Table Of Contents

Separation Of Duties Meaning

Separation of duties is a concept in business organizations that involves assigning different tasks and responsibilities to different individuals or teams to reduce the risk of fraud, error, and other financial misconduct. In addition, it helps to promote accountability, transparency, and ethical behavior within the organization.

It aims to create a system of checks and balances that helps to ensure that no one person can manipulate or misuse the process for their gain. It can also help improve the accuracy and reliability of financial reporting and internal controls and reduce the likelihood of errors or omissions in financial records.

Key Takeaways

- Separation of duties is an important control mechanism that helps to prevent fraud, errors,

- and other types of financial misconduct by ensuring that no single employee or team has complete control over a business process or function.

- It involves dividing tasks and responsibilities among different employees or teams to create checks and balances and to promote transparency and accountability.

- It aims to reduce the risk of fraud, errors, and other types of financial misconduct and promote transparency, accountability, and ethical behavior.

Separation Of Duties Explained

Separation of duties in a business organization reduces the risk of fraud, error, and other financial misconduct by preventing any individual or team from having too much control or authority over a critical business process or function.

By assigning different tasks and responsibilities to other individuals or teams, the organization creates a system of checks and balances that helps to ensure that no one person can manipulate or misuse the process for their gain. This helps to promote accountability, transparency, and ethical behavior within the organization.

In addition, it can also help to improve the accuracy and reliability of financial reporting and internal controls, as well as reduce the likelihood of errors or omissions in financial records. This can help the organization to comply with regulatory requirements and industry standards and avoid legal and reputational risks.

Separating duties aims to promote a culture of trust, integrity, and accountability and protect the organization and its stakeholders from the negative consequences of financial misconduct.

Examples

Let us understand this in the following ways.

Example #1

Imagine a small business that sells products online. The industry relies on a single employee with access to the company's online store, payment processing system, and shipping records to process orders. This employee is responsible for authorizing payments, recording transactions, and shipping the products to customers.

However, this arrangement risks fraud and error, as the employee controls the entire order fulfillment process. To address this risk, the business decides to implement it by dividing the following tasks into different roles:

- Authorization: One employee approves and manages the payment processing system.

- Recording: Another employee records transactions in the company's books and records.

- Custody: A third employee is responsible for managing the inventory and shipping products to customers.

Example #2

One real-world example in the news is the scandal at Wells Fargo, a central US bank. Employees opened millions of unauthorized accounts to meet sales targets and earn bonuses. The scandal was partly attributed to a lack of division of duties. Employees responsible for opening accounts were also responsible for approving and verifying those accounts.

Importance

This concept is critical in reducing the risk of fraud, error, and other types of financial misconduct. In addition, it is essential for promoting transparency, accountability, and ethical behavior.

Here are some of the critical reasons why it is so essential:

- Fraud prevention: By separating the tasks of authorization, recording, and custody, organizations create a system of checks and balances that helps to prevent fraud. No one person or team has complete control over a critical business process or function, reducing the risk of manipulation, embezzlement, or other types of financial misconduct.

- Error prevention: It also helps to reduce the risk of errors in financial records and reporting. By assigning different tasks and responsibilities to other individuals or teams, organizations can catch mistakes before they become major problems and ensure that financial data is accurate and reliable.

- Compliance: Many regulatory bodies and industry standards require organizations to implement it in their internal controls and risk management processes. Compliance with these requirements can help avoid legal and reputational risks and promote good corporate governance.

- Accountability: It promotes accountability and transparency within the organization. Ensuring that different individuals or teams are responsible for various aspects of a critical business process or function makes it easier to identify and address issues and hold people accountable for their actions.

- Ethical behavior: It can also help to promote a culture of ethical conduct within the organization. By reducing the risk of fraud and other financial misconduct, organizations can build trust with stakeholders and demonstrate their commitment to integrity and honesty.

Risks

While it can provide many benefits, organizations must be aware of potential risks and challenges. Here are some of the critical risks associated with the separation of responsibilities:

- Increased costs: Implementing it can be costly, requiring organizations to hire additional staff, invest in new systems and technologies, and train employees on new processes and procedures. This can be a significant financial burden, especially for small businesses or organizations with limited resources.

- Reduced efficiency: It can also lead to reduced efficiency, as employees may need approval or input from other team members before completing their tasks. This can slow down critical business processes and impact customer service and satisfaction.

- Increased complexity: It can make business processes more complex and challenging. This can increase the risk of errors, confusion, and miscommunication, especially if employees are not adequately trained or lack clear policies and procedures.

- Potential for collusion: While it is designed to prevent fraud, it is not foolproof. In some cases, employees may collude with each other to circumvent the controls and commit financial misconduct. This can be especially difficult to detect if there is a lack of oversight or if employees can work in isolation.

- Resistance to change: Employees may resist changes in their roles and responsibilities, especially if they feel unnecessary or burdensome. This can lead to morale issues and potentially impact employee retention and engagement.

Best Practices

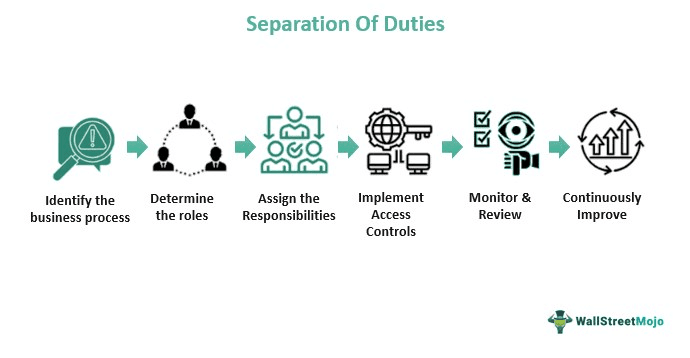

Implementing separation of duties in a business organization can be a complex process that requires careful planning, coordination, and communication. Here are some best practices to consider when implementing it:

- Define roles and responsibilities: It clearly defines the roles of each employee or team involved in the business process. It ensures that each part has specific tasks distinct from other roles so that there is no overlap or duplication of duties.

- Implement adequate controls: Implement appropriate controls to monitor and manage the division of duties. This may include access controls, approval processes, monitoring and reporting mechanisms, and periodic reviews of policies and procedures.

- Train employees on the importance of division of duties. It gives them the knowledge and skills to effectively perform their assigned tasks and responsibilities. Ensure all employees know the related policies and procedures and understand their role in maintaining the controls.

- Establish oversight mechanisms to ensure that duties are separated effectively. This may include assigning a dedicated team or individual to oversee the process. This is done by conducting periodic audits or reviews and soliciting feedback from employees and stakeholders.

- Monitor for compliance: Regularly monitor compliance with separation of duties policies and procedures, and take appropriate action if any violations are detected. Ensure that employees know the consequences of non-compliance and understand the importance of maintaining the controls.

- Continuously improve: Improve the process by soliciting feedback from employees and stakeholders, monitoring emerging risks and trends, and incorporating new best practices and technologies as needed.

Separation Of Duties vs Least Privilege

Separation of duties and least privilege are two important cybersecurity and information security principles. Here are the key differences between the two:

Separation Of Duties:

- Separation of duties involves dividing tasks and responsibilities among individuals or teams to prevent errors, fraud, and other financial misconduct.

- It primarily focuses on preventing conflicts of interest and creating organizational checks and balances.

- It is commonly used in financial and accounting processes, where it is important to have multiple individuals involved in processing transactions and reconciling accounts.

- Separation of duties is often required by regulations and standards such as SOX, PCI DSS, and HIPAA.

Least Privilege:

- The least privilege only provides users access and privileges necessary to perform their job functions.

- It primarily focuses on limiting access to sensitive information and resources to minimize the risk of unauthorized access and data breaches.

- It is common in IT security, where it is important to restrict access to systems, applications, and data based on the user's role and responsibilities.

- Least privilege is often recommended by security frameworks such as NIST and ISO 27001.