Table Of Contents

Slush Fund Meaning

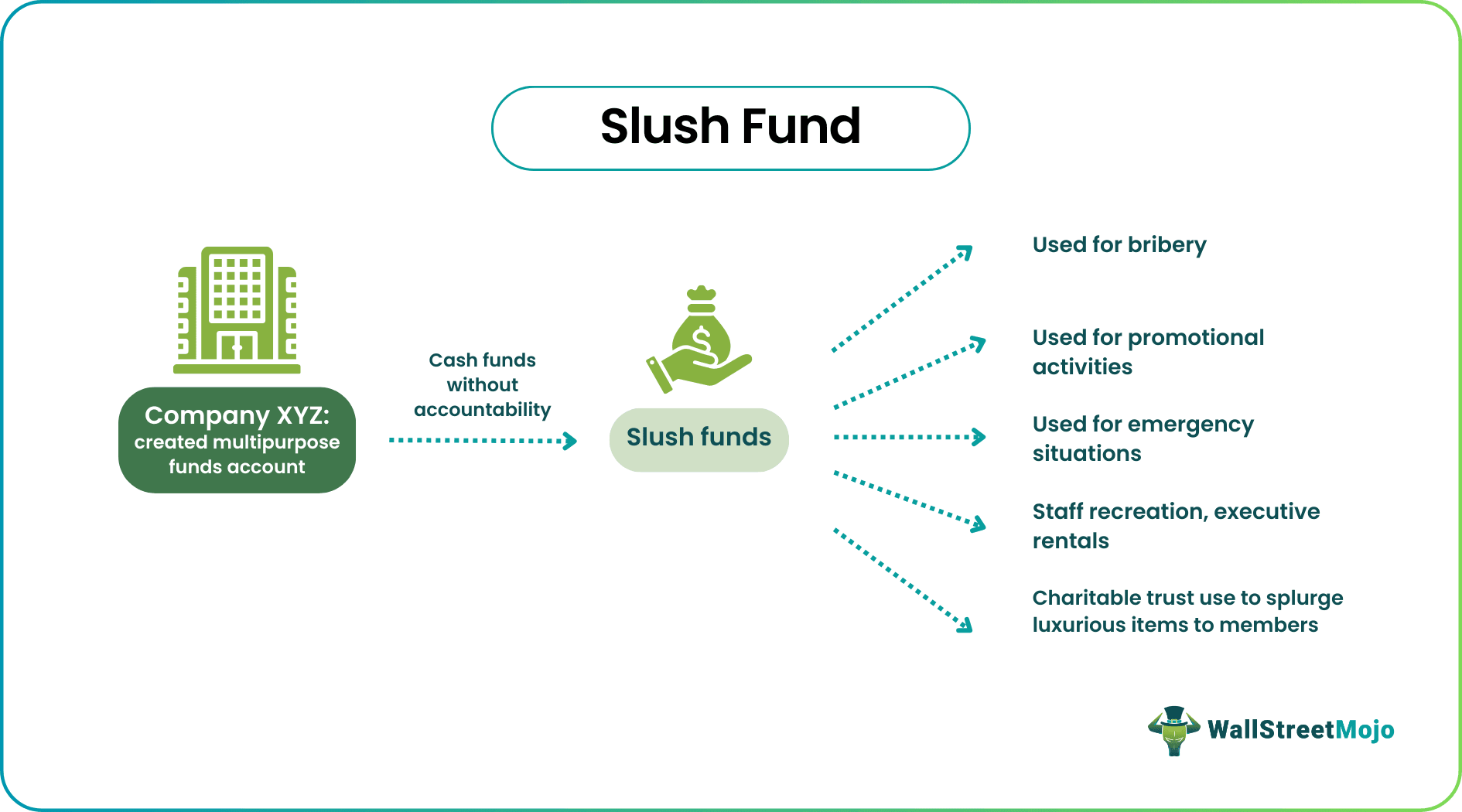

A slush fund is an account where money is kept for unspecified or unaccounted purposes, usually outside official records. Its main function is to conceal the purposes of expenditure and deposit funds from the public and government officials, whether a company or a politician is utilizing it.

A slush fund, or hush money, refers to a specific account within a company's general ledger where a range of transactions can be recorded, with only the net outflow reflected in the financial statements as reserve funds. Slush funds can be used for various purposes, including bribing officials for business or personal favors, as they have no fixed purpose and are not subject to regulatory oversight.

Key Takeaways

- A slush fund is an unallocated amount of funds companies, charitable trusts, and politicians use to further their interests without accounting for the same in financial statements.

- It serves as a savior for emergency requirements, a tool to influence powerful officials, and a contingency fund for staff recreational activities and executive trips.

- They were often created under fictitious names of individuals, companies, or employees using forged documents to pay salaries or trade with foreign companies and redirect the funds to personal use without accountability.

Slush Fund In Business Explained

A slush fund is a category of account in a company's general ledger that holds funds for non-designated purposes. These funds are unaudited by the company and government bodies, allowing them to be used for any business or official purpose. However, these funds are often used for illegal purposes such as bribery and shady deals for executives' profits. It's important to note that not all slush funds are used for illegal activities and can be used for legitimate purposes.

Hush money has become synonymous with illegal slush funds that attract negative attention. Accountants and analysts refer to these funds as black funds, used for illegal activities without keeping an official record in an organization's financial books. Nevertheless, these funds can benefit businesses as auxiliary accounts for unplanned or emergency official uses.

Sometimes, they act as reserve funds to cut costs and gain profits. The most important aspect of slush funds is non-disclosure to regulatory or tax authorities. This gives companies an advantage in creating hush money for corporate perks such as staff lunches and vacations, sudden business conferences, gifts, or executive car rentals. Additionally, charitable trusts sometimes transform some company accounts into slush funds and spend lavishly on their members' expenses.

Politics is also a hotbed of hush money activities where politicians hide the money received for campaign slush funds that must be kept secret. As a result, politicians and their parties use hush money in all their donations and campaign activities. Unfortunately, certain anti-social individuals and groups run companies with huge stash funds in slush money accounts for gambling, terrorist activities, and drugs.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Origin

The origin of the term "slush fund" dates back to the late 18th century and has non-financial roots. It is said that the term came from the waste fat produced from boiling animal meat for sailors' dinners on long journey ships. When cooled, this waste fat became a thick jelly-like substance useful for waterproofing or making candles. People started calling this smelly jelly "rancid semisolid fat slush." The cook and boat captain sold this slush to merchants and candle makers at a good price.

The funds obtained from the sale of this waste fat were called slush funds, and they were used to buy things that benefited the sailors, such as entertainment and books. The term "hush money" emerged from this origin, referring to extra money used to fulfill desires without worrying about accounting for it. Over time, the term "slush fund" came to be used in finance to refer to money kept aside for illicit purposes or to fund activities that are not publicly disclosed.

Examples

To understand the concept, let us scroll through some examples.

Example # 1

Let's say that a small business owner sets aside a portion of their monthly profits into a secret account that they call their "slush fund". The owner does not disclose the existence of this account to anyone and uses the funds for various undocumented expenses, such as gifts for employees or personal purchases. The owner can avoid scrutiny from business partners, investors, or tax authorities by hiding this account. However, this practice is generally considered unethical and illegal in many jurisdictions.

Example # 2

A former prosecutor in Michigan was arrested in 2020 for allegedly using confiscated money as his personal "slush fund" for over four years. According to reports, the prosecutor seized over $70,000 from drug forfeiture cases and used the funds for personal expenses such as clothing, car payments, and home improvements. This incident highlights the importance of transparency and accountability in using government funds, particularly those obtained through civil asset forfeiture. It also serves as a warning of government officials' potential abuse of power and the need for greater oversight in handling public funds.

.Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

An emergency fund is a designated account set up to provide financial support during unexpected situations. On the other hand, a slush fund is a type of account not designated for any specific purpose and can be used for any business or official purpose.

A sinking fund is an account set up to save money for a specific future expense, such as replacing equipment or paying off a loan. At the same time, a slush fund is not designated for any specific purpose and can be used for any business or official purpose.

A slush fund and a petty cash fund are similar in that they are both types of funds not designated for any specific purpose. However, the main difference is the amount of money involved. A slush fund typically contains a larger amount of money and is used for larger, unplanned expenses. On the other hand, a petty cash fund typically contains a smaller amount of money and is used for smaller, day-to-day expenses such as office supplies, postage, or minor repairs.