Table Of Contents

What Is SEC Form 13F?

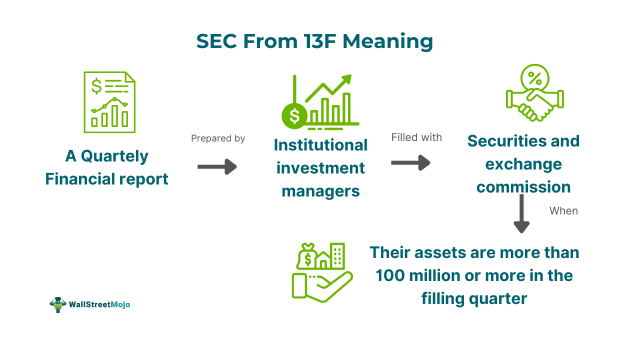

SEC form 13F refers to a quarterly financial report that institutional investment managers must file with the Securities and Exchange Commission when their assets under management are $100 million or more during any of the months in the filing quarter. Hence, the SEC can ensure transparent equity holdings through such reporting.

13F reporting helps regulators and small investors get an idea of the stocks held by the top institutional investors since their investment strategies play a critical role in shaping market movements. Earlier, this form allowed the reporting of only long positions, thereby failing to provide a comprehensive overview of such investments.

Key Takeaways

- The SEC form 13F is a mandatory quarterly report on the securities held by institutional investment managers who have $100 million or higher in assets under management.

- The Securities and Exchange Commission (SEC) decided a maximum time limit for such reporting at 45 days from the calendar quarter's closing date.

- The purpose of filing form 13F is to ensure transparency through public disclosure of the holdings by prominent institutional investors, which will increase the confidence of retail investors and help them understand market trends.

- However, it only includes reporting long positions.

SEC Form 13F Explained

The SEC form 13F is a document submitted by institutional investment managers who manage assets worth $100 million or more (in a particular month of the reported quarter) with the Securities and Exchange Commission for their quarterly reporting. The SEC demands such filing to maintain transparency in the financial market and build investor confidence. Moreover, retail investors consider these insights to understand the trends set by these high-level investors. Such information is crucial since institutional investors have the power to affect the market sentiments and position.

There can be three different forms of 13F filing:

- SEC form 13F-HR for the submission of the holdings reports and combination reports;

- SEC form 13F-CTR is used to demand confidential treatment for holdings reports and

- SEC form 13F-NT enables users to file the notice reports.

The SEC form 13F was proposed by Congress in Section 13(f) of the Securities Exchange Act in 1975. However, this form reports only the long positions taken by the institutional investment managers, which is only one side of the coin. Moreover, the failure to include short positions can result in an incomplete analysis of their investment strategies and divert small investors. Indeed, the information provided in Form 13F is outdated since there is 45 45-day timeframe to report their securities holding of a quarter. By the time they file for 13F and the report becomes public, the investors' position may change.

Filing Requirements

The SEC form 13F is a mandatory document filed by institutional investment managers like broker-dealers, corporations, investment advisors, insurance companies, pension funds, and banks that have a minimum of $100 million AUM. These are the natural people or entities who either buy, sell, or invest in securities for:

- Themselves on their accounts or

- On the other person's or entity's behalf or account.

This form is to be submitted to the SEC within 45 days from the calendar quarter's end date. Some of the basic information filled in form 13F include:

- Institutional Investment Manager's Name: The foremost detail is the name of the report filer, i.e., the institutional investment manager;

- Issuer's Name, Security Class, and CUSIP Number: The filer needs to mention the name of the security issuer, class of securities (common stocks, convertible debentures, or put/call option), and Committee on Uniform Securities Identification Procedures (CUSIP) number

- Number of Shares: This includes the total number of shares held by the manager at the end of a particular calendar quarter.

- Fair Market Value: This form requires the fair market value of securities held at the end of the given calendar quarter.

How To File?

Given below are the set of SEC form 13F instructions for such reporting:

- The institutional investment manager must initially determine whether they are eligible for filing form 12F, i.e., whether they have at least $100 million of AUM.

- Next, compile information on all securities held, such as stocks, options, convertible debentures, etc., for the given calendar quarter.

- The filer now needs to fill out the details in Form 13F electronically in the prescribed format through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system.

- In this step, the managers need to confirm that all the details mentioned in the form are accurate and error-free.

- Next is logging into the EDGAR system and submitting the form before the deadline, i.e., within 45 days of the quarter ending.

- Then, the filer needs to review the submission through an acceptance notice.

- It is important to keep a filing copy for personal records.

- Lastly, it is essential to keep a close eye on the changes in filing requirements and recent updates of the SEC in this context.

Examples

SEC form 13F is widely used to ensure transparency when top institutional investors make investments. Let us undertake the following examples for 13F filing:

Example #1

Suppose XYZ Insurance Ltd. has $121 million worth of assets under management for the quarter ending on June 30, 2024. The company has to file 13F last by August 14, 2024. Hence, the company reported the details of its securities holdings as follows:

- Institutional Investment Manager's Name: XYZ Insurance Ltd.;

- Issuer's Name, Security Class, and CUSIP Number: Common stock holding in PQR Co. Ltd; convertible debentures in ABC Ltd.; and their respective CUSIP numbers;

- Number of Shares: 46000 common stockholding and 14750 convertible debentures;

- Fair Market Value: Common stock holding worth $46 million in PQR Co. Ltd; convertible debentures worth $75 million with ABC Ltd. As of June 30, 2024.

Example #2

According to the SEC 13F filings, major institutional investors are inclined to invest in newly launched spot bitcoin ETFs. These investors have invested a decent amount of Bitcoins, surging the market confidence. One of the prominent investors is Park Avenue Securities LLC, with $9.9 billion of assets under management in Grayscale's GBTC, while Inscription Capital LLC holds $1.3 billion AUM in such shareholding. The other entities, such as American National Bank and Wedmont Private Capital, also have smaller stock holdings in these Bitcoin ETFs. Thus, it indicates an uptrend in the institutional investment managers' interest in Bitcoins in 2024.

Key Issues

Some of the major flaws with SEC form 13F are as follows:

- Lacks Data Reliability: Form 13F has certain loopholes and inaccuracies that provide an opportunity for institutional investment managers to engage in fraudulent practices without being noticed by the SEC.

- Reporting Delays: Form 13F information lacks real-time insights since it is submitted within 45 days after the calendar quarter ends, which raises questions about its relevance for determining the market trend.

- Herd Mentality: It may further compromise the unique investment strategies of these institutional investment managers since the fund managers could easily replicate one another's strategies, causing stock price inflation and trade overcrowding. Moreover, retail investors would struggle to exit a profitable position if they made a delayed entry.

- Incomplete Disclosure: Such filings focus on long positions and fail to consider the short selling and other investment strategies, which would provide a complete picture of the comprehensive investment strategy.