business budgeting is a simple tactic that will help you keep better track of your income and expenses. Moreover, it will help identify areas requiring improvement and strategic change.

Save For Emergencies

This one smart financial decision will not only help you in business or just professionally but also personally. Saving money and keeping aside liquid assets for meeting any urgent financial requirement is something many businesses fail to do. Keeping aside cash can help you deal with financial emergencies smoothly. Moreover, it can save your business from taking on debt to meet the expenses.

Having an emergency fund is a sign that a business owner has the preparation to withstand a financial crisis. Moreover, it shows that the organization focuses on risk management practices. If a business does not have an emergency fund, it may fail to overcome or power through challenging marketing conditions. It may also experience significant financial setbacks, which might force them to seek financial assistance, halt operations, and lay off employees.

Invest Wisely

When a business starts generating revenue and becomes profitable, most owners try to expand their business into different territories. They also look for new horizons and untapped markets with great potential. To fulfill the objective of growth, they buy capital assets like new land, machinery, and factories that can help generate more revenue. All of these are big investments. Hence, the owner must conduct thorough research and analysis before making a decision.

With increasing earnings, optimum allocation of resources is vital in the case of any financial strategy for business. Having capital and ambition does not mean that a business should blindly invest in multiple areas. With high income and the availability of capital, it becomes the responsibility of every business to make smart financial decisions and strive for the timely growth of the business with efficiency.

Manage Debt Carefully

Now, businesses require huge amounts of capital, and there is no way a business always has funds readily available to put into its operations or other activities. This simply means that a business has to take on debt multiple times from one or multiple lenders. The problem does not lie in taking on debt but not being able to manage the debt properly.

Hence, efficient debt management is one of the most common business finance tips across many experts. It is vital to ensure that you have proper resources and effective cash flow management practices to pay off loans on time without having a financial crunch. Carefully managing debt will ensure you avoid any payment default, which is crucial to winning investors' confidence.

Use HR Technologies

With modern technology, there are many online platforms and human resources or HR applications that can be put to good use to ensure efficient employee management. These resources offer utilities and flexibility to the workforce, and leveraging them is one of the most smart financial decisions a company can make for its employees. With the right HR management system, offices run on time, and the employee database is well-maintained with all the required information.

Every office today uses a human resources management system or HRMS in some capacity. The corporate world is way ahead of the traditional employee management frameworks, where most of the tasks are performed manually. An HRMS automates HR functions, including salary and reimbursement processing and employee attendance and leave management. This helps businesses minimise payroll errors while maintaining accurate financial records. Moreover, it helps in maintaining proper records of employee details and personal information.

Conclusion

In the end, we will encourage you to smartly manage your business’s funds and strive for better results, growth, and development over time. All these tips and tactics will help you build a perspective and help in better financial decision making when running the daily operations of a business.

You can also use some of the above tips, like creating a budget and building an emergency fund, to make smart financial decisions in your personal life. After all, better management of funds can help you become a better version of yourself and fulfill your personal financial goals.