Table Of Contents

What Is A Salary Advance?

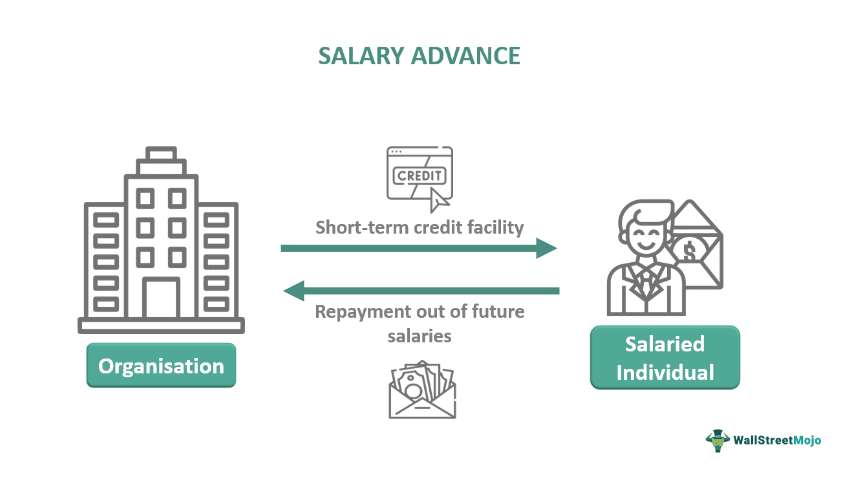

A salary advance is a short-term credit benefit or loan an organization may offer employees. In this system, employers can avail of a short-term loan that will be repaid from their future salaries. These loans are taken in emergencies.

The entire salary advance payment amount can be deducted from a single paycheck, or it can be deducted in parts over the next few months or years. A salary advance loan usually comes with several rules and restrictions. However, they are ideal for employees who intend to repay the loan within a short period.

Key Takeaways

- A salary advance is a credit facility that a salaried individual can avail of on a short-term basis. It is ideal for employees who need urgent money and are willing to repay the whole amount quickly.

- The loan amount is paid back from the future salaries of the borrower.

- The entire loan amount can be deducted from a single paycheck, or the deduction can be continued over a stipulated period where a part of the loan amount will be paid back every month.

- These loans are processed within a very short time. The loan is approved within hours of application, and the disbursal is completed within 48 hours of their approval.

Salary Advance Explained

A salary advance is a credit facility where an employer can take a short-term loan and pay it back from his future salary. Salary advance loan facilities are not an employer's right. The provision for such benefits depends on the organization and its policies. Often there are stringent rules associated with these loans. For example, the entire salary advance payment amount may be deducted from one month's paycheck or deducted in parts from future wages until the total amount gets repaid.

There are several eligibility criteria in place that an employee must fulfill to avail of this benefit. For example, an employee's tenure in the organization, his code of conduct, nature of employment, and no prior records for requesting such loans may be some of the criteria considered while granting the loan. In addition, the loan amount and term are decided based on the employee's salary, employment stability, and credit score.

Usually, the monthly salary advance interest rate and repayment period can vary with the company and the country. A minimum age requirement to avail of such a loan also varies according to each company. Only a salaried individual with a steady source of income can take this loan to ensure that the salary advance deduction process is hassle-free.

Reasons

This advance can be availed because of the following reasons:

- First, it is ideal for contingencies where the borrower can repay the amount quickly. Second, it is beneficial for urgent circumstances like medical emergencies, unpredictable expenses, and unexpected travels. Third, it ensures that unforeseen emergencies do not disrupt the monthly budget.

- The process of salary advance deduction has a systematic structure that helps the borrower plan out his future expenses well in advance to accommodate the loan amount deduction.

- There is no need for any collateral or guarantor to avail of this benefit.

- The disbursal of the loan is completed within a very short span, making it a reliable option for crises.

- The repayment tenure is flexible and can range from 3 months to 3 years.

Examples

Let us understand this concept with the following examples:

Example #1

Mr. Green is a salaried employee of Creative Constructions. His daughter got into an accident, and money was urgently needed to conduct her operations. He approached an organization that provides salaried employees with these loans. He applied for a loan of $5,000, which he agreed to pay back in the next few installments. Every month, $1,000 would be deducted from his salary until the entire loan amount gets repaid. His loan was approved, and the amount was disbursed within 12 hours. This is an example of a salary advance.

Example #2

Payflow is a newly formed salary advance start-up based in Barcelona, Spain. The fintech has sourced its funding from all over the world and is continuing to grow steadily since its establishment in 2020. This start-up provides a salary advance service from the employers to its staff. It charges a fee from the company in exchange for its services. However, the borrowers do not have to pay anything to avail of the loan. This feature sets it apart from all its other counterparts.

Disadvantages

The disadvantages of this advance are as follows:

- The salary advance interest rates may be high due to no standardized rate rules. As a result, the borrower may have to pay much higher than he anticipated.

- If the loan tenure gets extended for a long period, the borrower may be in a debt trap. The deduction from the employee's monthly salary may leave him in a worse financial condition. He might take another loan to cover that up, eventually leading him into a string of never-ending debts.

Difference Between Salary Advance And Loan

The differences have been discussed below:

- Salary Advance: It can be availed only by salaried employees. A self-employed individual cannot avail of this. It is used for short tenures. It is beneficial for borrowers who need urgent money and are willing to repay it quickly. The eligibility requirements are minimal, and the loan is disbursed quickly.

- Loan: Both salaried and non-salaried individuals can avail of these. A borrower can opt for a long-term repayment tenure. However, the eligibility criteria are strict, and the disbursal process is lengthy. Loans are usually taken for planned investments.

Difference Between Salary Advance And Salary In Advance

The differences are as follows:

- A salary advance is a credit facility. The granted loan amount is subjected to taxes, and the borrower needs to pay interest on the borrowed amount. In addition, the borrower has to repay the loan amount to the lending company within a stipulated term.

- Salary in advance is a benefit where an employee can request the employer pay a part of their salary earlier. It is not a loan and, thus, is not taxable. The borrower does not need to pay any interest on the received amount. In addition, they do not have to pay back the received amount to the lender.