Table Of Contents

What is Schedule K-1?

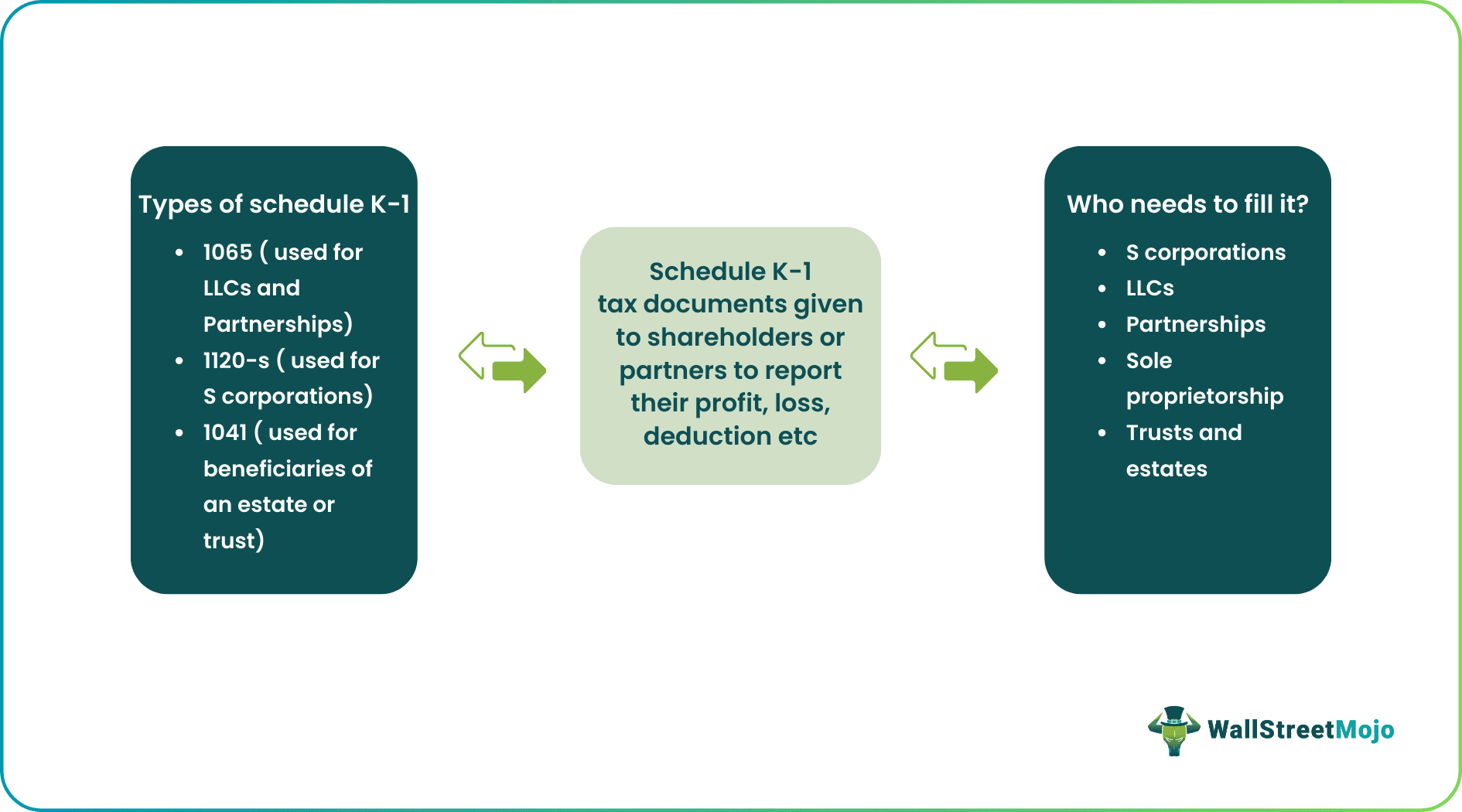

A Schedule K-1 is a tax form used to report a shareholder or partner’s earnings, losses, dividends, capital gain, etc., for a fiscal year. All pass-through entities, including S-corporations, LLCs, and partnerships, must file it. Pass-through entities transfers the tax liability from entities to shareholders or partners.

Beneficiaries of a trust or estate will also receive a Schedule K-1 tax form. The K-1 tax form makes it easier to track and measure the contributions of a shareholder towards overall business performance. There are different types of K-1 tax documents available for different kinds of businesses.

Key Takeaways

- The Schedule K-1 form is a tax form used to report a partner or shareholders’ profits or losses in a tax year.

- There are three types of K-1 forms- 1065 for partnerships, 1120- S for S corporations, and 1041 for beneficiaries of a trust or estate.

- A K-1 form needs to be filed by pass-through entities such as sole proprietorships, partnerships, LLCs, S-corporations, trusts, and estates.

- The K-1 and 1099 forms are often confused with each other. While the former needs to be filed by shareholders or partners, the latter is associated with individuals who are not considered an employee.

What Is It Used For?

Schedule K-1 reports each partner or shareholder's profits, credits, and deductions in an entity to the Internal revenue service (IRS). In the case of a business that functions as a partnership, the partners should pay the taxes on behalf of the company. As a result, each partner must file this tax form to IRS.

The Schedule K-1 form typically includes the following information -

- Dividends

- Income or losses received

- Deductions

- Guaranteed payments

- Invested Interest (The percentage of ownership of business)

"Pass-through entities" or "flow-through entities" are businesses that qualify for and must use schedule K-1 tax forms because the tax liability is transferred to the investor. In cases where profits are passed to individuals, the partner will not be subject to double taxation that occurs with corporations. Instead, the partner will only be liable for personal tax, avoiding corporate taxes altogether. Businesses that “pass-through” their income to their partners can thus avoid the corporate taxes and pass those savings to the partners. Pass-through entities can include Sole Proprietorships, Partnerships, Limited Liability Companies (LLC), and S-Corporations.

Individuals who plan to invest in these types of businesses, such as shareholders or partners, need to realize how much of the entity's income (or loss) they need to report on their tax returns. All K-1s need to provide accurate and comprehensive information on the tax return. The shareholders can use the information furnished in K-1 to file their separate tax returns.

Reasons One Would Receive a Schedule K-1 Form

A person receiving a schedule K-1 form needs to report it in the tax season since the income received is taxable income. The Internal Revenue Service (IRS) must have already been notified in this case.

A person receives the K-1 form for one of the following reasons.

- If they are the beneficiary of a trust or estate

- If they are the owner of a pass-through entity

- When they invests in an equity

Depending on the reason someone receives this tax form, its information will vary.

Types of Schedule K-1

There are different types of Schedule K-1 tax forms available. The type of form varies depending on the type of business. The different types of K-1 forms include:

- 1065

- 1120-S

- 1041

#1 - 1065 Form

All types of partnerships and some LLCs use the 1065 tax form in order to report their portion of profits or losses for an accounting period. The partnership passes the earnings to the partners, and they must use this information when filing their individual tax returns.

#2 - 1120-S form

S- corporations use the 1120-S form for the same purpose- to show each member of the entity how much they earned or lost for the tax year. The IRS will utilize the information detailed in the 1120-S to determine the percent ownership of an individual in an S-corporation.

#3 - 1041 Form

Lastly, beneficiaries of an estate or trust will use the 1041 form. It includes the income derived from an estate after the passing of a descendant.

Where Do You Find Schedule K-1 Forms?

How to File Schedule K-1 Forms

Even though the process is similar to filing other tax forms, it depends on the type of business and the type of tax forms used. One must pay attention to using the correct type of tax form and attach it to the personal tax return. One can submit the documents electronically or through a qualified accountant.

If someone does their own taxes, the address they should use depends on the state they reside in and the type of business they own. The address for filing the different kinds of tax forms is as follows.

Schedule K-1 vs 1099 Form

Often, one mistakes the K-1 forms for the 1099 tax form. Both these forms are "information returns" as they are not the actual returns that need to be filed, but contain information that is needed to file your taxes.

However, the information recorded on these forms will differ from one another. A K-1 form is for partners, while a 1099 form is for individuals who are not employees. These individuals can include:

- Freelancers

- Sole proprietors

- Independent contractors

- And self-employed individuals

One will also receive a 1099 form if they invest in equity, such as a stock that pays dividends.