Table Of Contents

What Are SEC Regulations?

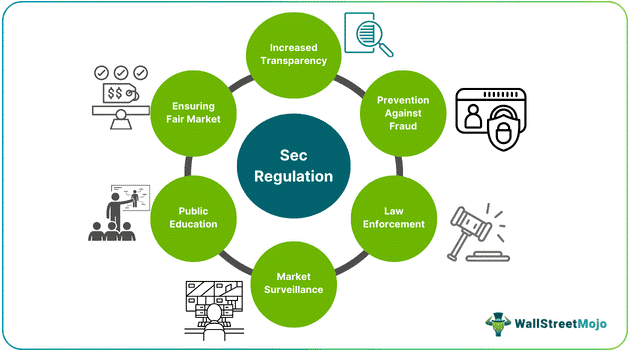

SEC regulations refer to a set of guidelines and rules that define how the securities market must operate. These rules are curated to ensure that investors remain protected and market participants maintain a fair and orderly practice. The Securities and Exchange Commission (SEC) is the governing body that curates, oversees, and amends these regulations.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

According to the SEC's regulations committee, all public companies, whether they deal with financial products or not, are subject to these guidelines since they offer securities to investors. Moreover, the broader sense of these regulations applies to all market participants, including investors, investment advisors, brokers, mutual funds, and other companies, dealers, exchanges, and self-regulatory organizations.

Key Takeaways

- SEC regulations refer to a set of rules and guidelines that govern the securities industry. These rules safeguard interests, promote transparency, and increase the accountability of public companies.

- These regulations apply to all market players, including investors, companies, brokers, self-regulatory organizations, dealers, investment companies such as mutual funds, and investment advisers.

- As part of these guidelines, these entities are required to furnish their financial information at regular intervals. SEC ensures that these companies and entities furnish accurate information.

- Failure to adhere to these norms set by the SEC results in strict punitive actions, such as fines, injunctions, suspensions, and ceasing orders.

SEC Regulations Explained

SEC regulations are a set of guidelines curated by the Securities and Exchange Commission in the United States. These guidelines or rules are curated to ensure the securities markets remain a level field for all participants. These rules are majorly directed to ensure that all investors are protected against fraud, scams, and other such illegal activities.

The SEC came into existence because of the infamous 1929 crash. At that crucial juncture, the government and economists wanted to ensure the market was free of manipulation and fraud. Therefore, the Securities and Exchange Commission (SEC) was born in 1934. The SEC oversees the market, enforces laws, and takes punitive actions against violators.

These guidelines apply to all securities market participants, such as investors, brokers, self-regulatory organizations, exchanges, dealers, mutual funds, and other companies. However, companies are constantly in a dilemma because they do not know if these regulations apply to them or not.

The simple answer is that all public companies are subject to rules curated by the SEC, regardless of whether their operations are related to finance. Since these companies offer securities to the public and are traded on exchanges, they are subject to the stringent rules of the SEC.

In fact, the SEC is infamous for being too strict with these regulations and levying heavy fines for any violations. For instance, the securities market watchdog collected over $3.9 billion in fines in 2021 alone. However, it has to be understood that new SEC regulations and strictness are needed to ensure that the market runs as efficiently as possible.

These guidelines clarify the market's rules for each player. As a result, the level of transparency, protection of market players against fraud, and fair and orderly conduct in the securities market have significantly increased.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Who Do SEC Regulations Affect?

The SEC regulations on cybersecurity, conduct, declaration, and participation in the securities market in general affect all market participants. The specifics of the same are:

- Investors: SEC regulations for investors aim to protect them from fraud and help them invest in a fair market. These guidelines are also in place to ensure there is no manipulation or fraudulent attempt to experience financial gains.

- Companies: Companies that offer securities to buy and trade on exchanges must register with the SEC by default. There are strict rules regarding disclosure and submitting necessary documentation at regular intervals.

- Intermediaries: Brokers, dealers, financial services firms, and exchanges that facilitate the operation of the securities market must be registered with the SEC. They are also subject to a set of rules, treat their clients (investors) fairly, and operate transparently.

- Mutual Funds and Investment Advisors: Since they buy, sell, and recommend securities and other investment vehicles, they must be registered with the SEC to ensure they are qualified enough to do so. Therefore, these rules and guidelines also apply to them.

- Company Insiders: Individuals within a public company, such as employees, directors, consultants, and a select few shareholders, are expected to adhere to rules that protect against insider trading and related issues. They must file a declaration with the SEC at regular intervals.

Regulations

Multiple old and new SEC regulations govern what is happening in the market. However, a few are more prominent than others as they form the very basis on which the market operates. Such regulations include:

#1 - Securities Act of 1933

The Securities Act of 1933 is the first set of rules curated toward stock market regulation. These rules came in the light of the infamous 1929 stock market crash. According to this act, public companies are compulsorily required to provide information about their securities market offerings.

The act strictly prohibits these entities from disclosing misleading or untrue statements about their security offerings. Most of the rules under this act are curated to focus on fraud prevention. With changing times and requirements, the SEC has made multiple amendments to the act over the years.

#2 - Securities Exchange Act of 1934

Congress passed the Securities Exchange Act of 1934, which gives the SEC authority over the entire securities market. The SEC can regulate, register, and oversee transfer agents, clearing agencies, brokerages, and self-regulatory organizations (SROs).

Various exchanges, such as the NASDAQ Stock Market, the New York Stock Exchange, and the Financial Industry Regulatory Authority (FINRA), are SROs.

The act also gives the SEC the power to identify and restrict specific types of market conduct or behavior, initiate disciplinary actions against entities and individuals not adhering to such norms, and direct public companies to report financial information at regular intervals.

#3 - Investment Company Act of 1940

The Investment Company Act (ICA) of 1940 regulates investment companies and their activities. The act's fundamental objective is to ensure that investors are protected and educated about the risks of purchasing, selling, and holding securities.

Under ICA, investment companies must provide investors with all information about investment policies, objectives, and financial soundness when the security is initially sold and at regular intervals. They must also be transparent about the company's operations and structure with investors.

#4 - Investment Advisers Act of 1940

Investment advisers play a critical role in the securities market. They leverage their expertise in the market and provide investment advice based on their client's investment objectives, risk appetite, and investment amount.

Since it is a job that requires utmost responsibility, there needs to be a check on their operations. Therefore, the Investment Advisers Act of 1940 came into existence. The act requires all investment advisers to be registered with the SEC to be qualified to provide such services.

They are also required to declare information about their remuneration (fees) and conflicts of interest. Moreover, the act clearly demarcates financial schemes that are not supposed to be practiced as they could lead to fraud.

Examples

Now that the concept's theoretical aspects are well-established, it is time to discuss the practical applicability of SEC regulations on cybersecurity and overall market behavior through the examples below.

Example #1

ABC Enterprises is a public company and has its stock listed on two different exchanges – NYSE and NASDAQ. As per SEC norms, they are required to furnish information concerning the company's financial health and securities to the SEC every quarter.

Upon review, SEC officials found irregularities in the company's accounts submitted and in the actual nature of those transactions. They also found that a few company insiders took undue advantage of the inside information and made financial gains.

As a result, the SEC barred the individuals who indulged in insider trading from the stock market and fined the company $1.5 million for negligence and misconduct.

Example #2

In September 2024, Congressman John Rose proposed a new bill regarding digital asset regulations. The proposal was to create a joint committee consisting of both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Given the rise in the popularity of cryptocurrencies, there has been regulatory uncertainty in the United States as a few cryptos are commodities while others are securities. However, both the SEC and CFTC have voiced their desire to conduct supervision according to their norms.

However, the BRIDGE Digital Assets Act aims to create a collaborative environment between the two watchdogs and bring more certainty to this market facet.

Benefits

The guidelines provided by the SEC have multiple benefits. It provides a much-needed framework for all market participants. However, it boils down to five main benefits that underline all other benefits. They are:

- The existence of the SEC regulation committee ensures that investors and businesses are safeguarded from pyramid schemes and other such fraudulent activities.

- Since most companies, company insiders, advisers, brokers, and other such market participants are required to furnish details from time to time, there is increased transparency in the market.

- These guidelines ensure that the market is fair and orderly. As a result, all market players have a level playing field, and no single entity has an undue advantage over the others.

- Since there is higher transparency and security, investors have a significant amount of trust in the system.

- When investors trust the system, they invest confidently. Ultimately, it benefits the overall economy.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.