Table Of Contents

Rolling Budget Meaning

A rolling budget is a continuous budget that is updated regularly when the earlier budget expires, or we can say it is an extension of the current budget. A rolling budget is also known as a budget rollover.

Key Takeaways

- A rolling budget means a continuous budget regularly upgraded if the earlier budget expires. It is also a current budget extension. It is also called a budget rollover.

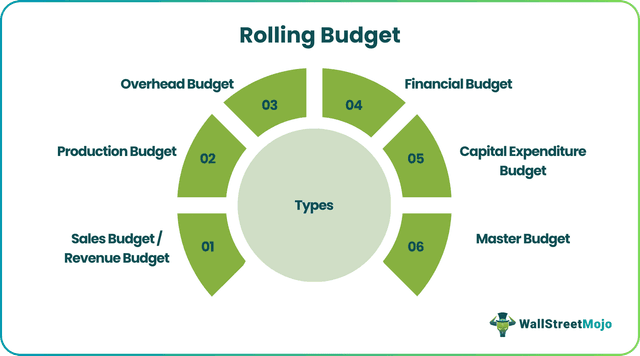

- Sales or revenue, production, overhead, financial, capital expenditure budget, and master budget are the types of rolling budgets.

- Incremental, activity-based, zero-based, and Kaizen budgeting are the rolling budgeting methods.

- It gives the employees a clear understanding of the business objective and the targets they need to achieve.

Types of Rolling Budget

Below are the types of rolling budgets:

#1 - Sales Budget/Revenue Budget

Sales Budget is the first budget that an enterprise must prepare because all other budgets depend on revenue/sales. In this budget, enterprises forecast their sales in terms of value and volume. In preparing the sales budget, the sales manager usually considers the below factors.

- The trend of the earlier period, i.e., average growth of last 5 – 6 years

- Total market potential of the coming year

- Government policies

- Seasonal demands

#2 - Production Budget

The production budget purely depends upon the sales budget. Therefore, the product manager estimates the monthly production volume according to the demand and maintains the inventory level in the production budget. In this budget, the cost of production is also evaluated. Below are the factors of the production budget.

- Raw Material

- Labor

- Plant & Machinery

#3 - Overhead Budget

In this budget, enterprises estimate the cost of indirect material, indirect labor, and operational expenses like rent, electricity, water, traveling, and much more. The overhead budget is divided into two parts- one is fixed overhead, and one is variable overhead. It is also known as the expense budget.

#4 - Financial Budget

The enterprise has to forecast the fund's long-term or short-term requirements for running the business within the financial budget. The company also plans to invest its excess cash to get a maximum return in this budget. In such a case, if the money is required for the business, they can easily pull out that money from the investment.

#5 - Capital Expenditure Budget

It contains forecasting of capital expenditure like expenditure on plant & equipment, machinery, land & building, etc.

#6 - Master Budget

After taking inputs from various functional heads, a master budget summarizes all the above budgets, verified by top management. It also shows the profitability of the business.

Methods of Rolling Budget

Below are the methods of rolling budgeting:

#1 - Incremental Budgeting

In this method, the budget is prepared by adding or subtracting a certain percentage in last year's budget based on the actual figures for last year to ascertain the current year's budget. It is traditional budgeting.

#2 - Activity-Based Budgeting

Activity-Based budgeting is done for each activity that needs to be performed to achieve business goals. It also helps to make plans to reduce the activity cost so that profit can be maximized. For example, if a company sets a target of $1,000 million in sales, the company has first to identify those activities that need to be performed to achieve this target.

#3 - Zero-Based Budgeting

Zero-Based budgeting starts from zero, which means there is no history of any department, activity, expense head, or revenue. Instead, zero-base budgeting is prepared on the inputs given by each activity manager with their experience and justification. This budgeting method is used for cost control or assessing the potential saving of cost.

#4 - Kaizen Budgeting

Aggressive and innovative organizations use this method of budgeting. It means continuous improvement in efficiency, quality, and productivity.

Example of Rolling Budget

Below is an example of a rolling budget.

Below is the rolling budget of Walmart Inc for the year 2019, where the company is preparing a rolling budget for each quarter. The points mentioned below have been considered in the preparation of this rolling budget:

- Assumed value and volume growth at a rate of 10% for each quarter;

- Direct material and direct labor are the variable costs directly related to the production of finished goods.

- Variable overhead also depends on the production, like freight expenses.

- Fixed overheads are not dependent upon production. Therefore, it is the same for all the four quarters, like rent expenses.

Walmart Inc for the Year 2018

| Particulars | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| Volume | 100000 | 110000 | 121000 | 133100 |

| Sales/Revenue | $5,000 | $5,500 | $6,050 | $6,655 |

| Direct Material | $1,500 | $1,620 | $1,750 | $1,890 |

| Direct Labour | $800 | $880 | $968 | $1,065 |

| Variable Overhead | $500 | $550 | $605 | $666 |

| Fixed Overhead | $300 | $300 | $300 | $300 |

| Profit | 1,900 | 2,150 | 2,427 | 2,735 |

The actual results of Q1 have been released. Below is the variance analysis of the actual budget:

Below are the observations of Variance Analysis –

- Volume and value have achieved 105% of the budget.

- Direct material and direct labor costs have changed according to the cost of goods sold.

- Variable overhead has increased by 1.43% because the budgeted variable overhead was 10% of sales, whereas the actual variable overhead comes to 11.43% of sales.

- The actual fixed overhead was the same as budgeted.

- Profit Margin has been reduced by 1.62% because of the increase in variable overhead.

Note

Based on actual performance, the company can modify the budget for the next quarter if management believes that the same pattern will also continue for other quarters.

Advantages of Rolling Budget

- Rolling the budget does not require more time because it is just an extension of the earlier budget with necessary changes.

- It is easy to change the budget if any unexpected event occurs.

- It is easy to assess the actual performance against the budget in this budget.

- Rolling budget brings better understanding, responsibility, and objectives among the company's employees.

- The rolling budget helps find the organization’s strengths and weaknesses and can take steps to remove the defect accordingly.

Disadvantages of Rolling Budget

- A rolling budget requires a robust system and a skilled workforce.

- The rolling budget creates confusion and disturbs employees because of constant changes.

- A rolling budget is not advisable for those organizations where conditions are not changing frequently.

- If the budget target sets are challenging to achieve, it demotivates employees.

- It is a very costly affair because it requires additional staffing to regularly update the rolling budget and analyze the actual performance vs. the budget.

Conclusion

A rolling budget is a continuous process of budgeting where the budget is prepared quarterly/half-yearly/early based on the last budget. A rolling budget assessment happens at the end of each budget period. Rolling budget gives a clear understanding among employees of the business objective and what to do to achieve the goal. For a successful budget, information taken for budget preparation must be correct; otherwise, it will harm the business and employees.