Table Of Contents

What Is A Samurai Bond?

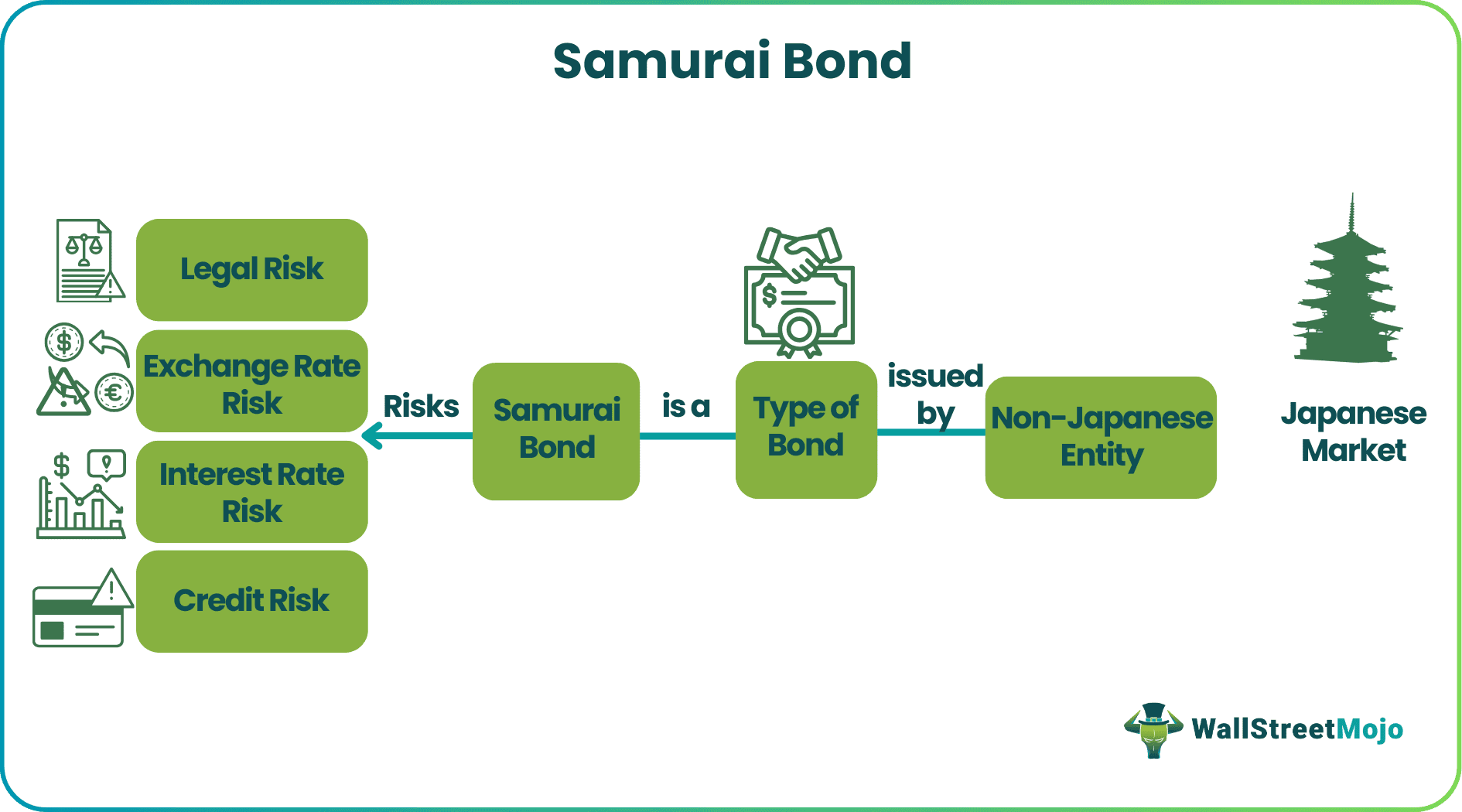

A Samurai bond is issued by a non-Japanese entity in the Japanese market and denominated in Japanese yen. It allows foreign issuers to tap into the Japanese capital market and raise funds from Japanese investors. The purpose of Samurai bonds is to diversify funding sources for foreign entities and provide access to Japanese investors.

Samurai bonds play a crucial role in fostering international capital flows, facilitating cross-border investment, and strengthening financial ties between Japan and other countries. Moreover, Samurai bonds are very important as they contribute to the development of Japan's financial market by increasing liquidity and expanding investment options for domestic investors.

Key Takeaways

How Does A Samurai Bond Work?

Samurai Bonds are those bonds that are issued by non-Japanese identities, although they are denominated in Yen. They provide access to the Japanese capital and are subject to Japanese regulations. Let us look at how it operates:

Its working starts when it is initiated by a non-Japanese entity, such as a corporation or a government when it decides to raise funds in the Japanese market through bond issuance. They work with underwriters, usually investment banks, to structure the bond and determine its terms and conditions. Thenafter, the issuer launches the bond offering in Japan, targeting Japanese investors, The bond is in Japanese yen, which means the principal amount and interest payments are in yen.

It functions through the Japanese investors, including institutions, banks, and individuals, who can subscribe to the bond offering. They assess the issuer's creditworthiness, evaluate the bond's terms, and decide whether to invest.

Also, the issuer makes periodic interest payments to bondholders at fixed intervals. At the bond's maturity, the issuer repays the principal amount to the bondholders. Also, to make it legally work, issuers must comply with relevant Japanese regulations and guidelines regarding bond issuances, disclosure requirements, and investor protection measures.

Features

Let us look at the Samurai bonds features:

- Denomination in Japanese yen: Samurai bonds are denominated in Japanese yen, which allows issuers to access the Japanese capital market and tap into a stable and liquid currency.

- Non-Japanese issuer: These bonds are by non-Japanese entities, such as corporations or governments, seeking to raise funds in Japan. This provides foreign issuers with an avenue to attract Japanese investors.

- Investor base: They primarily target Japanese investors, including institutions, banks, and individuals. They offer an opportunity for Japanese investors to diversify their portfolios and invest in international entities.

- Regulatory compliance: Issuers of Samurai bonds must comply with Japanese regulations and guidelines governing bond issuances. These regulations ensure transparency, disclosure requirements, and investor protection measures.

- Yield differentials: Samurai bonds often offer higher yields than domestic Japanese bonds, attracting investors seeking potentially higher investment returns.

- Market development: Samurai bonds contribute to the development and liquidity of Japan's bond market by expanding the range of investment options available to domestic investors.

Issuance Process

Let us look at the issuance process of a Samurai bonds:

- Preparation and Planning: With the assistance of investment banks or underwriters, the non-Japanese issuer prepares for the bond issuance. They determine the bond's structure, maturity, coupon rate, and size based on market conditions and investor demand.

- Documentation and Due Diligence: The issuer works with legal advisors to draft the necessary documentation, including a prospectus outlining the bond terms. Due diligence is to ensure compliance with regulatory requirements and investor protection measures.

- Bookbuilding and Pricing: The issuer and underwriters engage in a bookbuilding process to gauge investor interest and determine the demand for the bond. Based on this demand, the pricing of the bond is finalized, including the coupon rate and any other relevant terms.

- Registration and Approval: The bond issuance is registered with the relevant regulatory authorities in Japan, such as the Financial Services Agency (FSA) or the Tokyo Stock Exchange (TSE). Approval is obtained to ensure compliance with Japanese regulations.

- Marketing and Investor Subscription: The underwriters promote the Samurai bond to potential investors, targeting institutions, banks, and individual investors in Japan. Investors assess the issuer's creditworthiness and subscribe to the bond based on their investment preferences.

- Closing and Settlement: Once the subscription period ends, the issuer and underwriters finalize the allocation of the bonds to investors. The bond issuance is closed, and the settlement process begins. It involves the transfer of funds from investors to the issuer.

- Coupon Payments and Redemption: After the issuance, the issuer makes periodic coupon payments to bondholders as specified in the bond's terms. At maturity, the issuer repays the principal amount to the bondholders.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

According to an article by Ked Global, Korea Investment & Securities Co. recently became the first South Korean brokerage company to issue and sell Samurai bonds. The bond issuance raised 20 billion yen (approximately $145 million). This development follows the resumption of a bilateral currency swap between Seoul and Tokyo, marking an improvement in their relations after an eight-year suspension.

Korea Investment announced that the bonds were sold in five different tranches. The one-year maturity tranche, worth 6.3 billion yen, carries an annual interest rate of 1.04%. The one-and-a-half-year tranche, valued at 1.6 billion yen, was also issued at a 1.36% interest rate. The three-year tranche, amounting to 6 billion won, was offered with an interest rate of 2.25%. This move by Korea Investment demonstrates its successful entry into the Japanese market by issuing Samurai bonds.

Example #2

Consider GlobalTech, a US-based multinational corporation that issues a Samurai bond in Japan to raise funds for its expansion. Impressed by GlobalTech's creditworthiness, Japanese investors subscribe to the bond, providing financial support. With the raised funds, GlobalTech successfully expands its operations in Japan, fostering economic growth and strengthening international financial ties. The Samurai bond issuance demonstrates the importance of diversifying funding sources and facilitating cross-border investments.

Benefits

Let us look at the benefits for issuers:

- Diversified Funding Sources: Samurai bonds provide non-Japanese entities with access to the Japanese capital market, diversifying their funding sources beyond their domestic markets. This reduces reliance on a single market for financing needs.

- Attractive Interest Rates: Japanese yen-denominated Samurai bonds often benefit from Japan's favorable interest rate environment. Issuers can use lower borrowing costs than their domestic markets, potentially reducing their overall financing expenses.

Let us look at the benefits for investors:

- Diversification: Japanese investors can diversify their investment portfolios by including Samurai bonds issued by non-Japanese entities. This allows them to spread their investment risks across different geographies, sectors, and currencies.

- Yield Opportunities: Samurai bonds often offer higher yields than domestic Japanese bonds due to credit risk differentials and potential currency appreciation. Investors seeking potentially higher returns may find such bonds attractive.

Risks

Let us look at the associated risks:

- Exchange Rate Risk: For non-Japanese issuers, Samurai bonds denominated in Japanese yen expose them to exchange rate fluctuations. If the issuer's local currency weakens against the yen, the cost of servicing the bond's interest payments and repaying the principal may increase, potentially impacting the issuer's financial position.

- Interest Rate Risk: Samurai bonds are subject to interest rate risk, as changes in interest rates can affect the bond's value. If interest rates rise, existing bonds with fixed coupon rates may become less attractive to investors, leading to a decline in their market value.

- Credit Risk: Investors in Samurai bonds face the risk of default or credit deterioration by the issuer. If the issuer's financial condition weakens or experiences financial difficulties, it may struggle to make coupon payments or repay the principal, leading to potential losses for bondholders.

- Market and Liquidity Risk: Samurai bonds may be subject to market and liquidity risk, particularly during market stress or disruptions. Suppose there is a lack of demand for Samurai bonds or a limited secondary market. In that case, it may be challenging for investors to buy or sell the bonds at favorable prices, impacting liquidity and potentially leading to higher transaction costs.

- Regulatory and Legal Risk: Issuers and investors must navigate the regulatory and legal frameworks of the Japanese market, ensuring compliance with regulations and disclosure requirements. Changes in regulations or unexpected legal developments may introduce additional risks or uncertainties.

Samurai Bond vs Shogun Bond

Samurai Bond vs Euroyen Bond

Let us look at the differences between Samurai Bond vs Euroyen Bond

- Samurai bonds mainly target Japanese investors, appealing to the domestic market. Euroyen Bonds are mainly targeted at international investors, aiming to attract a broader global investor base.

- Samurai bonds typically have higher interest rates due to credit risk associated with non-Japanese issuers. Euroyen bonds typically have lower interest rates due to established issuers and lower perceived credit risk.

- Samurai bonds are attractive to foreign issuers with an existing Japanese investor base, leveraging their familiarity and trust. Euroyen Bonds target international investors looking to access the Japanese market.

- Samurai bonds have a larger market size than Euroyen bonds, offering potentially greater fundraising opportunities.