Table Of Contents

Explanation

As per the first method, the stockholder's equity formula can be derived by using the following steps:

Firstly, gather the total assets and the total liabilities from the balance sheet.

Finally, the stockholder's equity equation can be calculated by deducting the total liabilities from the total assets.

Shareholder's Equity = Total Assets – Total Liabilities

As per the second method, the stockholder's equity formula can be derived by using the following steps:

Step 1: Firstly, collect paid-in share capital, retained earnings, accumulated other comprehensive income, and treasury stock from the balance sheet.

Step 2: Finally, the stockholder's equity formula can be calculated by summing up paid-in share capital, retained earnings, and accumulated other comprehensive income and then deducting treasury stock.

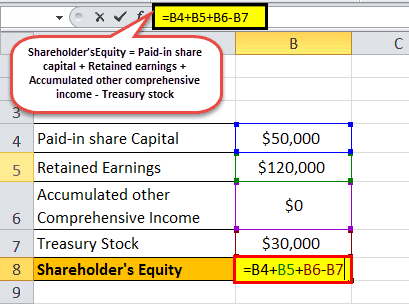

Shareholder's Equity = Paid-in share capital + Retained earnings + Accumulated other comprehensive income - Treasury stock.

Examples of Stockholders Equity Formula

Let's see some simple to advanced examples to better understand the stockholder's equity equation calculation.

Example#1

Let us consider an example of a company PRQ Ltd to compute the Shareholder's equity. The company is in the business of manufacturing synthetic rubber. As per the balance sheet of PRQ Ltd for the financial year ended on March 31, 20XX, the paid-in share capital stood at $50,000, retained earnings of $120,000, and the company repurchased stocks during the year worth $30,000. Based on the information, calculate the Shareholder's equity of the company.

- Given, Paid-in share capital = $50,000

- Retained earnings = $120,000

- Treasury stock = $30,000

The above given is the data for calculating the Shareholder's equity of company PRQ Ltd.

Therefore, the Shareholder's equity of company PRQ Ltd. can be calculated as,

- Shareholder Equity Formula = Paid-in share capital + Retained earnings + Accumulated other comprehensive income - Treasury stock

- = $50,000 + $120,000 + $0 - $30,000

Shareholder’s equity of company PRQ Ltd= $140,000

Therefore, the stockholder's equity of PRQ Ltd as on March 31, 20XX stood at $140,000.

Example#2

Let us consider another example of a company SDF Ltd to compute the stockholder's equity. As per the company's balance sheet for the financial year ended on March 31, 20XX, the company's total assets and total liabilities stood at $3,000,000 and $2,200,000, respectively. Based on the information, determine the stockholder's equity of the company.

- Given, Total assets = $3,000,000

- Total liabilities = $2,200,000

Above is data for calculating the Shareholder's equity of company SDF Ltd.

Therefore, calculation of shareholder’s equity as on March 31, 20XX will be –

- Shareholder’s equity = Total assets - Total liabilities

- = $3,000,000 - $2,200,000

- = $800,000

Therefore, the stockholder's equity of SDF Ltd as on March 31, 20XX stood at $800,000.

Example#3

Let us take the annual report of Apple Inc. for the period ended on September 29, 2018. As per the publicly released financial data, the following information is available. Based on the information, determine the stockholder's equity of the company.

The following is data for calculating the Shareholder's equity of Apple.Inc for the period ended on September 29, 2018.

| Particulars (in Millions) | Sep 30, 2017 | Sep 29,2018 |

|---|---|---|

| Paid-in Share Capital | $35,867 | $40,291 |

| Retained Earnings | $98,330 | $70,400 |

| Accumulated Other Comprehensive Income | -$150 | -$3,454 |

| Treasury Stock | $0 | $0 |

Therefore, the calculation of Shareholder's equity of Apple Inc. in 2017 will be –

Shareholder's Equity formula = Paid-in share capital + Retained earnings + Accumulated other comprehensive income – Treasury stock

= $35,867 Mn + $98,330 Mn + (-150) Mn - $0

Stockholder’s Equity of Apple Inc. in 2017= $134,047 Mn

Therefore, the calculation of Shareholder's Equity of Apple Inc. in 2018 will be –

Stockholder’s Equity formula = Paid-in share capital + Retained earnings + Accumulated other comprehensive income - Treasury stock

= $40,201 Mn + $70,400 Mn + (-$3,454) Mn - $0

Stockholder’s Equity of Apple Inc. in 2018 = $107,147 Mn

Therefore, the stockholder's equity of Apple Inc. has declined from $134,047 Mn as at September 30, 2017 to $107,147 Mn as at September 29, 2018.