Table Of Contents

Series I Bond Definition

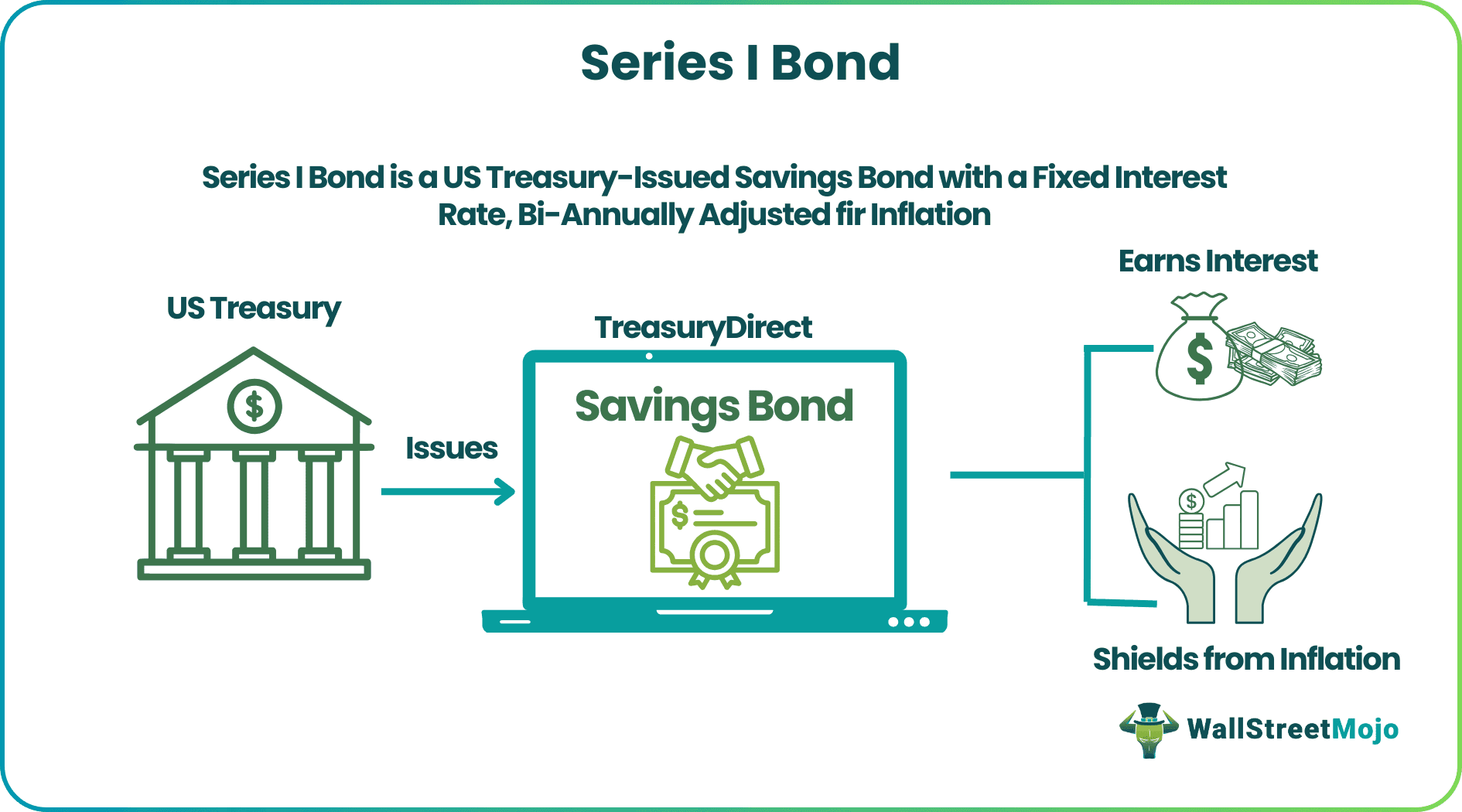

Series I Bond is a US Treasury-issued low-risk savings bond. It comes with an annual interest rate derived from a predetermined interest rate and a biannually set inflation rate. It helps safeguard the investors from inflation and retains the value of their cash.

It is a secure investment offering a reasonable return and a hedge against inflation. With government guarantee and state tax exemptions, the bond is a safe haven for investors with a low-risk appetite. It may be used to sponsor education, support retirement earnings, or relish tax reliefs. The latest I bond is available through April 2022 at an annual interest rate of 7.12%.

Key Takeaways

- Series I bond is a US Treasury-issued savings bond with a fixed interest rate and a bi-annually adjusted inflation rate to protect buyers from inflation.

- Electronic I bonds are available via the Treasury Direct account, while paper bonds are only obtained from the IRS for a tax refund.

- The prevailing interest rate of I bonds issued during November 2021-April 2022 is 7.12%.

- Adults, minors, trusts, corporations, estates, partnerships, and other establishments may hold I bonds subject to specific terms and conditions.

- Both the fixed interest rate and the inflation rate determine the total amount of interest earned on I bonds, generally known as the Composite Rate.

Series I Bond Explained

I Bonds are government-backed debt instruments offering a fixed interest rate that is adjusted for inflation semi-annually. It provides lifetime security against inflation with a steadfast supply of earned interest. The interest (if any) is monthly added to the bond and is rewarded on redeeming it.

Note that the I bond's maturity period is 30 years for which you earn interest. These bonds are non-negotiable instruments and cannot be traded on the secondary markets. Being low-risk securities, they offer modest returns. However, since the interest rates are adjusted for inflation, any surge in inflation is likely to drive its rates up.

Of late, the inflationary spike has skyrocketed the interest rates on these bonds. The bonds issued from November 2021 to April 2022 offer an annual interest rate of 7.12% for the initial six months of possession. Later, a new rate will be allotted for the next semester based upon the inflation rate and the fixed rate of this bond.

The I Bonds are issued in electronic and paper form. They are sold at face value and in denominations of $25 or above (electronic bonds) and $50, $100, $200, $500, and $1000 (paper bonds). You can buy the electronic I bonds from the TreasuryDirect and paper I bonds from the IRS (Internal Revenue Service) in the form of a tax refund.

Since January 1, 2012, the US treasury has discontinued selling paper savings bonds at commercial organizations. Nevertheless, investors can purchase them with an IRS tax refund. Paper bonds are delivered through email, while the TreasuryDirect account holders can promptly buy, control, and retrieve electronic I bond from their web browser.

You can buy a maximum of $10,000 worth of electronic bonds and $5000 paper bonds per calendar year. Remember to must hold them at least for a year before redeeming. However, you may lose the last quarter interest if you cash them before five years.

The I bond enjoys state and local tax exemptions, excluding inheritance or estate taxes. However, you are liable to pay federal income tax on the interest earnings, except if used for funding education.

Who Can Buy the Series I Bond?

Minors, adult individuals, and other organizations may purchase the electronic and paper bond subject to definite terms and conditions. Both adults and children under the age of 18 must have a TreasuryDirect account with:

- A valid Social Security Number

- US citizenship/ US residency/ Civilian employee status of the US

Note that minors cannot open the TreasuryDirect account or manage any business proceedings. Nonetheless, an adult guardian may open their account linked to their own and handle the dealings.

Trusts, estates, partnerships, corporations, and other entities with a valid TreasuryDirect account can have the electronic I bond. Howbeit, only trusts, and estates may have paper bonds in some cases.

Series I Bond Calculations

The interest rate on the I bond is a composition of two rates, thus usually called Composite Rate or Overall Rate.

- Fixed interest rate – It is a set annual rate that remains the same throughout the bond’s lifespan. The US treasury determines the bond interest rate every six months, i.e., the first business day in May and November. It applies to all I bonds issued throughout the next semester. It remains unchanged.

- Inflation rate – This biannual rate fluctuates according to the Consumer Price Index modifications for all urban consumers (CPI-U). The Bureau of the Fiscal Service reports the CPI-U-based rates each May and November. The rates usually change every semester.

Now, both of these rates are merged, utilizing the below-mentioned equation.

Composite Rate =

Note that the composite rate won’t ever be less than zero. It can be lesser than the set rate. In case of a negative inflation rate, it can nullify some of the set rates (not lower than zero).

Example

Let’s understand the composite rate calculation through an example. Suppose,

Fixed interest rate = 0.10%

Biannual inflation rate = 2.56%

So, Composite Rate =

= 0.001+0.0512+0.0000256

= 0.052256

= 0.0523

= 5.23%

The latest Forbes article explains how US series I bonds are paying more than 7% interest. The interest rates on these bonds hovered in the range of 1.06% to 2.53% over the last decade, but inflation has propelled the interest rate to an all-time high of 7.12%. Therefore, they have become the toast of the town. The article reports that the purchases made in November 2021 ($1.07 billion) have well surpassed the buyings in fiscal 2020 or fiscal 2021.