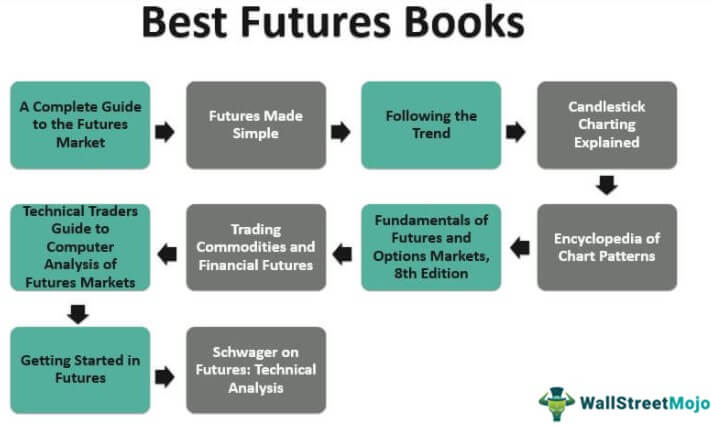

Top 10 Futures Trading Books

Below are the top 10 best futures books worth reading and learning:

- A Complete Guide to the Futures Market ( Get this book )

- Futures Made Simple ( Get this book )

- Following the Trend: Diversified Managed Futures Trading ( Get this book )

- Candlestick Charting Explained ( Get this book )

- Encyclopedia of Chart Patterns ( Get this book )

- Fundamentals of Futures and Options Markets, 8th Edition ( Get this book )

- Trading Commodities and Financial Futures ( Get this book )

- Technical Traders Guide to Computer Analysis of the Futures Markets ( Get this book )

- Getting Started in Futures ( Get this book )

- Schwager on Futures: Technical Analysis ( Get this book )

Let us discuss each of the futures books in detail, along with its key takeaways and reviews.

#1 - A Complete Guide to the Futures Market

by Jack D. Schwager

Book Review

For successful trading, one must have a complete grip on the realities and nuances of the futures market. This futures book offers genuine investors and traders the essential tools to be on the profitable side of the ledger. It provides all insights, including trading systems, technical analysis, and fundamental analysis of options, spreads, and practical trading principles.

Key Takeaways

The following aspects of the futures market are successfully covered:

- It is an in-depth analysis of multiple trading and analytical approaches such as technical indicators and trading systems, chart and regression analysis, etc.

- It helps avoid market myths from real-life scenarios.

- It is a simplified step-by-step instruction for the robust development of original ideas and systems and how to test them successfully.

- Easy to understand illustrations from a wide range of options trading strategies and explain its implications for each of them.

- A detailed explanation from a vast pool of practical trading guidelines and market insights from an established and recognized trading authority.

This top futures book is clearly and concisely prepared with easy-to-understand language offering a solid foundation on futures markets, detailed critical analysis, and forecasting techniques, exploring advanced trading concepts. In addition, it provides real-life examples of the need to understand the implications of the learned concepts.

#2 - Futures Made Simple

by Kel Butcher

Book Review

This futures trading book is an uncomplicated version for traders with any experience desiring to move into futures trading. It offers expert advice and fundamental guidance for profitable investing. It lays out the essential aspects such as what the futures are, how the exchanges function, analysis of the markets, and execution of the futures online or offline. The highlights are-

Key Takeaways

The highlights are:

- A simplified entry-level guide to futures trading

- The contents are from the experience of a successful trader in equities, futures, options, and other financial products.

- Featuring practical and simple examples and bulleted summaries of key points to simplify learning further.

This book on futures trading outlines basic and complex strategies that investors can use to multiply little money in the futures market. One is not even required to hire a financial advisor for further guidance.

#3 - Following the Trend: Diversified Managed Futures Trading

by Andreas Clenow

Book Review

This futures trading book is a highly educational, statistical, and valuable guide written by an experienced Futures Fund manager for anyone looking to commence their funds. It provides fine-level detail on the core principles of Diversified Trend following. In addition, it can be highlighted as a potential roller coaster ride with the positive and negative angles of trend following.

One must have always observed a group of hedge funds or other exotic products which must have outperformed in all kinds of conditions and volatility. The traders never reveal their strategies and proprietary trading algorithms. Therefore, this book reveals such tactics and their implementation with relatively simplistic models. Such traders are generally Cross Asset Future Managers, also known as CTA.

Key Takeaways

This futures book aids in focusing on the wrong things, such as buy and sell rules and the importance of trend following. The focus is to avoid following stringent trading rules which have been traditionally established. Instead, one may have to take sufficient risks during choppy market conditions and take action accordingly. By analyzing the trend of performance and attribution on a year on year basis, readers will be able to build a deep understanding of how to trade futures on a large scale and identify various problems and opportunities.

#4 - Candlestick Charting Explained

By Gregory Morris

Book Review

This future book would mold the subjectivity of the Japanese Candlestick analysis by providing the readers with standardized and straightforward coverage of 89 powerful candlestick charts patterns. It will indicate current trader behavior and how one can use each of these patterns to improve market knowledge and analytical abilities instantly. The essential components covered are:

- Allowing instant analysis of investor attitude and expected market direction

- It provides established methods for integrating candlesticks with traditional Western Charting analysis for enhanced signal verification.

- It gives real-life insights into the traders' psychology and how it impacts the buyers and sellers.

Key Takeaways

For millions of traders around the globe, candlesticks have become a vital tool in creating and verifying trading signals. It is the only book one requires to integrate proven versatility and effectiveness in the technical trading program. It is an in-depth exploration of traditional and all-new candlestick charts expressing a logical, understandable, and profitable component of the current trading program. Concerning each of the candlesticks, the following features are covered up:

- Commentaries giving detailed explanations

- Rules of Recognition

- Scenarios and Psychology behind the pattern

- Pattern Flexibility

- Pattern Breakdown

- Related Patterns

- Sufficient and real-life examples

#5 - Encyclopedia of Chart Patterns

by Thomas Bulkowski

Book Review

This encyclopedia is a deep dive understanding of various aspects of technical trading, providing enhancement with new performance statistics for both bear and bull markets and 23 new patterns, including a second edition devoted to 10 event patterns. It is roughly a 1,000-page book containing 53 chart patterns plus 9 more event patterns, which covers all possible combinations within technical trading. Some of the event patterns are:

- Broadening Formations (Right Angled Ascending/Descending)

- Cup with Handle

- Island Reversals

- Double Tops (Eve and Adam/Eve and Eve)

- Dead Cat Bounce / Inverted

- Stock Downgrades/Upgrades

- FDA Drug Approvals

Key Takeaways

In a nutshell, this futures book provides essential information on the good and bad patterns and what each chart's movement depicts. The various financial events, such as Quarterly Earnings announcements, retail sales, stock upgrades, and downgrades, will impact the firm's share price, which will also reflect in the various chart patterns. This book will teach the readers how to interpret the same in all kinds of scenarios and during the regular business course.

#6 - Fundamentals of Futures and Options Markets, 8th Edition

by John C. Hull

Book Review

This futures book predominantly targets students pursuing a career in finance and would like to have a solid base on futures and Options. However, current and aspiring professionals can also use a broader perspective on the products. This top futures book is packed with numerical examples and accounts of real-life situations, thereby effectively guiding the readers on the material and equipping them with essential knowledge and skills to combat the working world.

Key Takeaways

It offers a clear topic overview without using calculus or complex models. Some of the components covered are:

- Mechanics of Futures Market

- Hedging strategies using futures

- Determination of forwarding and Future Prices

- Interest Rate Futures

- Swaps in Finance

- ESOP’s

- Mishaps from the use of Derivatives and learnings from them

It is also covering up some essential aspects of being abreast with the changing requirements in the financial market, such as:

- The changes taking place in the manner OTC derivatives are traded

- New non-technical explanation of the Black-Scholes-Merton formula

- Reflecting the importance of Principal protected notes

- It explains various exotic options, including a discussion of cliquet and Parisian options.

- It enhances using Credit Derivatives and their importance in the market.

- Value at risk is explained with real data examples supplemented.

#7 - Trading Commodities and Financial Futures

by George Kleinman

Book Review

This best futures trading book is a masterpiece on how to handle the trading of commodities and futures contracts in the world of derivatives. It offers an insight into how trading psychology functions in a high-frequency computer trading world and how to avoid the latest pitfalls. Extensive coverage of electronic trading is provided with present-level contracts and advanced trading techniques, including the author's exclusive Pivot Indicator approach.

Key Takeaways

It has updated information on algorithmic trading, peculiarities of electronic trading, and all aspects in which a new or veteran trader must dominate the market using a step-by-step guide. The guide is written in a straightforward, easy-to-read style, which makes it interesting and exciting.

The author also reveals precisely how the commodities markets have evolved over some time and the consistent discipline to avoid choppy market conditions and manage the dangerous risks of the markets. It also magnifies that one should include a decent amount of commodities in their overall portfolio.

#8 - Technical Traders Guide to Computer Analysis of the Futures Markets

by Charles Lebeau and David Lucas

Book Review

With the low cost of modernized computer hardware and software combined with communications on prices with the aid of satellites, a regularly updated and expanding market of traders using computers has developed rapidly. This top futures book helps bridge the gap between basic instructions accompanied by software programs and what a trader must know to create and maximize the futures trading system.

Key Takeaways

With specific information on how to set up and use computer-generated technical studies of the most popular indicators, which include:

- How to build a trading system tailored to the specific needs of the trader

- Practical instructions on how to display and analyze technical information from the markets

- It offers advice for developing disciplined money management with risk control strategies.

- Techniques to be adopted for monitoring trading systems for detection if something has gone wrong before any mishap occurs.

The authors are real-life traders with many years of experience, giving an in-depth insight into the most common indicators and oscillators used in the market. Most essential indicators to be learned about while operating the trading systems have been highlighted, and real-life studies for each technical indicator have been provided along with their performance under different conditions.

#9 - Getting Started in Futures

by Todd Lofton

Book Review

The author has used simple and easy-to-understand terms on everything one must know for successful futures trading. One will learn all the basics of the future and other critical components, such as -

- Accurate forecasting of prices.

- Understanding the mechanics of hedging and the conditions under which one should implement it.

- Taking advantage of the new electronic trading opportunities.

Key Takeaways

It highlights the role of futures markets in foreign currencies, equity indexes, interest rates, and smooth management of money. It also displays an intelligent manner of understanding all the complex financial strategies in an organized manner.

Some critics have argued that the book needs more examples of techniques like calling spreads, triangle formation, and limited money management information. However, this book is a definite read for beginners. It can also be used as a reference guide for experienced traders in the future.

#10 - Schwager on Futures: Technical Analysis

by Jack Schwager

Review

The author, Jack Schwager, is perhaps one of the most visible and iconic figures in the futures industry today. Through this best futures trading book, the author has created one of the most comprehensive guides to understanding and using technical analysis for futures trading. It offers in-depth coverage of technical analysis from the perspective of a trader. The focus is on covering the subject and exploring ideas that practically can or cannot work in the markets. With an emphasis on trading applications, the book will cover the following:

- It provides a separate module for illustrating chart analysis in the practical world.

- Detailed illustrations on several original trading systems

- Insight into the understanding of cyclical analysis

- Highlighting the concepts and use of "continuous futures" while comparing 10-year continuous futures

- It also offers a separate section to understand the importance of trading strategies and philosophies, including more than 100 trading tips.

Key Takeaways

The text has been written in the most informative, insightful, and non-technical style to make the readers understand the most complex information and how to process them successfully. The beginning of this futures book is an elementary method but completely describes the essential technical techniques to be followed. The subsequent chapters discuss building trading systems using combinations of the ways one learned in the initial chapters. A fair amount of history lessons have also been provided regarding how one excavated the methods. Finally, it gives a detailed analysis to the reader about the various techniques and can convince them to adopt the practices because of the possible successes involved.

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.