Table Of Contents

What Is Sales And Collection Cycle?

A Sales And Collection Cycle refers to the continuous flow of business activities concerning the cash or credit sale of commodities to the receipt of payment in exchange for the same. When this cycle is effective, a business is more profitable given the robust mechanism of sale of goods and services and receipt of payments in exchange for the same.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Also known as the Revenue, Receivables, and Receipts (RRR) Cycle, it determines an entity’s cash flow efficiency. The process starts with selling goods or services to the customers and completes with the realization of the final payment from them. However, multiple other activities occur depending on the nature of the business, the firm’s size, structure, accounting procedure, and credit policies.

Key Takeaways

- A sales and collection cycle is a series of business transactions between selling products and recovering the final payment from the customers.

- It includes cash sales, credit sales, creation of accounts receivable, cash receipt, sales return, and allowances, charge-off uncollectible accounts, and bad debts.

- An external auditor goes through documents like customer orders, sales orders, shipping receipts or bills of lading, sales invoices, sales journals, credit notes, sales return.

Sales and Collection Cycle Explained

A sales and collection cycle is simply the business activities that account for the flow of goods from the company to the customers and the realization of the sales proceeds in full. Although business entities maintain transparent sales books, manually or electronically, there is always scope for manipulation or mistakes in such entries.

There are instances where companies don’t record sales transactions to save taxes or draw a false representation of their financial position. On the contrary, in some cases, the records vary from the actual sales because of mistakes made unintentionally.

This is what makes it essential for auditors to intervene and study the company’s RRR cycle to find discrepancies. They look for various evidence of the financial transactions, discover the inappropriate entries, and then submit their report on the sales and collection cycle audit.

Classes of Transaction

The RRR cycle involves five broad classes of transactions, as discussed below:

- Sales transaction: It involves the processing of customer orders, granting credit, shipping goods, customer billing, and sales records.

- Cash receipt transaction: It deals with creating and accounting for cash receipts.

- Sales return and allowance transaction: It prepares for sales returns and allowances.

- Write-off of uncollectible accounts transaction: It involves waiving off the uncollectible accounts receivable.

- Bad debt expense transaction: It includes provision for bad debts.

The eight core business functions studied under these five classes of transactions include:

- Credit grant

- Shipping of goods

- Billing customers

- Recording sales

- Processing of cash receipts and recording the same

- Processing of sales returns and allowances and recording of the same.

- Writing off accounts receivable that are uncollectible.

- Providing for bad debts

Flowchart

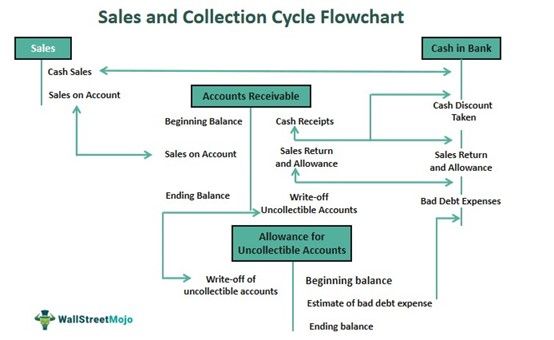

To understand the fundamental process of how the cycle works, let us go through the following flowchart:

Given below is the summarized version of the functioning of an RRR cycle in the business:

- The goods or services are sold in cash or on credit.

- If it is a cash sale, the proceeds go to the cash in the bank.

- If it is sales on account or credit sales, the company adds it to the accounts receivable.

- Whenever the debtor makes the final payment after cash discounts, the amount goes to cash in hand.

- However, the accounts receivables are reduced in case of sales return.

- If the debtor fails to pay or defaults, the company writes off the uncollectible accounts as bad debt expenses.

Examples

Let us consider the following scenarios to understand the workings of the cycle better:

Example #1

Auditor Mary examines the sales and collection cycle of ABC Ltd. for January 2023. She figures out that the company dispatched goods worth $7000, but it has not generated any sales invoice for it. The auditor does not find any record related to the dispatch/delivery of those items. At this stage, ABC’s mistake is detected, which it later gets countered for, irrespective of being intentionally or unintentionally involved in the same.

Example #2

Suppose XYZ Co. Ltd. maintains its sales records manually. The auditor, John, randomly selects a sample of transactions, say in a week, to cross-verify the purchase order, sales invoice, customer statement, accounts receivables, etc. He matches all the serial numbers, the signatures of the managers, and the company’s seal for authentication of the transactions. When a few transactions appear to be suspicious, he increases the testing bundle for accurate conclusions.

Example #3

In 2021, Stanley Black & Decker (SBD) introduced end-to-end digital presentment and reconciliation measures to ensure the timely receipt of payments from dealers. The organization made this attempt to facilitate a better and more improved sales and collection cycle and automate its accounts receivables procedures to boost its overall liquidity.

SBD collaborated with JP Morgan to automate and optimize the entire process, thereby also having well-established digital platforms where offers and incentives could be introduced from time to time for its dealers.

Audit of Sales And Collection Cycle

The external auditors often examine the company’s RRR cycle at the end of every financial year to identify any revenue or receivables misstatements or fraud. The audit of the RRR cycle is carried out to determine the fair representation of the company’s sales and revenue transactions as per the accounting standards. This process leads to a thorough review of the internal controls, based on which the auditors assess planned control risk and check the extent of testing controls. They attain the auditing objective through the tests of control and substantive tests of sales and receipt transactions.

The auditor performs the following three functions:

- Go through the company’s sales and control cycle flowchart,

- Design an internal control questionnaire, and

- Execute the walk-through sales tests.

Company audits can either be transaction-related or balance-related or both. The auditor checks the above transactions on the grounds of their occurrence, completeness, accuracy, cut-off, and classification. Once they verify the details from all aspects, they come to the most relevant conclusion.