Table Of Contents

What Is Securities Lending?

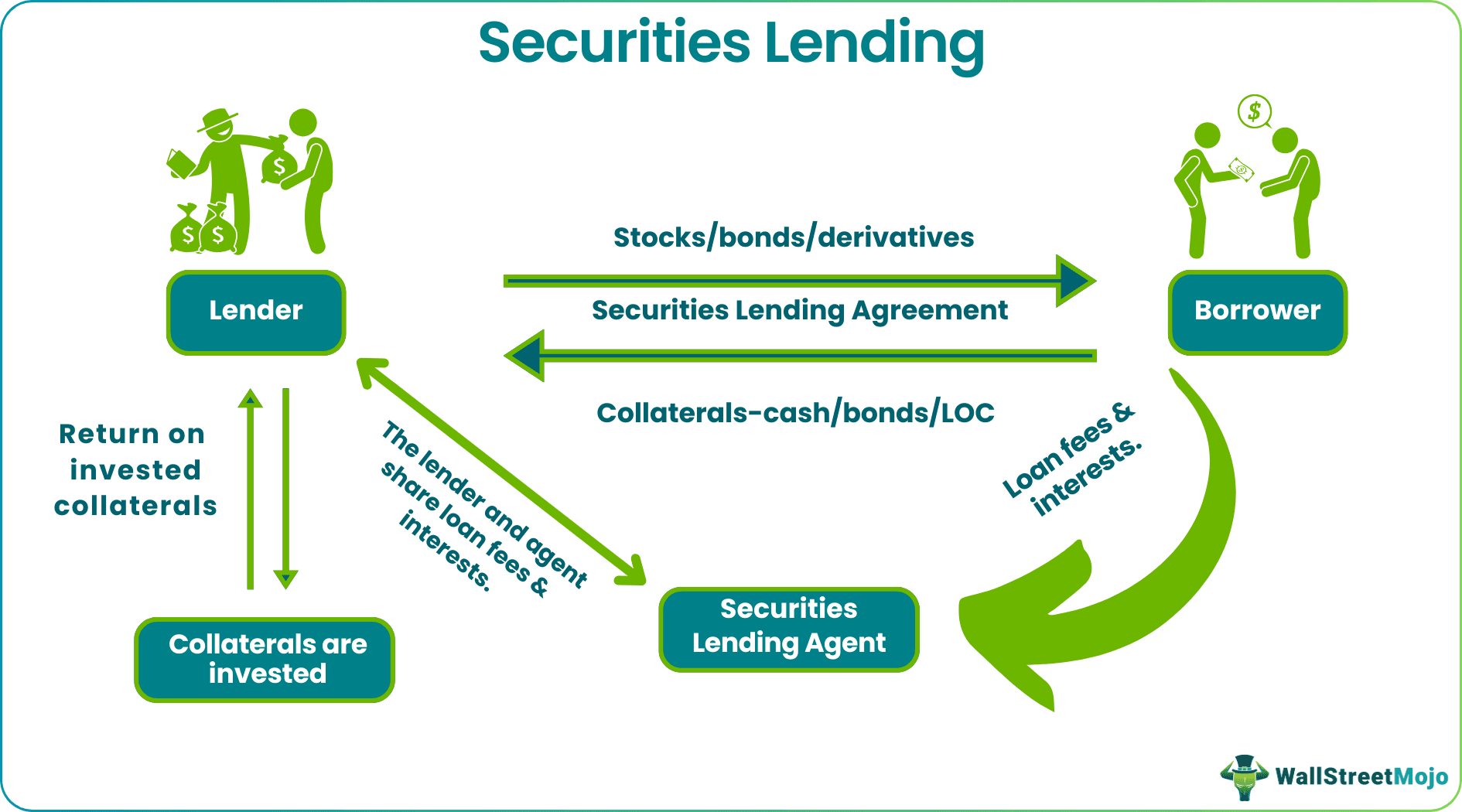

Securities lending temporarily transfers ownership of stocks, bonds, or derivative contracts to a borrower. In return, the borrower has to keep collateral such as any other stock, cash, or bond as security, along with a borrowing fee. Thus, it is a lending and borrowing of securities between two parties.

The lending takes place per the terms of the securities lending agreement before the security transfer. The broker charges the client a borrowing or loan fee and any interest on the loan. The collateral is equal to or more than the loan value. The borrower must return the securities on demand or a particular date.

Key Takeaways

- Securities lending refers to lending securities to borrowers, such as stocks, bonds, derivative contracts, etc.

- The borrower pays a brokerage fee or loan fee to the securities lending agent and any interest, per the terms of the agreement.

- The borrower keeps some collateral, like cash, bond, stock, or Letter of Credit, as security against the loan, whose value should be more than or equal to the security loan amount.

- The borrower must return the securities on a particular date or when the lender demands them.

Securities Lending Explained

Securities lending involves lending securities in the form of shares, bonds, derivative contracts, etc., to a borrower in exchange for collaterals like stocks, bonds, or a letter of credit. A brokerage firm helps in the agency securities lending deal, according to the terms of the securities lending agreement.

The agreement clearly states the interest rates, the loan fee for the broker, the duration of the loan, and the type of collateral. The collateral should equal or more than 100% of the security value.

Even after lending the securities, the ownership remains with the lender. Therefore, the interest and the fee the lender may charge will depend on how difficult it is to borrow such security. Most of the time, the fee payment is made monthly.

Such program has existed in the market for many years and has grown to a large extent. The process allows the proper functioning of the financial market. It is a suitable investment method that helps enhance returns for various financial institutions.

Collateral Requirements

The collateral requirements for the securities lending program are as follows:

- Cash Collateral – It can be US dollars, Canadian dollars, Australian dollars, Euro, Yen, and British pounds.

- Non-cash Collateral – global equities, specific supranational debt, specific equity index baskets, sovereign debt, or investment grade corporate bonds.

The total market value of securities borrowed should be less than the total collaterals. Then the lender invests these collaterals in the money market for the short term. In the case of security collateral, the lender and the firm that helps to conduct the agency securities lending deal share the loan fee and interest. But for cash collateral, the borrower gets a rebate, and the revenue earned is shared between the lender and agent.

Examples

Some examples will help in understanding the concept better:

Example #1

John, a trader in the securities market, has been analyzing and actively following the stock price of ABC Ltd. He concludes that the stock's price, currently trading at $150 per share, will come down to $100 within the next two months. Therefore, John approaches the securities lending agent, Expert Securities, borrows 70 shares of ABC Ltd, and sells them at the current market price. Thus, he earns $10500 (70 x $150).

As estimated, after two months, the stock price comes down to $100, and John purchases them at that price. So, he spends $7000 (70 x $100). This short-selling transaction gives him a profit of $2500 (10500 – 7000).

In the above situation, the stock lending facility allows John to take advantage of the price fall to earn a profit.

Example #2

A few months back, the US Securities and Exchange Commission (SEC) changed the lending securities market to increase efficiency and transparency. Under the new scheme, lenders will send all information related to lending transactions to a securities association registered for this purpose. In addition, the lenders will also send daily updates at the end of the day regarding the securities already lent and the ones available for lending.

Benefits

There are certain benefits in the process of securities lending. They are as follows:

- Facilitate short selling – In short selling, investors sell securities first, hoping to buy them later at a lower price. Thus, after selling, the borrower or the investor borrows the stocks at a lower price.

- Additional income for fund investors – The process generates extra income from fees and interests collected from borrowers. These securities lending rates are fixed in the agreement and help the fund investors compensate the management fees.

- Benchmark for securities performance - The lending process provides a benchmark to judge how well the stocks perform in the market.

- Borrower’s rights – Since the securities are temporary with the borrower, they can vote for the stocks, earn dividends, and participate in any other company distributions.

- Banks make markets - Banks are always in the process of transacting securities of mutual funds, pension funds, etc. So if they need to sell, banks can borrow the securities at short notice if they do not have them.

- Borrowed securities used for market strategies – The borrowed securities help in techniques like hedging (risk reduction, trading, or arbitrage (the process of taking advantage of the price difference in different markets to earn a profit).

Risks

Let us discuss the types of risk involved in the stock lending process:

- First, insolvency of the borrower – The borrower may become insolvent, and the collateral's value may come down, which is a massive loss to the lender.

- Lender’s loss during reinvestment – The lender might suffer losses while reinvesting the collaterals. Thus even if stock lending generates income, the loss during reinvestment dilutes it.

- Delay in getting the collateral – Delay in delivering collateral can be risky since the lender does not have any security during that time.

- Security value rises after short selling – If the security value rises after short selling, the borrower will lose money since they have to borrow the securities at a higher price than they sell.

- Ethical risk – Both lenders and borrowers might misuse any term of the agreement for their benefit, which is a moral risk.

Securities Lending vs REPO vs Margin Lending

Securities lending means lending out stocks, bonds, or derivative contracts in exchange for collaterals and earning fees and interest against them. In REPO or repurchase agreement, one party sells the securities to another party with an agreement to repurchase them at a better price. Margin lending is a trader borrows money to invest in financial instruments. The difference between them is as follows:

| Securities Lending | REPO | Margin Lending |

|---|---|---|

| In this, lenders lend securities to earn interest and fees. | In this, sellers sell securities to repurchase them later at a higher rate. | Here, the fund helps to purchase financial instruments. |

| The transaction is between the lender and the borrower. | The transaction is between market makers like central banks, dealers, and investment banks. | The transaction is between the broker and trader or investor. |

| It mainly involves equities. Here, financial instruments are | Government securities and fixed-income instruments. | The trader purchases financial instruments or derivative contacts. |

| There is a transfer of voting rights and other corporate actions. | There is no transfer of voting rights and other corporate actions. | There is no transfer or any voting rights or corporate actions. |

| The lenders have the right to demand back the securities whenever they want. | Unless specified through an agreement, the seller cannot recall the securities at any time during the transaction. | The trader continues to borrow funds as long as the margin trading account exists. |

| The primary motivation is borrowing securities. | The primary motivation is borrowing funds. | The primary motivation is to access more financial products and earn profit. |

| Collaterals are cash, stocks, letter of credit, etc. | Collaterals are Government securities and fixed-income instruments. | Collaterals are a percentage of the total trading amount. |

| There are interest charges against the loan. | There is no interest involved. | There are interests against margin money. |