Top Benefits Of Using An SIP Calculator For Financial Planning

Table Of Contents

SIP Calculator for Financial Planning

Building wealth through a Systematic Investment Plan (SIP) has become the most common and successful way of reaping good returns. Every month, your bank account knocks, collects the SIP, and silently invests in desired funds. But, have you ever wondered about the pile of money (or wealth) you save by the end of 10, 25, or 30 years of investing in SIPs?

Well, you have a big, hefty, and quite impressive amount saved when your SIP matures, thereby helping you fulfill all your financial commitments and dreams! Now, when the number is huge, you can’t even think of calculating it manually. Isn’t it?

That’s where the SIP calculator comes in and computes the exact amount receivable, considering the inflation and growth rate applicable to investing a repeated amount every month. In this blog, you will learn how to calculate future returns with this calculator and the maximum benefits of using it to achieve your investment objectives hassle-free!

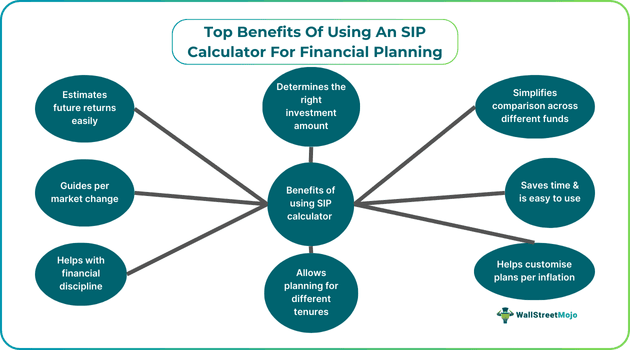

Top Benefits

Using a SIP calculator has enormous benefits for investors, helping them decide how much to invest to achieve their financial goals. As an investor, you can use the calculator to elevate your financial planning process with certain insights receivable on SIPs. You can also put in the desired return rate and investment amount and customize the tenure (years) you wish to continue SIPs for. Some pointers will detail the top benefits of using this calculator for your financial planning.

#1 - Estimate Future Returns Easily:

Investors use the SIP calculator as a primary tool for calculating future returns for today's investments. Many online calculators use mathematical equations to estimate the return on investment value tomorrow (or years later). So, if you plan to invest $200 today, you can easily calculate the total amount receivable after 20 years. With this calculator, one can view how certain variables (like growth rate and inflation) can affect returns. Additionally, you may utilize the power of compounding and accelerate the compounded annual growth rate (CAGR).

#2 - Determine the Right Investment Amount:

Future yield can only be impressive if invested right. Only when you know how much to invest can you calculate future returns receivable on mutual funds. However, using a SIP calculator solves this problem for you. Enter or drag the range to the desired amount and view the returns achievable with that investment. Likewise, this calculator also has a dynamic modification feature, which means you can alter the amount multiple times.

#3 - Simplifies Comparison Across Different Funds:

The realm of mutual funds is wide, and deciding which is best for you and your portfolio is tough. One way is to either compare the returns or look at the holdings (companies) in that fund. Since there are no limits on the usage, you can use this calculator multiple times to make the comparison. Moreover, you can add your favorite MFs to the wish list and compare them based on net asset value (NAV), annualized returns, and past performance.

#4 - Saves Time and Is Easy to Use:

One of the prime advantages of the SIP calculator is its accessibility and usability. Be it a newbie or an intermediate investor, this calculator does not have much hassle. It is easy to use and generates results within seconds. By simply putting in investment amounts (monthly or lump sum), expected growth (%), and tenure (years), you can receive insights on the mutual funds and potential yield associated with them.

#5 - Helps Customize Plans Based on Inflation:

Inflation is a vital factor that influences a majority of instruments in the financial markets. Considering its impact, you can use a SIP calculator to combat its effects. For instance, equity funds can help in achieving desired returns at an inflation-adjusted rate. You can pick any of these instruments for analysis and bag the best one suitable as per your financial goals.

#6 - Plan for Different Tenures:

Financial goals can differ depending on one’s age and the number of years left for retirement. If you are in your 20s or 30s, you can use this calculator to decide the right tenure (between 1 year to 30 years) for your investment. It estimates how many years one has to make SIP payments. As the fund matures, you can have access to the entire wealth accumulated.

#7 - Helps with Financial Discipline:

Any investment strategy needs a lot of patience and discipline at each level. By putting in variables like investment amount, tenure, and expected returns, you can witness how small, regular amounts can grow over time. These returns calculated by the SIP calculator motivate individuals to inculcate the habit of investing regularly with patience and maintaining the required discipline.

#8 - Adapts to Market Changes:

Risk and return are inevitable pillars of investment. While all investments are not risk-free, diversification plays a crucial role in any investment strategy (including mutual funds). As a result, the SIP calculator assists investors to a major extent. You can choose the “Adjust to inflation” feature to get a more accurate picture of the investment value. Likewise, you can switch (or transfer funds) to a liquid fund and start a SIP investment if there is high volatility.

Conclusion

Mutual funds are gaining popularity among newbies eager to enjoy a peaceful and luxurious retirement. However, pre-deciding on the finances helps to achieve them faster. With SIP calculators, you can easily start investing at the right age, as interpreting the calculated results is easy and can help you make wiser investment decisions. They provide inputs like investment amount (lump sum or monthly), tenure, and expected growth rate, thus making it easy for you to decide on the best and right mutual fund.

Utilizing the robust power of these calculators empowers the inner potential of investments with a disciplinary approach. Head on to the popular online SIP calculators and witness this chance to see your investment baby grow at the desired rate.