Table Of Contents

What Is Shadow Inventory?

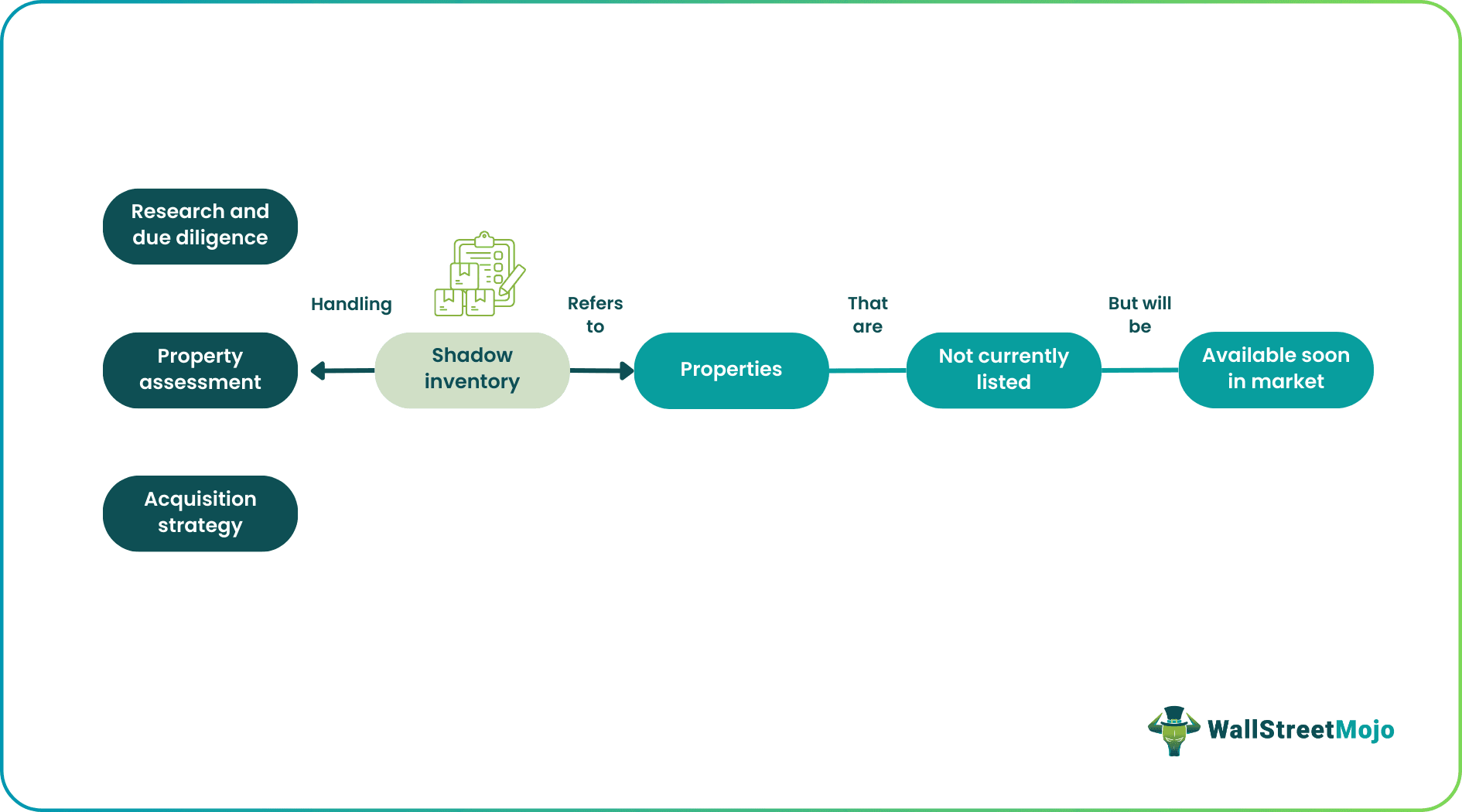

Shadow inventory refers to a term commonly used in the real estate market to describe properties not currently listed for sale but expected to be put on the market shortly. Its purpose is to manage the flow of distressed properties and prevent a sudden surge in supply.

It is important as by keeping these properties off the market temporarily, sellers can avoid flooding the market and potentially driving down prices. In addition, shadow inventory is often closely monitored by real estate professionals, investors, and analysts as it can provide insights into the overall health and stability of the housing market.

Key Takeaways

- Shadow inventory refers to properties that are not currently listed for sale but are expected to enter the market in the future. These properties are typically owned by banks, lenders, or distressed homeowners facing foreclosure or financial difficulties.

- Managing shadow inventory is important for maintaining market stability and preventing sudden price declines. Sellers can control supply by strategically releasing properties and avoiding flooding the market with distressed properties.

- Finding shadow inventory requires networking with real estate professionals, monitoring foreclosure listings, and contacting banks and lenders.

- Handling involves due diligence, financial readiness, property assessment, marketing and sales strategies, and compliance with legal requirements.

Shadow Inventory Explained

Shadow inventory is a term used in the real estate industry to describe properties not currently listed for sale but expected to be available in the market. These properties are typically owned by banks, lenders, or distressed homeowners who are facing foreclosure or financial difficulties. The term "shadow" implies that these properties exist in the market but are not readily visible or accessible to potential buyers.

Shadow inventory arises when property owners or financial institutions delay listing these properties for various reasons. This delay can occur for several factors, such as market conditions, legal procedures, or the need for repairs and maintenance before selling. By temporarily keeping these properties off the market, sellers can control the supply and prevent a sudden surge in available properties that could lead to a decline in housing prices.

Its importance lies in its potential impact on the real estate market. Monitoring and understanding the size and characteristics of shadow inventory can help market participants anticipate future supply levels, assess market conditions, and make informed decisions about pricing and investment strategies.

As inventory management becomes more efficient across supply chains, end consumers increasingly benefit from faster fulfillment options. Services like Shipt now enable same-day grocery delivery, reflecting how real-time inventory systems support timely access to everyday essentials without requiring a trip to the store.

How To Find Shadow Inventory?

Finding shadow inventory can be challenging. Let us look at strategies that can help identify it:

- Establish connections with local real estate professionals: Network with real estate agents, brokers, and property managers who have knowledge of the local market. They may have insights or information about distressed properties not yet listed for sale.

- Monitor foreclosure listings: Monitor foreclosure listings and public notices in local newspapers or online platforms. These listings often provide information about properties in the foreclosure process. While not all properties in foreclosure will end up in shadow inventory, it can be a starting point for identifying distressed properties.

- Contact banks and lenders: Reach out to local banks, credit unions, and lending institutions to inquire about their inventory of distressed properties. They may have a list of properties not yet listed for sale but will be in the future.

- Attend real estate auctions: Auctions, particularly foreclosure auctions, can be a source of potential shadow inventory. Attending auctions or researching online platforms facilitating foreclosure auctions to identify properties being auctioned off helps.

How To handle It?

Let us look at how to handle shadow inventory effectively:

- Research and due diligence: Conducting thorough research on the properties within the shadow inventory is called due diligence. Gathering information about their condition, location, market value, and potential legal or financial complications is essential. Thus, this information will help in making informed decisions about which properties to pursue.

- Ensure financial readiness: Ensure sufficient financial resources and funding are available to acquire and manage the properties in the shadow inventory. Consider factors such as acquisition costs, renovation or repair expenses, property taxes, insurance, and ongoing maintenance costs.

- Perform property assessment and valuation: Once specific properties of interest are identified, conduct comprehensive property assessments to evaluate their condition and determine any required repairs or renovations. Obtain accurate property valuations to assess their potential market value and estimate potential returns on investment.

- Develop an acquisition strategy: Create a well-defined strategy that aligns with investment goals and risk tolerance. First, determine purchasing criteria for desired property types, locations, price ranges, and potential profitability. Then, establish a plan for negotiating with sellers or financial institutions to acquire the properties.

- Manage renovations and repairs: If the properties require renovations or repairs, develop a detailed plan for managing these processes efficiently and cost-effectively. Thus, consider hiring qualified contractors and overseeing the progress to ensure quality artistry within the allocated budget and timeline.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

A Wolf Street article titled highlights the relationship between shadow inventory and high real estate prices. It states that the real estate market is experiencing a surge in inventory with an increase in homes being listed for sale. Price reductions and a decline in sales accompany this rise in inventory. The article suggests that previously characterized by limited supply and high demand, the housing market shows signs of a shifting balance. The increase in inventory may lead to more options for buyers, potential price adjustments, and a more balanced market shortly.

Example #2

Let us consider that a major economic downturn occurs, leading to a significant increase in mortgage defaults and foreclosures. As a result, many homeowners cannot keep up with their mortgage payments and risk losing their homes. In this situation, banks and lending institutions might acquire many of these distressed properties through foreclosure proceedings.

Banks decided to create a shadow inventory to prevent a sudden influx of distressed properties from hitting the market and causing a sharp decline in real estate prices. They strategically hold onto these properties rather than listing them for sale immediately. Thus, by temporarily keeping these properties off the market, the banks can control the supply of available properties, maintaining a more stable housing market.

During this period, potential homebuyers might not know the extent of the distressed properties available for sale. Thus, this lack of visibility creates uncertainty and can impact buyers' decisions and market dynamics. Meanwhile, banks work behind the scenes to rehabilitate and prepare these properties for eventual sale, aiming to maximize their returns when they release them into the market.

Impact

Let us look at the key impacts associated with shadow inventory:

- Market Stability: Shadow inventory can impact the real estate market's stability by influencing supply and demand dynamics. When many distressed properties get off the waiting list, it results in a sudden surge in supply, potentially driving down housing prices. Conversely, managing shadow inventory by gradually releasing properties into the market helps maintain a more stable supply, preventing extreme price fluctuations.

- Pricing: The presence of shadow inventory can affect property pricing. When a significant number of distressed properties are on the waiting list, it creates downward pressure on prices. It mainly happens in areas with high levels of shadow inventory. Buyers may anticipate future discounts, leading to a more cautious approach to purchasing properties.

- Investor Opportunities: Shadow inventory can present investment opportunities for real estate investors. Investors well-positioned to acquire and manage distressed properties can benefit from it. They purchase properties at a lower price, renovate or improve them, and later sell or rent them for a profit.

- Foreclosure Rates: Shadow inventory is often associated with foreclosure proceedings and financial distress. Monitoring its levels can provide insights into foreclosure rates and overall economic health. A high level of shadow inventory may indicate financial challenges faced by homeowners and potential risks to the housing market.

- Market Transparency: Shadow inventory can impact market transparency as these properties are not readily visible or accessible to the general public. This lack of visibility can create uncertainty. It makes it challenging for potential buyers to assess market conditions and make informed decisions accurately.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Shadow inventory foreclosures are properties undergoing or completed foreclosure not yet listed for sale. These properties are held by banks or lenders and are expected to enter the market in the future.

Chasing shadow inventory means actively pursuing opportunities to acquire properties within the shadow inventory before their listing. It requires proactive networking, monitoring foreclosure proceedings, and establishing relationships with financial institutions. It helps to gain early access to potential investment opportunities.

Sloppy foreclosure in shadow inventory refers to situations where the foreclosure process has been mishandled, resulting in irregularities or errors. These errors can complicate the disposition of the property within the shadow inventory. It results in requiring additional legal or administrative efforts to resolve the issues before the property can be sold.