Table Of Contents

Silent Partner Definition

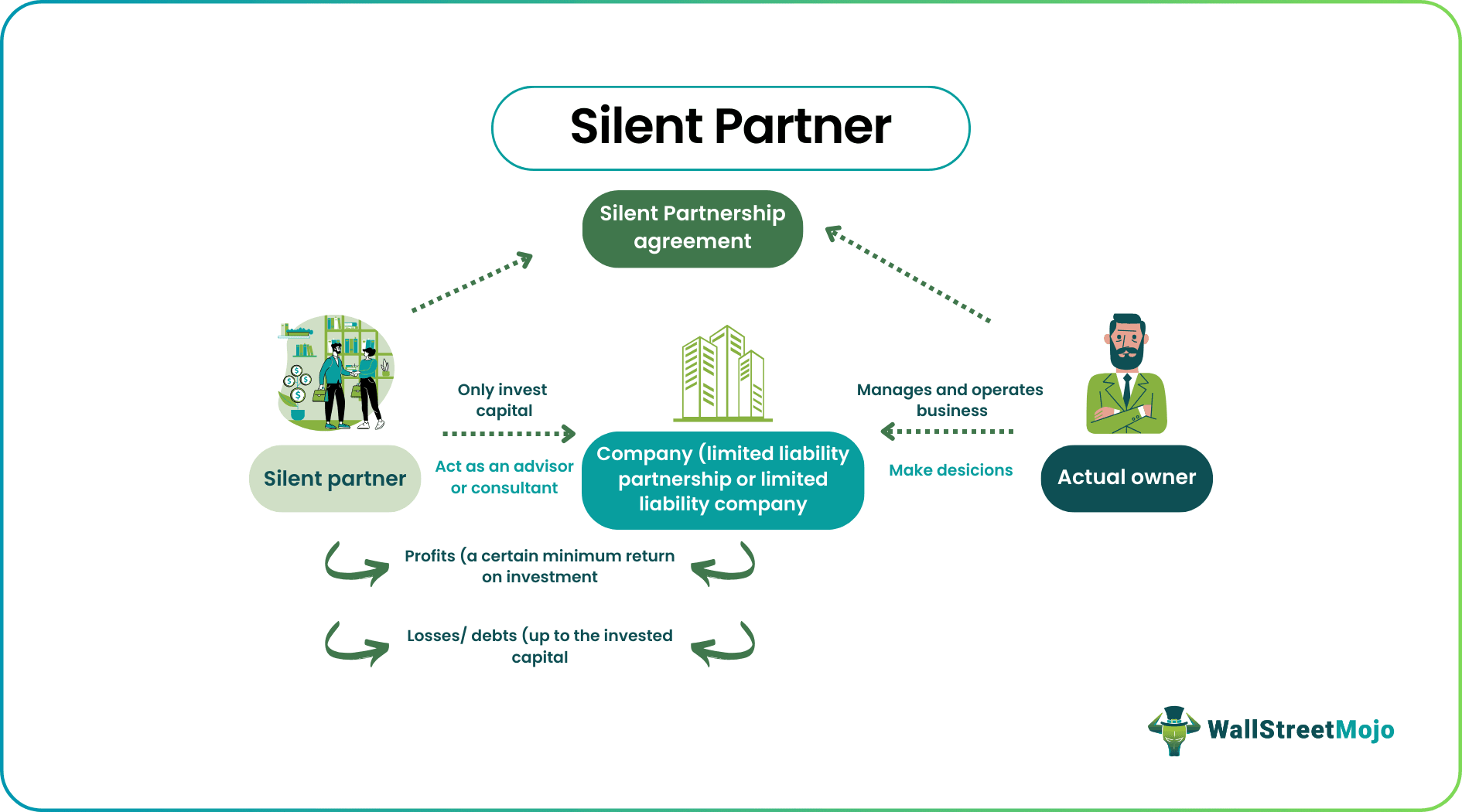

A silent partner is a business partner who invests in a business and becomes a part-owner of it with limited partnership liabilities. As the investor, they get a significant share in the company profits, which becomes the source of their passive income.

It mainly involves people who lack expertise in business management but have enough funds to pursue their dream of being a part of a company. A silent business partner enters into a partnership with the actual owner under the terms of a documented, non-negotiable set of clauses known as the Silent or Limited Partnership Agreement. Also known as limited partners, they have no role in the management and operations but can offer advice on matters affecting a business.

Key Takeaways

- A silent partner or investor is an individual who provides capital to a business they find profitable. They never involve in its management as the actual owner retains the sole control over the operations and decision-making.

- Their responsibilities include offering pertinent business advice when asked for, providing clients to grow the business, and mediating disputes amongst other partners.

- Also referred to as limited partners or joint owners, they receive the company’s stocks in return for their investments. Also, they get a significant share in the profits and losses the business makes.

- Both the silent investor and the business owner must sign a Silent or Limited Partnership Agreement, which spells out their respective roles, obligations, benefits, liabilities, and expectations.

How Does Silent Partnership In Business Work?

Many people with experience in business management want to start their businesses but lack sufficient funds. Likewise, some individuals want to be part of a growing business and take limited risks but have zero industrial knowledge. It is where limited partnership connects the two. The latter types of people become the investors for the businesses seeking finance. However, a company must have a convincing proposal to attract investment from a silent partner in business.

They are also known as limited partners because their partnership liabilities are limited to the investment they have made. It means that they do not have management responsibilities and can not withdraw funds without the owner’s approval. They invest and forget, only to share the profits and losses. But they act as joint owners and can offer a piece of advice whenever asked.

While the actual owner remains the sole controller of the business, customers and clients remain ignorant of silent business investors associated with it. A partnership like this builds on the foundation of trust in the business. Real estate and private equity firms often involve limited partnerships.

Steps Involved In Silent Partnership

- Once the silent business partner and the business owner are ready to start, the business would need to register as a limited liability partnership or limited liability company as per the respective state’s regulations.

- The second step involves signing a written, non-negotiable Limited Partnership Agreement. It defines the roles of the parties involved in the deal. Both the parties sign the agreement only if they agree to all the terms and conditions.

- The agreement outlines the benefits and the partnership liabilities for the limited partner to avoid disputes later.

- It also specifies scheduled investments to be made by the limited partner over a set period.

- As a part-owner of the company, the silent business partner earns a percentage of its capital investments in profits generated or suffers losses incurred up to the invested capital. Both terms appear in the agreement, which both the parties agree to before they sign it.

- The agreement also includes the clause that restricts limited partners from interfering in the business management or its decision-making process. However, it allows them to act as business consultants.

Examples

Let us consider the below set of examples to understand the concept better:

Example #1

- Sarah, who aspires to become an entrepreneur, has sufficient funds to finance a venture. But she has always been scared of the losses that she might incur if the business failed.

- One day, in conversation with her friend Rob she came to know about his business proposal, which she found interesting.

- Knowing that her friend was searching for an investor, she offered to become his silent business partner, to which he agreed.

- Both of them signed the Limited Partnership Agreement, and Rob started the business.

- Sarah knew that she would be only partially sharing the risk liabilities while having an opportunity to enjoy a significant share in profits. In doing so, she does not have to manage the business affairs in any manner.

Example #2

- In 2014, Microsoft Corp. co-founder Bill Gates-funded investment firm Cascade Investment became a silent partner of Water Street Tampa, a wellness-focused, waterfront community developed by Strategic Property Partners.

- Strategic Property Partners is a joint venture between Tampa Bay Lightning owner Jeff Vinik and Cascade Investment. The project worth $3.5 billion was the initiative of Vinik.

- Gates and his team never wanted to be known as the names behind this project. However, the silent partnership came into public knowledge after seven years during his divorce from Melinda French Gates.

Do Silent Partners Get Paid?

Absolutely. As soon as the silent partner invests funds, they receive stocks of the concerned company. Based on the performance of the securities, they get their share. Another way in which they get paid is through profit sharing. The business agrees to share a significant proportion of its profit with its silent investor.

Silent Partnership Agreement

A Silent or Limited Partnership Agreement is a legally binding contract between the business owner and the limited partner. Both parties mutually agree to its terms and conditions. It clearly describes the roles, responsibilities, liabilities, and expectations of the parties involved. Furthermore, it covers each aspect of the business to ensure no dispute arises between the owner and the limited partner in the future.

The contract is usually divided into the following segments to make sure every perspective is well-described:

- Contributions by the silent partner in business

- Legal nature of the agreement

- Term of the partnership

- Business management and operations

- Position of the limited partner

- Details on control rights

- Profit participation

- Withdrawal of profits

- Loss sharing

- Debt liability

- Death of the silent investor

- Termination of the partnership

- The credit balance of the limited partner

- Severability

Moreover, any amendment in the agreement in question would be in writing. Also, it must include the buyout terms to avoid any further disputes related to profit sharing.