Table Of Contents

What Is Security Analysis?

Security analysis refers to analyzing the value of securities like shares and other instruments to assess the business's total value, which will be useful for investors to make decisions. There are three methods to analyze the value of securities – fundamental, technical, and quantitative analysis.

Even though the process has its own negative and positive effects, it is essential to do it so that investors can actively participate in the financial market. Market conditions, currency and interest rate fluctuations, and political changes influence the analysis. However, it is necessary to diversify the portfolio to earn a maximum return.

- Security analysis involves diligently determining the intrinsic value of securities, such as stocks and financial instruments, to help investors make well-informed decisions for optimal returns.

- The three primary types of security analysis are fundamental, technical, and quantitative, each employing distinct methodologies to assess securities' worth and market trends.

- Security analysis serves the pivotal purpose of enhancing individuals' net worth by strategically investing their earnings in diverse financial instruments to achieve profitable outcomes.

- Ethical conduct, competence, and dedication are the guiding principles for security analysts, ensuring clients' interests are safeguarded and prioritized throughout the investment process.

Security Analysis Explained

The security analysis process involves the analysis and evaluation of different financial instruments like bonds, stock, or any other security where funds can be invested to earn good returns. The study helps determine the risk and return opportunity, allowing investors to decide whether they should put their money in them to make returns or whether there are better opportunities available.

Investing is necessary after considering factors like time horizon, return expectation, investment objective, and, most importantly, risk appetite. It is possible to invest funds in an opportunity that is worth only when proper security risk analysis and evaluation are done. This can be done by individual investors, analysts, or professional portfolio fund managers, who are well-informed about the assessment process and have the necessary competence to calculate the return and risk.

But even though good analysis is done, there is no guarantee of success in the process. There may be risks and uncertainties that are not always possible to predict. Therefore, it is important to diversify the portfolio is order to minimize risk of losses.

Features

Let us identify and understand the various features of security analysis.

- To value financial instruments like equity, debt, and company warrants.

- To use publicly available information. The use of insider information is unethical and illegal.

- Security analysts must act with integrity, competence, and diligence while conducting the investment profession of doing security risk analysis.

- Using various analytical tools, including fundamental, technical, and quantitative approaches.

- Security analysts should place the interest of clients above their interests.

Examples

Here are some suitable examples to understand the concept better of security analysis portfolio management.

#1 - Box IPO Analysis

For Box IPO valuation, I have used the following approaches: -

- Relative valuation – SaaS comparable comps

- Comparable Acquisition Analysis

- Valuation using stock-based rewards

- Valuation cues from Box private equity funding

- Valuation cues from Dropbox's private equity funding valuation

- Box DCF Valuations

You can learn more about Box Valuation Analysis from here.

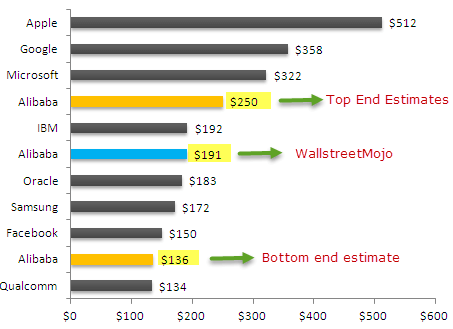

#2 - Alibaba IPO Analysis

I primarily used the discounted cash flow technique in analyzing the Alibaba IPO.

You can learn more about approaches of security analysis while doing a security analysis of Alibaba from this article - Alibaba Valuation Analysis

Types

Below are the top 3 types of approaches of security analysis.

The securities can broadly be classified into equity instruments (stocks), debt instruments (bonds), derivatives (options), or some hybrid (convertible bond). As per the nature of securities, security analysis can broadly be performed using the following three methods: -

#1 - Fundamental Analysis

The fundamental security analysis is a type of security analysis that is an evaluation procedure of securities where the primary goal is to calculate the intrinsic value. It studies the fundamental factors that affect a stock's intrinsic value, such as the company's profitability statement and position statements, managerial performance, future outlook, present industrial conditions, and the overall economy.

#2 - Technical Analysis

This type of security analysis is a price forecasting technique that considers only historical prices, trading volumes, and industry trends to predict the security's future performance. It studies stock charts by applying various indicators (like MACD, Bollinger Bands, etc.), assuming every fundamental input has been factored into the price.

#3 - Quantitative Analysis

This security analysis is a supporting methodology for both fundamental and technical analysis, which evaluates the stock's historical performance through calculations of basic financial ratios, e.g., Earnings Per Share (EPS), Return on Investments (ROI), or complex valuations like Discounted Cash Flows (DCF).

Objectives

The primary target of every individual is to increase their net worth by investing their earnings into various financial instruments, i.e., the creation of money using the money. Security analysis portfolio management helps people achieve their ultimate goal, as discussed below: -

#1 - Returns

The primary objective of the investment is to earn returns in the form of capital appreciation and yield.

#2 - Capital Gain

Capital gain or appreciation is the difference between the sale and purchase prices.

#3 - Yield

It is the return received in the form of interest or dividend.

Return = Capital Gain + Yield

#4 - Risk

It is the probability of losing the principal capital invested. Security analysis avoids risks, ensures capital safety, and creates opportunities to outperform the market.

#5 - Safety of Capital

The capital invested with proper analysis; avoids the chance of losing interest and money. Invest in less risky debt instruments like bonds.

#6 - Inflation

Inflation kills one's purchasing power. Inflation over time causes you to buy a smaller percentage of goods for every dollar you own. Proper investments provide you with a hedge against inflation. Choose common stocks or commodities over bonds.

#7 - Risk-Return relationship

The higher the potential return of an investment, the higher the risk. But the higher risk does not guarantee higher returns.

#8 - Diversification

"Just do not put all your eggs in one basket," i.e., do not invest your whole capital in a single asset or asset class but allocate your wealth in various financial instruments and create a portfolio pool of assets. But, again, the goal is to reduce the volatility risk in a particular asset.

Note: Analyzing securities does not guarantee profits because research is done with publicly available information. However, contrary to the Efficient Market Hypothesis (EMH), markets do not reflect all the information available. Thus security analysts can beat the market using technical and fundamental approaches.

Risks

Some common risks involved in the process of fundamental security analysis are as follows:

- Market Risk – Risk like changes in economic and political condition, changes in interest rate and currency fluctuations and variation in overall market sentiments influence the securities.

- Credit risk – This refers to the credit worthiness and risk of default by companies or issuers. Investors may face the risk of not getting payments on time.

- Liquidity risk – Some investment options may have lock-in period or strict rules where the investor cannot break it till maturity.

- Risk or timing the market – The analyst may not be able to time the market and identify the exact entry point where it will be worth investing. Trying to predict market movement for short term may lead to losses of missing of opportunity.

Thus, the above are some risks that the investor may face even after thorough assessment or evaluation.

Security Analysis Vs Intelligent Investor

Both the above concepts refers to books that are written by Benjamin Graham which cover investment strategies and principles that are interlinked but at the same time different. Let us study the differences between the two books.

- The former focuses on analyzing the securities and studying them in-depth to understand the movements and opportunities of gain or possibility of loss on investment. But the latter concentrates on investor behavior and the important of financial discipline.

- In the former, the study covers accounting, fundamental and technical concepts whereas in the latter, the study covers the mood and approaches of investors while trading in financial instruments.

- The former stresses more of maintaining the margin of safety and avoiding speculation. The latter emphasizes more on value investing and not trying to time the market and, at the same time, looking for undervalued but strong stocks.

Frequently Asked Questions (FAQs)

Security analysis finds widespread applications in finance. It plays a crucial role in stock selection, portfolio management, risk assessment, company valuation, and making informed investment decisions based on market trends and economic indicators.

While security analysis is valuable, it has certain limitations. These include the inherent uncertainty in predicting market trends, the influence of non-financial factors on security prices, challenges related to the availability and accuracy of financial data, and the difficulty of accurately valuing complex securities.

The objectives of security analysis are multifaceted. They include identifying undervalued securities with growth potential, evaluating companies' financial health and performance, assessing investment risks, and providing recommendations and insights for investment strategies and decision-making processes. The ultimate goal is to optimize returns while managing risks in the ever-changing financial landscape.

Recommended Articles

This article is a guide to what is Security Analysis. We explain the risks, objectives, types, differences with the book intelligent investor, with examples. You can learn more about financing from the following articles: -