Table Of Contents

What Is Simple Interest (SI) Formula?

Simple Interest (SI) is a way of calculating the amount of interest that is to be paid on the principal and is calculated by an easy formula, which is by multiplying the principal amount by the rate of interest and the number of periods for which the interest has to be paid.

Here, interest is calculated only on the amount initially invested, and there is no interest in interest as the case with compound interest formula. It finds its usage in car loans and other consumer loans extended by banks and financial institutions. Also, the interest paid on savings bank accounts and term deposits by banks is also based on simple interest.

Key Takeaways

- Simple Interest (SI) is a straightforward method of determining the interest to be paid on the principal amount. It is calculated by multiplying the principal by the interest rate and the number of periods for which the interest is due.

- Enter the period in years, adjust the interest rate for the entire year, and convert months to a fraction of a year.

- Banks use simple interest for savings and term deposits, calculated quarterly. Simple interest ignores compounding, resulting in lower returns for short-term loans and savings accounts.

Simple Interest Formula Explained

The term simple interest formula explains the amount of interest or a monetary privilege that a sum of money will earn during a given period using a particular formula. This formula is very easy to understand and detailed in the article below.

In the process of simple interest formula for rate, the principal or the initial amount invested continues to remain the same every year and the interest is calculated based on this initial investment. Therefore, the interest amount is also same every time. But at the end of the maturity of the investment, the total amount is calculated after adding up the initial contribution and all the simple interest received during the tenure of the investment.

It is a concept that is very closely related to loans. Borrowing money at simple interest means this is the amount that the borrower will pay as the cost of taking the loan and this will prove to be the earning for the lender for giving credit facility to the borrower. From the point of view of banks, customers who have savings account with them, get interest which is SI in nature on their deposits in savings account.

This formula is very easy to interpret and use. In it we see that the principal amount is multiplied by the rate of interest and tenure of the loan. The resultant amount is the interest. This calculation is widely used for loans that are taken on a short-term basis, like automobile loans or certain personal loans.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

How To Calculate?

Here we will learn how to calculate the interest using the simple interest formula for rate applicable for the same.

As we already noticed, the formula states that the principal amount is multiplied with the rate of interest and the tenure of loan. So, we just need to substitute the values of the above in the formula to get a correct amount.

The process is very easy to understand and use. Therefore, any individual can easily identify what will be the cost of taking loan or charges they need to pay on the borrowed amount. If it is an investment, then too it is possible to calculate simple interest formula and understand how much return they can expect from it based on simple interest calculation at the end of the maturity period.

Examples

Let us understand the concept with the help of some suitable examples and calculate simple interest formula, as given below.

Example #1

ABC lends $5000 at 10% per annum for five years. Calculate the simple interest and total amount due after five years.

Principal: $5000

Interest Rate: 10% per annum

Time period (in years) = 5

So now we will do the calculation this using the simple interest equation i.e

- Simple Interest = Principal * Interest Rate * Time Period

- Simple Interest =$5000 * 10%*5

- =$2500

Total Simple Interest for 5 years= $2500

Amount due after five years=Principal + Simple Interest

- = $5000+$2500

- Amount due after five years = $7500.

Example #2

Ravi purchased a microwave oven from an electronics store priced at Rs 10000. He financed the same from its lender, HDFC bank. Details are as follows:

loan amount: Rs 12000

loan period: 1 year

interest: 10% per annum

The frequency of payment: monthly

We can calculate the equated monthly amount in excel using the PMT function.

Accordingly, the EMI amount Ravi will have to pay comes out to rs 879.16 (which includes both interest and principal amount). We can observe from the below amortization schedule of the mortgage that the interest amount kept decreasing with each payment and the principal amount kept increasing; however, the monthly installment remained the same across the tenure of the loan.

Important Points to Note when calculating simple interest:

- The period must be in years. If the same is in a month, it should be converted into years as a fraction.

- The interest rate must be expressed annually, but if the period is less than a year, it must be adjusted for one year. For instance, if the interest rate is 12% per annum, but the problem pertains to the monthly interest rate, then it will be 1% (12%/12).

Example #3

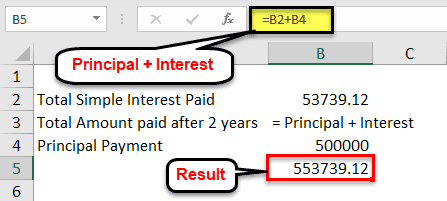

Ram took a car loan of $500000 from HDBC Bank, where interest is payable at 10% for 24 months. The loan is to be repaid by making equal monthly payments of $23072.46 (calculated using the PMT function in Excel)

The Schedule of payments calculated using SI formula in excel is as follows:

Let’s understand the concept of SI formula in excel using one more industry example related to Certificate of Deposits (CD).

Example #4

ABC Bank subscribed to the certificate of deposits totaling $20000 issued by the government of India, which carries a 5% interest per annum. The certificate of deposits matures in 6 months.

Interest earned by ABC Bank on the certificate of deposits:

Simple Interest= Principal * Rate* Time period

Thus, ABC Bank will earn a total interest of $500 on the certificates of deposits on maturity, i.e., after six months.

The above examples explain the concept of annual simple interest formula from the point of view of both the lender as well as the borrower, detailing the positive and negative effects of the process in the financial system.

Relevance And Uses

Given below are some applications of the concept of simple interest formula for excel in the financial market. Let us analyse them in details.

- Simple interest finds its relevance in the way interest is calculated by Banks on the savings bank account and term deposits held by depositors. Banks normally calculate interest every quarter in savings and term deposits.

- Returns calculated under simple interest will always be less than returns calculated under compound interest as it ignores the concept of compounding.

- SI formula ensures that the interest portion is higher in the Initial years and subsequently reduced as the tenure of the loan progresses.

- It calculates interest on short-term loans like car loans, certificates of deposits and savings accounts, and term deposits.

- Since the formula is very simple and easy to understand, the clients like borrowers and investors can follow it very easily without much complication.

- The borrowers can easily keep track of the amount they need to shell out every month or quarter or year. This helps them to plan their budget without any complexity or keep aside funds for this purpose.

- This is best way to take short term loans which will also ensure that not a huge amount is moving out of the pocket and thus the amount is easily manageable.

Therefore, the above are some noteworthy uses of this process in the financial market.

Simple Interest Formula Vs Compound Interest Formula

The above refer to interest calculation on loans but using different method. Let us understand the points of differences between them.

- The most important difference is that in case of the former, the interest is always calculated on the initial principal or investment. But in case of the latter, the interest is calculated on the principal plus interest added for the previous term, thus making it compounded.

- Due to the above process, in case of the simple interest formula for excel, the interest amount does not change through the tenure of the loan, but for the latter, the interest amount will change every time.

- In case of the former, the final amount accumulated is much less than the amount accumulated using the formula used in case of the latter.

- The formula for the former is very easy to understand and use compared to the latter.

- The former is the process that is mostly used in case of loan that are meant for short-term, which may include automobile loans or certain personal loans. But the latter is widely used for long term loans like property related ones, investment on bonds or long-term securities, etc.

- The former is also referred to as just an interest whereas the latter is referred to as interest on interest.

- In case of the former, the final investment amount does not make a significant difference from the initial investment, but in case of the latter, the value of the final amount upon maturity is significantly larger than the initial investment.

- From the above point it can be derived that the former is extremely beneficial for borrowers because they need to pay less amount when paying back the loan to the lender, but from the lender’s point of view, it is less lucrative. But for the latter the case is just opposite in which the lender benefits due to the loan repayment amount increasing to a large extent because of compounding but is less appealing to the borrower.

Thus, the above are some important points of difference between the two financial concepts. It is necessary for borrowers or investors to understand these differences so that they can make informed decisions while making any substantial investment of taking loans to meet financial requirements.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.