Table Of Contents

What Is Semi Variable Cost?

Semi-variable cost refers to the hybrid expense type, which include traits of both the fixed cost as well as the variable cost. Here, the fixed costs are set at a certain production level and when that specific limit is crossed, it becomes variable costs, for example, electricity bill, etc. The behavior of a semi-variable cost depends partially on fixed & variable costs because of which these costs are also known as mixed cost.

The fixed part will occur irrespective of the production level; even in the case of zero production activities, a fixed cost will still occur. However, the variable part of such costs is dependent on the level of production work carried by the entity and increases in proportion to the production levels.

Semi-Variable Cost Explained

Semi-variable cost, as the name suggests, is not completely variable in nature. It is also known as semi-fixed cost, given its partial resemblance to fixed expenses that a company bears. In short, these expenses are the mixed form of both variable and fixed costs as they exhibit partial traits of both these types of costs.

When a company is in production, there are two types of costs that can be identified. One is them is a fixed cost, which does not change with the change in the production volume and the other is the variable cost, which changes from time to time with the change in the volume of production.

Since the proportion of fixed and variable costs in semi-variable expenses plays an important role in helping the management make effective business decisions, it is important to identify them. When the fixed cost proportion is lower in semi-variable expense as it indicates a lower break-even point. As these are identified, businesses can easily project the cost changes beforehand and get prepared accordingly.

The Generally Accepted Accounting Principles (GAAP) does not need to distinguish between variable and fixed costs as no separate mentions of them are required on the financial statements of a company.

Formula

Semi-variable costs can be calculated by adding the fixed costs and the variable costs (based on the level of production).

The expression is mentioned below:

Semi Variable Cost = F + VX

Where:

- F = fixed cost

- V = variable cost per unit

- X = total production in units

Examples

Let us understand the following examples to understand the concept better and see how it is calculated:

Example #1

The best examples to understand this concept are the expenses related to telephone and electricity:

Telephone Bills: – A firm has a landline telephone connection with a plan to make 100 calls per day. The plan costs $750 per month; however, if the firm makes more calls, then $0.50 per call will be charged. Calculate the firm's variable, fixed, and semi-variable costs for one month. Assume the firm makes additional 40 calls per day.

Solution:

Firm’s Fixed Cost = $ 750 per month

The fixed cost of the constant amount incurred by the firm irrespective of the number of calls made.

Total Variable Cost = Variable Cost Per Unit * Additional calls per month

- =0.5 * (40*30)

- =$ 600 per month

Semi-Variable Cost Formula = Fixed Cost + Total Variable Cost

- =$ (750 + 600)

- $ 1350

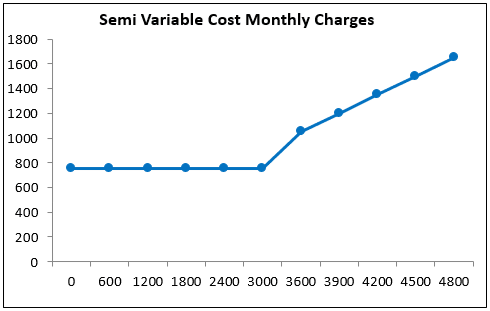

Create a sensitivity analysis of the cost for the telephone bills of the firm and create a graphical presentation.

Graphical presentation of mixed cost for monthly charges is as follows-

Example #2

The production dept of a company incurs fixed expenses of $1.5 million per month while operating on its minimal capacity. Due to a big urgent order, it has to work for an additional 90 hours in the month. The company provides the data regarding its variable costs, which consist of electricity bills, telephone bills, raw material expenses, and salaries to be $12000 per hour. The company wants to calculate its total semi-variable cost.

We have the following data for the calculation of cost-

- Fixed Cost (F): $1,500,000

- Variable Cost per hour (V): $12,000

- Working hours (X): 90

Calculating the total mixed cost:

- T = F + VX

- =1,500,000 + (12000 * 90)

- =1,500,000 + 1,080,000

- =2,580,000

Example #3

Let's say, Admiral Sportswear Pvt. Ltd, an international sportswear manufacturing company located in England. For the upcoming ICC cricket world cup tournament, the factory needs to work for some extra hours to fulfill the other requirements. Therefore, the management is worried about the increment in the costs due to additional production activities.

Consider the following information about the semi-variable cost at different production levels provided by the company's production department to calculate the variable cost and the fixed cost.

Given:

| Quantity Units | Semi-Variable Cost |

| 500000 | £14,000,000 |

| 100000 | £5,000,000 |

Calculating the variable portion (per unit)

#1 - Difference between the units of output and related Cost

#2 - Variable cost per unit

Divide the calculated difference cost by quantity:

- = £9,000,000 / £ 400000

- = £22.50

#3 - Calculating Fixed cost

- = £ 50,00,000 - £ 22,50,000

- = £ 27,50,000

#4 - Rechecking the results: by adding the fixed cost to the total variable costs (at 500000 units). The result should be the total cost as given.

Refer above-given excel sheet for detailed calculations.

Relevance

Semi-variable cost has components of both variable and fixed expenses; hence it becomes vital for companies to consider while planning for additional production activities. Ignorance or inefficient management of costs may limit the company's profitability at higher levels of production.

Remember, this cost remains fixed up to a certain level of production but gradually increases upon utilization of the company's higher levels of production capacity.