Table Of Contents

Significant Influence Meaning

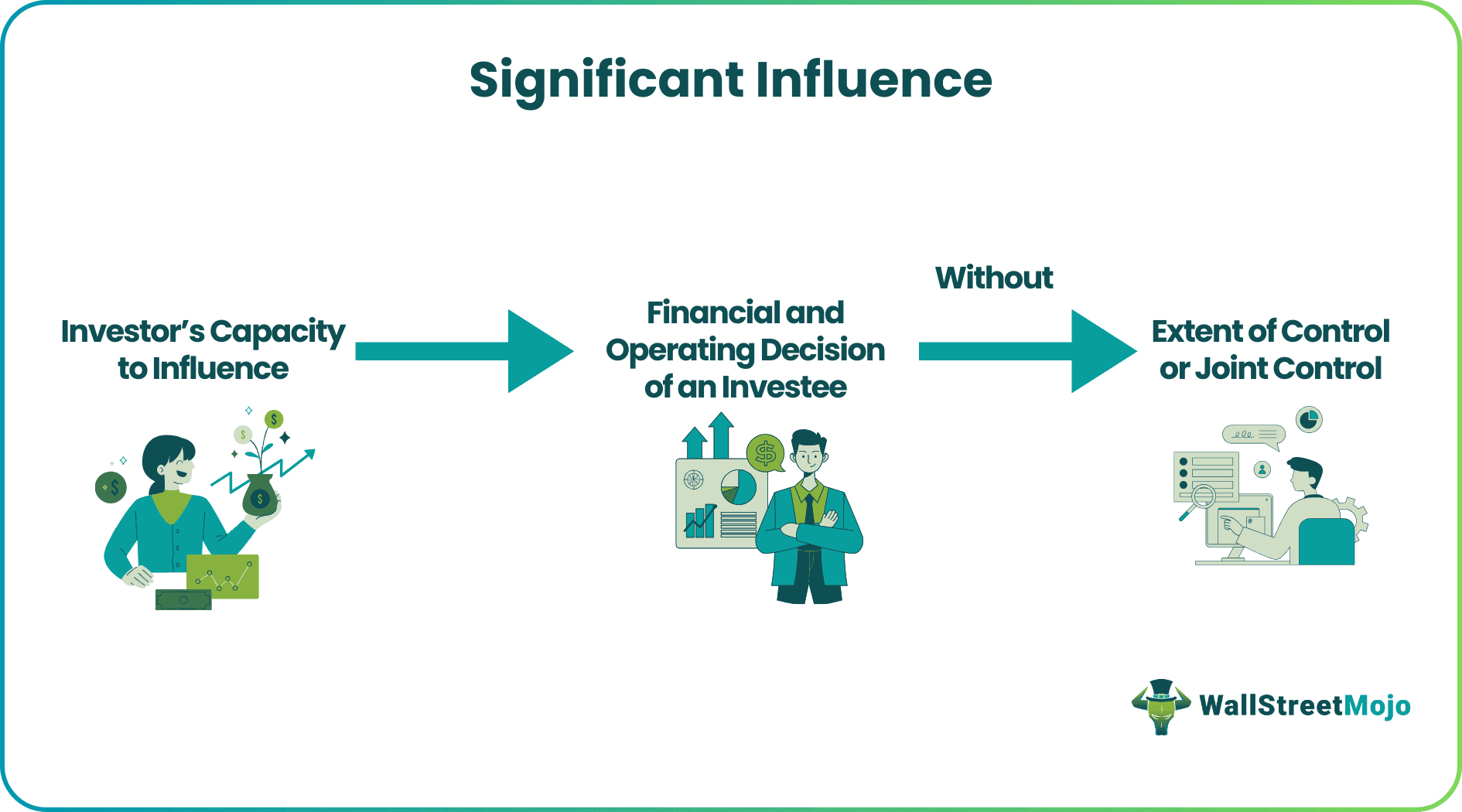

Significant Influence of a firm refers to the ability to participate in the operating and financial policy decisions of the investee without any control of any form over it. It allows any investor to influence a company indirectly when their holding increases beyond 20%, although the threshold may vary depending on various factors.

Several elements, such as the personal stake between the investee and the investor, their relationship, and agreements, contribute to it. Whenever an investor wields significant influence, it attracts the application of the significant influence equity accounting method. It also gives managerial exchanges, board representation, and policy to such investors.

Key Takeaways

- Significant influence denotes the capacity to engage in an investee's financial and operational policy choices without sole or joint control.

- As an investor's stake surpasses the threshold, this influence permits an indirect impact on a company, contingent on diverse factors.

- It is indicated by the proportion of ownership, board representation, involvement in policy, material transactions, and management personnel exchanges between the investee and the investors.

- It occurs at up to 20% ownership by institutional investors or activists, while control demands over 50% ownership for investors or stakeholders.

Significant Influence Explained

Significant influence in accounting means the ability of an investor to influence and not control the investee's decision of a business in the absence of any majority control over it. It comes into force when an investor has more than 20% voting shares of the investee. However, the specific ownership percentage for the influence differs per regulatory environment, industry, and other elements. Nevertheless, personal exchanges, material transactions, and policymaking participation also come under an investor's influence.

The equity method of accounting helps in understanding the amount of influence an investor can exert over the investee. Furthermore, by acknowledging the investor's portion of the investee's income, the equity method is utilized to account for investments made in standard stock or other qualifying securities.

As such, this technique allows the investor to document its investment at cost and then amend it later to represent the investor's portion of the investee's revenue. In this manner, it reflects the investor's strong influence over the investee. Understanding significant influence functions within corporate frameworks aids in comprehending governance and operational roles within organizations.

Hence, it can give the company the correct shape to progress and have transparent and accountable management. It promotes responsible decision-making in a company. All these implications motivate investors to actively participate in improving corporate governance. It, in turn, protects the interests of every shareholder, fostering open communication plus market efficiency.

Indicators

Indicators are crucial because they show whether an investor has the authority to influence an entity's financial and operational policy decisions without really controlling or sharing joint control over those decisions. Let's understand its indicators:

- Ownership percentage: Typically, ownership of 20% or more of the voting stock of the investee is considered an indicator of significant influence. However, it's important to note that this is a guideline and not an absolute rule. It can be present with less than 20% ownership, or it might not exist even with more than 20% ownership, depending on other factors.

- Representation on the Board of Directors: If the investor has the power to elect or appoint a board member for the investee.

- Participation in policymaking decisions: The investor may be able to influence financial and operational policy decisions even in the absence of majority voting rights.

- Material transactions: It may be shown by a large number of transactions between the investee and the investor.

- Exchange of managerial personnel: A significant effect may be indicated if the two organizations switch around their managerial staff.

There can be other factors, such as significant technological dependency, shared brand names, or long-term contractual agreements.

Examples

Let us use a few examples to understand the topic.

Example #1

In September 2023, Simply Wall St reported that Wells Fargo & Company (NYSE: WFC) is primarily influenced by institutional owners, holding approximately 75% of the shares. The top 25 shareholders collectively own 51% of the business. This institutional dominance implies significant sway over share prices and suggests confidence in the company's future. The most prominent stakeholders include The Vanguard Group, Inc. with 9.0%, BlackRock, Inc. with 7.3%, and State Street Global Advisors, Inc. with 4.2%.

Despite insider ownership under 1%, valued at US$112 million, their impact on company decisions remains limited. The general public, holding a 25% stake, may not heavily influence policy decisions but can collectively impact company policies. This ownership breakdown highlights the significant influence institutional investors wield over Wells Fargo.

Example #2

In the fictional land of Finaria, XYZ Holdings is a prominent company with significant institutional influence, particularly from Arcane Capital and Crystal Investments. This dominance sways FICTEX indices and influences stock prices, which is evident in their $10 billion investment, reflecting a booming market. Arcane holds 12% while Crystal commands 8%, both impacting board decisions profoundly.

Contrastingly, the General Public holds a dominant 80% share in XYZ Holdings, underscoring a diverse ownership structure. While these individual investors may not have direct influence over specific company policies, their collective investment decisions contribute to noticeable market fluctuations. This dynamic illustrates the intricate balance of power in Finaria's stock market, where institutional investors wield significant influence in shaping corporate governance and strategy. At the same time, the aggregated actions of public shareholders play a crucial role in determining market movements and the overall trajectory of companies like XYZ Holdings.

Significant Influence vs Control

Through the following table, let us understand the distinction between significant influence and control and why it is essential in the realm of corporate governance and investment.

| Significant Influence | Control |

|---|---|

| It is held by large institutional investors, shareholders, or activists up to 20% of the total shares. | Investors or stakeholders must have more than 50% shares. |

| It gives the ability to exert an important role in decision-making by various means. | Investors have complete control over all decision-making of the company. |

| May veto specific actions or push for its agenda. | Investors can appoint board members and directors, take the company in the desired direction, and control significant transactions. |

| Face stiff public pressure and regulatory scrutiny if they tend to be activist shareholders. | Subjected to more stringent regulations and disclosure needed due to their full control |

| This may create a dispute between regular shareholders and significant influence holders. | Accountable to shareholders and bear the responsibility to ensure the company's success. |