Table Of Contents

Risk-On Risk-Off (RORO) Meaning

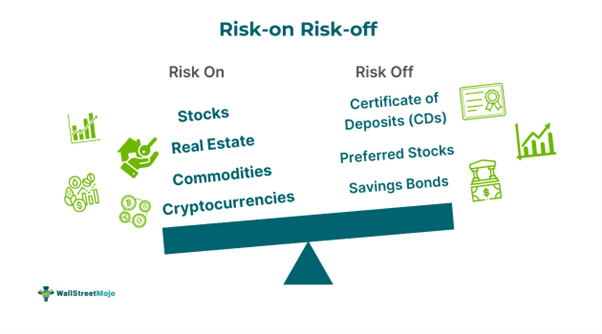

Risk-on and risk-off (RORO) are terms used by market participants to gauge the financial markets’ risk sentiment and, thereby, investors' risk appetite. Risk-on refers to investors’ acceptance of taking on riskier trades or investments. Risk-off, on the other hand, refers to investors who are reluctant to take risks because they want to play safe.

The risk-on risk-off chart can experience changes due to economic patterns and social and political shifts. Therefore, market players, especially traders, are assured that they are trading in line with the current market sentiment and not against the tide. Whether the trading session is risk-on or risk-off determines the movement of investments in assets.

Key Takeaways

- Risk-on risk-off is a representation of the collective market sentiment with respect to the risk involved in a specific financial market.

- Risk-on sentiment pushed investors to take on more risk and invest in financial instruments such as stocks, currencies, and cryptocurrencies. During risk-off periods, investors tend to move towards safer investments such as bonds and gold.

- RORO metrics help investors forecast market movements and make investment decisions. It also helps them with risk management.

- However, RORO can affect diversification and portray wrong results, as consistently timing the market is impractical.

Risk-On Risk-Off Explained

Risk-on-risk-off (RORO) is an indicator of shifts in market sentiment concerning risk. It sways between risk on and off based on economic situations and signifies the reluctance or willingness to invest in a particular asset class in a specific market situation.

It is a well-established fact that every investment carries some level of innate risk. However, where investors decide to invest despite knowing the risks involved is their risk tolerance. To find the risk sentiment in the market, investors use multiple strategies. One of the most popular ones is risk-on-risk-off indicators. Other such strategies are dollar cost averaging and bucket strategy.

There are two aspects of the RORO concept. On the one hand, the risk-on approach is when investors show a willingness to assume more risk to achieve a more significant profit. On the other hand, a risk-off strategy is when investors strongly resist taking risky bets and instead like to play it safe.

Depending on the collective market sentiment, funds can move from one asset class to another. Some of the most common risk-on assets are emerging-market currencies, stocks, and commodities. Risk-off assets include cash, bonds, and assets with historically low-risk traits.

Most investors should maintain a long-term vision and stay invested in an asset class based on their risk appetite. It is illogical for long-term investors to move funds from one asset class to another due to short-term fluctuations. For traders, however, this might be a great way to capitalize on the sway in risk sentiment and make extra profits.

Types Of Risk-On Risk-Off Assets

Types of risk-on risk-off assets are:

#1 - Risk-on

These assets typically grow faster than inflation, thus giving investors greater returns. However, it comes with another trait – the higher risk involved. A few of the most common assets in this category are:

- Stocks

- High-yield bonds

- Commodities

- Real Estate

- Non-fungible Tokens (NFTs)

- Cryptocurrencies

- Currencies

#2 - Risk-off Assets

These assets give stable and, in most cases, assured returns. Therefore, the risk is significantly lower than their counterparts. However, the returns are also considerably lower. The most common assets with these characteristics are:

- T-Bills

- Fixed Annuities

- Savings Bonds

- Certificates of Deposit (CDs)

- Investment-grade Corporate Bonds

- Money Market Mutual Funds

- Preferred Stocks

Factors Influencing Risk-On Risk-Off Investments

Various factors influence shifts in risk-on-risk-off indicators. Some of the most prominent ones are global economic conditions, risk tolerance, and market sentiment. Each of these factors is discussed in detail below.

#1 - Global Economic Conditions

Global economic cues play a critical role in RORO investing. Whenever global markets are on an upward trend, risk on mindset is typically present in investing circles. They look at it as an opportunity to maximize their profit-making exploits. However, when global markets show bearish symbols, a risk-off approach kicks in. Investors prefer playing it safe and shifting their investments to lower-risk asset classes.

#2 - Risk Tolerance

Risk tolerance refers to an investor’s appetite for taking risks regarding their investments. A handful of factors influence an investor’s risk tolerance, including investment amount, financial goals, and time horizon. Investors tend to find their own sweet spot that gives them the maximum returns for the amount of risks they are ready to take.

#3 - Market Sentiment

It refers to the collective outlook of investors towards a specific financial market or security. It is most commonly referred to as a bullish outlook (prices rising) or a bearish outlook (prices falling). Ironically, these movements are most often caused by feelings and emotions in financial markets instead of the actual performance of the company, sectors, or asset class. Investors use the CBOE Volatility Index (VIX) to measure market sentiments.

Examples

The theoretical aspects of risk-on-risk-off charts are well-established. Now, it is time to address the concept's practical applicability, which is explained in the examples below.

Example #1

Abraham is a trader with over a decade of experience. He likes to take on risk when the market is bullish and take full advantage of rising prices. However, he also has a moderate risk tolerance.

Therefore, when the Russia-Ukraine war was declared, he knew that disruptions of supply chains and oil undersupply would lead to a bearish market. He decided to move most of his funds from stocks to low-risk assets such as currencies and short-term government bonds.

Example #2

In August 2024, Foreign Portfolio Investors (FPIs) pulled out $1.8 billion from financial stocks. The withdrawal took form as a part of risk management. There were persistent fears and rumors that the United States would go into recession.

Subpar earnings and little to no growth in deposit rates further contributed to the negativity or bearish sentiments. As a result, investors moved funds to relatively safer sectors such as FMCG and healthcare.

Importance

The importance of understanding RORO strategy in financial markets includes:

- An understanding of risk-on-risk-off assets helps market players manage risks.

- It helps traders make practical decisions on where to park their money based on market conditions/sentiments.

- RORO is a reliable method to forecast the changes in risk sentiments across global markets.

- It helps investors and traders with their analysis. They can decide if the market sentiment is in line with their risk tolerance and the rewards for staying vested.

- In the long run, it helps traders and investors have a more diversified portfolio that can weather the storm and take advantage of bull runs.

Limitations

Despite helping traders and investors, there are a few factors that are from the other end of the spectrum. The limitation of risk-on risk-off indicators are:

- The basis of this strategy lies in timing the market. Practically, timing the market is not consistently possible, so the risk of misjudgments is very probable.

- Investors' fear or greed cloud their objectivity and, therefore, their decision-making abilities.

- Short-term volatility is persistent across all asset classes. However, transferring funds to a different asset class because of that could be termed an overreaction.

- The strategy often suggests shifting from risky assets to safer assets or vice versa. As a result, portfolio diversification might suffer.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Risk-On vs Risk-Off

Risk-On

- Corporate earnings show a positive attitude.

- Central banks show optimism.

- Traders invest in relatively risky assets.

- Commentary on the market happenings is positive.

Risk-Off

- Corporate earnings have negative results.

- There is uncertainty and less optimism from central banks.

- Pessimistic trader behavior.

- Traders lean towards assets with significantly lower risk.

- Negative commentary is persistent concerning market happenings.