Table Of Contents

Shooting Star Candlestick Meaning

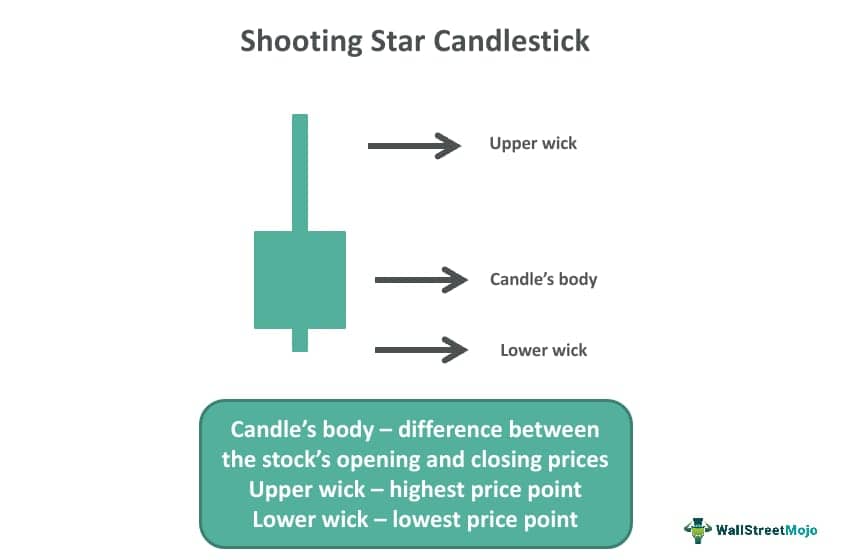

A shooting star candlestick is a Japanese candlestick pattern that appears when the security price rises significantly, but the closing price falls and lands close to the opening price. The bearish shooting star candlestick pattern appears towards the end of an uptrend to indicate a forthcoming trend reversal.

The candlestick pattern is characterized by its long upper and short lower shadow. The candle body stays closer to the lower wick. The length of the upper shadow is at least double the candle's body size. This implies that the difference between the closing price and the highest price point is twice the candle's body.

Table of contents

- Shooting Star Candlestick Meaning

- A shooting star candlestick is a technical analysis indicator. It is a Japanese candlestick pattern indicating a potential price trend reversal. It appears at the end of a bullish price trend.

- This candlestick pattern is characterized by its long upper shadow and a short lower shadow, with the candle body closer to the lower point.

- This candlestick pattern appears when bullish traders cause the stock price to increase significantly during the trading day. However, towards the end of the trading session, they lose control over the market as the bearish traders take over. They push back the stock price, and the closing price lands close to the opening price.

Shooting Star Candlestick Pattern Explained

The shooting star candlestick is a Japanese candlestick pattern type where the candle has a long upper shadow and a short lower shadow. The candle body lies close to the lower wick, while the distance between the upper wick and the candle body is twice the candle body's length. The shooting star candlestick pattern indicates that the security price rose considerably during the day when it exceeded the opening price. However, towards the end of the day, the security price fell massively, and the closing price landed close to the opening price.

The bearish shooting star candlestick pattern indicates a trend reversal. The shooting star candlestick formation appears at the end of an uptrend signifying a potential downtrend in the coming days. During the trading session, the buyers cause the security price to rise, which suggests similar buying pressure as observed in the past few trading sessions. However, as the trading session draws toward an end, the sellers take charge, and the buyers lose control. The sellers push the price to fall back near the opening price. The shooting star candlestick formation confirms an upcoming reversal in the price movement where the security price will continue to fall.

Examples

Let us understand this candlestick with the following examples:

Example #1

Suppose ABS is a company that manufactures cars. On March 3, 2023, the opening share price of ABS was noted at $140. The share price increased significantly during the trading session, peaking at $180. Toward the end of the trading session, it fell to $100. The closing price was recorded at $120.

It implies that the upper wick, which is the highest price point, is $180, while the lower wick, which is the lowest price point, is $100. The difference between the opening price, which is at $140, and the closing price, which is at $120, is the candle body. The lower shadow, which is the distance between the lowest price point and the closing price, is the difference between $100 and $120. The upper shadow, which is the distance between the highest price point and the opening price, is the difference between $180 and $140. The length of the upper shadow is twice the length of the candle's body.

Example #2

On March 6, 2023, the NIFTY equity index formed a shooting star candlestick pattern. This pattern indicated a bearish trend reversal. India's VIX moved up from 12.18 to 12.26 levels by 0.72%. The market volatility increased slightly during the day. However, overall, it was cooling off from the last few sessions.

How To Trade?

The process of trading with this candlestick pattern is as follows:

- While trading with this candlestick, confirming the pattern before entering the trade is essential. There should be an active ongoing bullish trend. The candle body should have a short length and a long upper shadow. These factors will verify the existence of this candlestick pattern on the chart. Thus, traders might want to sell the securities as it indicates an upcoming bearish price trend reversal.

- Traders can engage in a stop-loss order while trading with this candlestick pattern. This candlestick may not always give reliable predictions. As a result, to be safer, stop loss can be used to minimize potential losses effectively.

Chart

Let us look at the following 15-minute Euro/US Dollar chart to understand the concept better.

In the above chart, one can find that the formation of the shooting star candlestick took place on November 1, 2022, at 5 pm. The long upper wick, which is more than twice the size of the body and the lack of a lower shadow make it easily identifiable among even new traders.

The candlestick denoted that the price level rose aggressively in that trading session owing to the buying pressure. However, before the session ended, the bears or sellers pushed the price downward close to the open. The next candlestick in the chart shows that the bears took control in the following session.

Individuals can visit the official TradingView website to look at similar charts and develop a clearer idea regarding this concept.

Shooting Star Candlestick vs Hammer Candlestick vs Inverted Hammer Candlestick

The differences are as follows:

- Shooting Star Candlestick: This candlestick pattern has a long upper shadow and a short lower shadow, and the candle body is closer to the lower point. It forms at the end of an uptrend indicating a price trend reversal. It is a bearish pattern that indicates an upcoming downtrend.

- Hammer Candlestick: This candlestick pattern has a short upper shadow, and a long lower shadow, with the candle's body being closer to the higher point. They appear after a long period of a downtrend. It is a price trend reversal pattern.

- Inverted Hammer Candlestick: An inverted hammer candlestick has a short lower shadow where the candle body is positioned closer to the lower wick and a long upper shadow. It appears at the end of a downtrend. It is a bullish trend reversal pattern that indicates a potential uptrend.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

This candlestick pattern has a success rate of around 69%, while it predicts the possibility of a bearish trend reversal during an ongoing bullish trend. However, this low success rate is because this candlestick pattern is insufficient to forecast a price trend reversal on its own. Thus, traders need to look for other indicators that confirm the results of this candlestick pattern.

This candlestick pattern forms at the end of an ongoing uptrend and indicates a bearish price trend reversal. It occurs when the bullish traders increase the stock price significantly during the trading period, but the bearish traders push back the stock price near its opening price as the trading day ends. This pattern indicates high market volatility and profit booking at higher levels.

When the market is in a highly volatile state, the stock prices keep fluctuating very quickly. Thus, during an uptrend, a single candlestick is not very reliable. It can be considered trustworthy only if it is used in conjunction with other technical analysis indicators.

Recommended Articles

This article has been a guide to Shooting Star Candlestick and its meaning. We explain its comparison with hammer & inverted hammer candlestick, and how to trade it. You may also find some useful articles here -