Table Of Contents

Simple Budget Spreadsheet

A simple budget template refers to the budget prepared to handle the finances by a person where the budget starts entering all the sources of income for the period under consideration like monthly, weekly, yearly, etc., Then, they list down the bill against which payments are due and all other expenses incurred during the period. Lastly, they derive the savings during the period by deducting total expenses from the total income.

An Excel simple budget template provides a clear overview of income and expenses. Its simplicity helps in quick comprehension, enabling better financial management. However, drawbacks include potential oversights due to its basic nature, limited ability to handle complex financial scenarios, and the absence of detailed analysis, making it less suitable for those requiring a comprehensive understanding of their finances.

Simple Budget Template Explained

A simple budget is a fundamental financial planning tool that individuals and households use to manage their finances effectively. It acts as a blueprint for allocating income and tracking expenses within a specified timeframe, often on a monthly or yearly basis. The key components of a simple budget include income, fixed expenses, variable expenses, and savings.

It is a simple worksheet of generally one page, which shows the periodic income and expenses. These income and expenses are unlisted in detail transaction-wise. Instead, they group into some of the handful of categories, which can broadly highlight the individual's crucial types of income and expenses.

It is so because bifurcating and listing all the expenses is time-consuming and will not make the budget simple any longer. But on the other hand, the budget, which is simple in real terms, will let the person know the budget in very little time.

The significance of a simple budget lies in its user-friendly approach, allowing individuals to gain a quick, clear understanding of their financial situation. It is a starting point for those new to budgeting, providing a manageable framework to enhance financial awareness and encourage responsible spending.

However, it's essential to recognize and acknowledge the drawbacks of a free simple budget template. Its basic nature may lead to oversights in complex financial scenarios, and its lack of detailed analysis may not suffice for individuals requiring a more in-depth understanding of their finances. Nonetheless, for those seeking a straightforward tool for financial management and planning, a simple budget is a great way to start financial discipline and achieve long-term financial objectives.

Categories

While an Excel simple budget template or a software-based budget differs from individual to individual, the categories below are commonly a feature of such budgets.

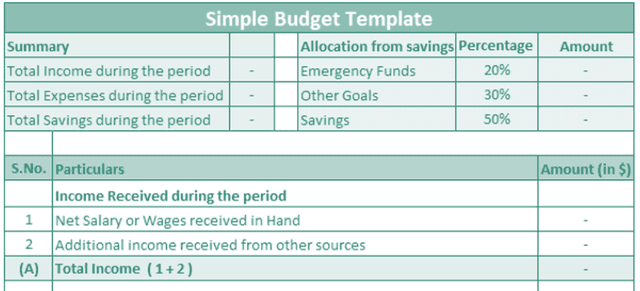

#1 - Heading

One must write the heading simple budget template at the top of the simple budget template. Such a heading will clarify to the user of the template that the template pertains to the simple budget. This heading, as mentioned, will remain intact and will not be changed from individual to individual.

#2 - Summary

This summary contains the details of the total income and details of the total income. These details will be taken automatically from the value in the below-mentioned steps.

#3 - Income

Under this, it will mention all the income of the individual. Further, it is divided into the following categories:

- First, net salary or wages received in hand.

- Additional income is received from other sources like side business income etc.

The total of both the above incomes will give the figure for the person's total income during a particular period.

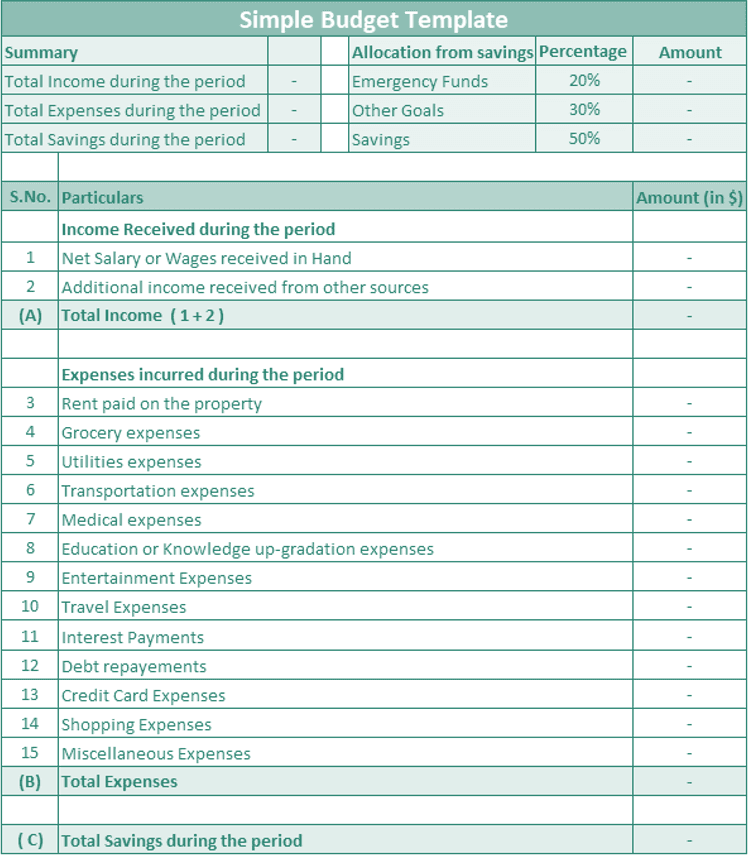

#4 - Expenses

Under this, it will mention the individual's expenses by categorizing them into specific groups. Further, it divides into the following categories:

- Rent paid on the Property: This includes the total rent paid by the individual during the period.

- Grocery Expenses: This includes the total grocery expenses paid by the individual during the period.

- Utility Expenses: Utility Expenses include the total bill of utilities paid by the individual during the period.

- Transportation Expenses: This includes transportation expenses paid by the individual during the period.

- Medical Expenses: This includes the total medical expenses paid by the individual during the period.

- Education or Knowledge up-gradation Expenses: This includes total expenses paid by the individual in his education-related areas.

- Entertainment Expenses: Total expenses incurred on entertainment;

- Travel Expenses: Total expenses incurred on travel.

- Interest Payments: Total expenses incurred on interest payments.

- Debt Repayments: Total debt amount repaid during the period;

- Credit Card Expenses: Total bill of credit card paid.

- Shopping Expenses: This includes the total expenses paid by the individual during shopping.

- Miscellaneous Expenses: This includes any other miscellaneous expenses paid.

The total of all the above expenses will give the figure of the total expenses of the person during a particular period.

#5 - Savings

The individual savings are calculated by subtracting the total expenses from the total income.

#6 - Allocation from Savings

Under this, it will allocate the savings calculated for different purposes. An individual can modify areas where the savings are allocated and the percentage of such allocation per their situation. Then, the amount is automatically calculated using the specified percentages.

How to Use this Template?

Now that we understand the intricacies of a free simple budget template, let us also touch upon how to use this template through the points below.

- Individuals using this template will have to enter all the details required in the fields that are not already pre-filled.

- This first detail of the income includes net salary or wages received in hand and must enter any additional income from other sources.

- Along with the income details, one must enter all expenses incurred by grouping them into categories. E.g., rent paid on the property, grocery expenses, utility expenses, transportation expenses, medical expenses, education or knowledge, up-gradation expenses, entertainment expenses, travel expenses, interest payments, debt repayments, credit card expenses, shopping expenses, and miscellaneous expenses. However, if the individual thinks another category counts for an essential portion of their expenses, it can be added to the template.

- After that, deduct the total of all the expenses from the total income earned to know the total amount left, i.e., the savings.

- Now, the template will automatically provide the summary and the allocation of the person’s savings. The individual can also modify this allocation area or percentage of allocation according to their requirements.

Simple Budget Vs Expense Tracker

The primary difference is that the former is a planning tool while the latter is a recording tool. However, there are more differences in their functions and implications. Let us understand the differences between a free simple budget template and an expense tracker through the comparison below.

Simple Budget

- Focuses on proactively planning and allocating income for various categories, including fixed expenses, variable expenses, savings, and debt repayment.

- It provides a forward-looking approach to finances, helping individuals set financial goals and allocate resources accordingly.

- Organizes expenses into predefined categories, making it easier to track and manage spending habits.

- Encourages financial discipline by outlining spending limits for each category, guiding individuals to live within their means.

Expense Tracker

- Primarily, it tracks and records expenses as they occur, offering a retrospective view of spending patterns.

- Enables real-time monitoring of expenditures, allowing users to see where their money is going instantly.

- It often allows users to categorize expenses with tags, providing a detailed breakdown of spending across different areas.

- Offers detailed insights into spending habits, helping users identify areas for potential cost-cutting or adjustments.