Table Of Contents

What Is A Royalty Trust?

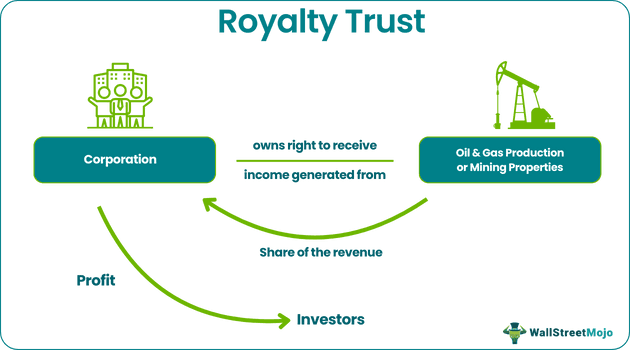

A royalty trust is a specialized investment vehicle primarily associated with the mining and energy sectors. Unlike owning physical assets such as reservoirs, these trusts hold the right to receive income generated from these resources, often in the form of royalties. The primary aim of royalty trusts is to distribute a portion of the income derived from mineral, gas, or oil properties to investors.

Investing in royalty trusts can provide high yields, but it also comes with elevated volatility risks. One notable advantage is that the income generated within these trusts is typically not subject to corporate-level taxation. Instead, investors holding trust units are taxed individually. Furthermore, royalty trusts offer investors a means to diversify their portfolios and serve as a source of financing for the companies involved in these ventures.

Key Takeaways

- A royalty trust is a specialized investment vehicle in the mining and energy sectors that grants ownership rights to mineral deposits, wells, and reservoirs to distribute income to investors.

- Investors can expect higher returns from this type, but the yield is subject to the volatility of commodity prices and production levels.

- It exhibits distinctive characteristics such as core assets, a unique tax structure, limited lifespan, volatile yield, tax complexities, and fixed growth potential.

- Two main types are American Income Trusts and Canadian Royalty Trusts.

How Does A Royalty Trust Work?

A royalty trust is a unique financial entity involved in oil and gas mining, and known for its tax-efficient structure. These trusts typically distribute more than ninety percent of their revenue to shareholders through dividends. While they are more common in Canada and the USA, royalty trusts typically do not engage in direct mining operations. Instead, they act as owners of mineral rights, wells, or reservoirs.

Third-party entities typically handle mining, extraction, or excavation operations, while financial institutions often manage these trusts. Royalty trusts often acquire mature or declining mining assets, providing investors with relatively high yields and a dependable cash flow stream.

The process usually begins with an oil, natural gas, or mining company forming a royalty trust. Subsequently, the company grants the trust the right to purchase mineral rights to a specific property. Any income generated through property sales is then passed on to the trust's investors in the form of quarterly dividends as long as the underlying resources remain productive.

Royalty trusts come with inherent risks, primarily due to fluctuations in production levels and volatile commodity prices. These trusts are closely tied to the performance of the oil, natural gas, and mining industries. Therefore, trust investors face similar levels of volatility and risk as direct investors in these sectors. However, compared to direct investment, royalty trusts offer the advantage of potentially higher yields and tax benefits.

This type of investment can be valuable to an investor's portfolio, depending on their risk tolerance and investment objectives. They are particularly appealing to investors seeking higher yields and tax advantages. However, it's crucial to recognize that they are generally short-term investments with specific termination conditions.

Tax Implications

Investing in royalty trusts presents several notable tax advantages and considerations for investors. These trusts operate as pass-through entities, meaning that income generated flows directly to investors, bypassing corporate taxation. This structure potentially results in investors enjoying a larger share of trust-generated income while managing their tax reporting. Additionally, purchasing units in a royalty trust can lead to a lowered cost basis, potentially increasing capital gains upon sale.

However, investors must understand the implications of deferred taxes and capital gains, which typically arise upon the sale of trust units. Furthermore, investors might be eligible for tax credits in specific cases related to clean energy projects, reflecting government incentives for sustainable energy production. Navigating these complexities necessitates consulting with tax professionals for personalized guidance on royalty trust investments.

Characteristics

The key characteristics are the following:

- Assets: They own interests in energy resources but don't operate them.

- Taxes: Like MLPs(Master Limited Partnerships) and REITs (Real Estate Investment Trusts), they pass income directly to investors, avoiding corporate taxes.

- Limited Lifespan: They have an end date based on votes and production levels.

- Unpredictable Income: Payments to investors can vary greatly due to changing oil and gas prices.

- Tax Complexity: Tax filings can be complex.

- Focus: They invest in established mines and wells, not for growth.

- Risks: Risks include resource depletion, price fluctuations, and production changes.

- Closure Uncertainty: They don't last forever.

- Limited Growth: Returns don't grow much over time due to fixed resources.

Types

There are two types of royalty trusts:

- American Royalty Trusts (or American Income Trusts): These trusts primarily concentrate on preserving their existing assets, emphasizing the maintenance of current holdings rather than allocating funds towards new acquisitions or extensive capital expenditures. This strategic approach often results in limited financial resources available for expanding their asset base. American royalty trusts are known for distributing cash and dividends to investors until the underlying resources are completely depleted. Consequently, investors in these trusts can typically expect relatively high short-term payouts.

- Canadian Royalty Trusts: Canadian royalty trusts present a contrasting profile. They are recognized for their potential to deliver yields in the double-digit percentage range, making them an attractive investment option for those seeking exposure to the energy market. Additionally, these trusts often enjoy favorable tax advantages, further enhancing their appeal to investors. Unlike their American counterparts, Canadian royalty trusts possess the flexibility to raise capital through various means, including borrowing or issuing shares. This financial flexibility empowers them to invest in new projects or develop existing mining or oil and natural gas fields.

Examples

Let us look into a few examples:

Example #1

The San Juan Basin Royalty Trust, established in November 1980, holds a 75% net overriding royalty interest in Southland Royalty's oil and gas properties in the San Juan Basin of northwestern New Mexico.

This royalty interest is the Trust's primary asset. PNC Bank, N.A. serves as the trustee, responsible for collecting monthly net proceeds (Royalty Income) from the Royalty and distributing them to Unit Holders after deducting expenses and maintaining cash reserves. The Trust is listed on the New York Stock Exchange under the symbol "SJT." Annual reports, including audited financial statements, are accessible electronically, and hard copies are available upon request to Unit Holders free of charge.

Example #2

Imagine Jacob has a lemonade stand in his backyard. His friend wants to use it to sell lemonade, and they agree to pay him a royalty of $1 for every glass they sell. This $1 is his royalty income. His lemonade stand is like a royalty trust because it generates income without him having to work. He just collects his royalties, and his friend handles all the lemonade-making and selling. This way, he earns money from his lemonade stand without the daily hassle of running it.

Advantages And Disadvantages

Some of the advantages are the following:

- It typically offers higher returns to investors, providing them with a source of high income.

- Investors and corporations can enjoy tax benefits when investing in it, often due to their pass-through tax structure.

- Investors can indirectly own resources in the mineral, mining, and oil well sectors through royalty trusts, allowing for diversification.

- Investing in royalty trusts frees investors from the daily complexities of managing these sectors, as third parties handle the operational aspects.

- Royalty trusts involve only single taxation, benefiting investors by avoiding double taxation at the corporate level.

- This type of investment offers exposure to basic materials sectors and commodities, providing speculative opportunities for investors.

- Investors can diversify their investment portfolios, reducing risk through asset allocation.

Some of the disadvantages are the following:

- Trust yields depend on fluctuating commodity prices and gas, minerals, or oil production levels. This variability can lead to irregular dividend payouts.

- This type focuses on finite assets that deplete over time, limiting long-term growth potential.

- When the underlying oil wells, reservoirs, or mines are exhausted, the trust becomes inactive, potentially resulting in a sudden loss of income.

- Complex tax reporting, including state income taxes, can be a characteristic of investing in royalty trusts, making tax compliance more intricate.

- Commodity price movements and volatility directly affect the performance, introducing investment risk.

- Investors have no control over the underlying assets or the trust, making these investments inherently risky.

Frequently Asked Questions (FAQs)

Royalty trusts are important for investors seeking income and exposure to the energy and resource sectors. They provide regular payouts, tax benefits, and diversification opportunities. They also allow investors to indirectly own interests in mineral, mining, or oil assets without direct involvement in operations.

Royalty trusts come with risks, including income variability due to commodity price fluctuations and resource depletion. They lack control over asset management and face management risk. Tax complexities and uncertainties in closure are also associated risks.

While both royalty trusts and master limited partnerships (MLPs) offer income and tax benefits, they differ in assets. Royalty trusts primarily hold mineral, oil, and gas interests, while MLPs typically own energy infrastructure assets like pipelines and storage. MLPs involve active businesses, while trusts are more passive, distributing income from resource royalties.