Table Of Contents

How To Calculate?

Let us look at some of the formulas used to calculate risk premiums in the financial market.

Specific premium forms can also be calculated separately, known as the market risk premium formula and Risk Premium formula on a Stock using CAPM. The former calculation aims to calculate the premium on the market, which is generally taken as a market index like the S&P 500 or Dow Jones. It is achieved by subtracting returns on a risk-free investment from a probable return on a similar investment in a specific market index.

Market Risk Premium = Rm - Rf

The expected risk premium formula on a stock using CAPM is intended to help understand what other returns can be had with investment in a specific stock using the Capital Asset Pricing Model (CAPM). The risk premium for a specific investment using CAPM is beta times the difference between the returns on a market investment and a risk-free investment.

Expected Return = rf + Beta (rm - rf)

Example

Given below is a suitable example that will help us to understand the concept better.

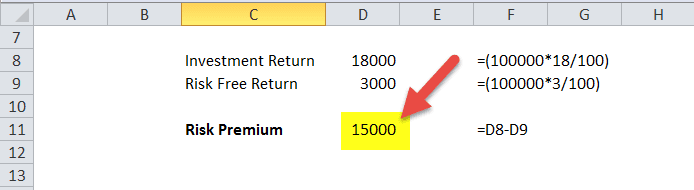

Person ABC wants to invest 100,000 US$ for the best returns possible. ABC has the option to invest in risk-free investments like the US treasury bond, which offers a low rate of return of only 3%. On the other hand, ABC is considering an investment in a stock that can give returns up to 18%. To calculate the risk premium example for taking on the extra amount of risk involved with this stock investment, ABC would carry out this mathematical operation:

Risk Premium = ra (100,000 x 18 / 100) - rf (100,000 x 3 / 100) = 18,000 - 3000 = 15,000 US$

Hence, in this case, ABC enjoys a 15,000 US$ risk premium example with this stock investment compared to the risk-free investment. However, it entirely depends on the stock's performance and if the investment outcome turns out to be positive. For this, ABC would need to understand the risk factor involved by studying the fundamentals of the stock at length and assess if this investment is worth it and whether he would be able to realize the risk premium or not.

Thus, the above example clearly explains the process of making the calculation using the market or equity risk premium formula. It also tell us what are the factors that we should keep in mind while using the concept so that it is possible to earn maximum return by keeping the risk under control.

Use And Relevance

The formula has uses in different types of risk premium calculation.

In case of equity, the premium is very high. Thus, here, the risk-free rate is deducted form the expected return to get the premium value using the equity risk premium formula. The expected return is the normal level of compensation that the investor will want an the risk free rate is represented by government bonds.

There is a certain amount of risk in corporate bonds, which can be measured using this formula, where the risk-free rate is again deducted from the yield on corporate bonds. The yield is what the bond issuer needs to pay the bondholders.

It must be carefully understood that market premium seeks to help assess probable returns on investment compared to any investment where the risk level is zero, as in the case of US-government-issued securities. This additional return on a risk-laden investment is in no way promised or guaranteed in this calculation or by any related factor. Should this investment outcome be negative, the premium calculation would have little relevance. The risk that an investor agreed to take upon in return for extra returns should the investment have a positive outcome. The difference between anticipated and actual returns on any investment must be understood clearly.