Table Of Contents

What Is A Reverse Convertible Note (RCN)?

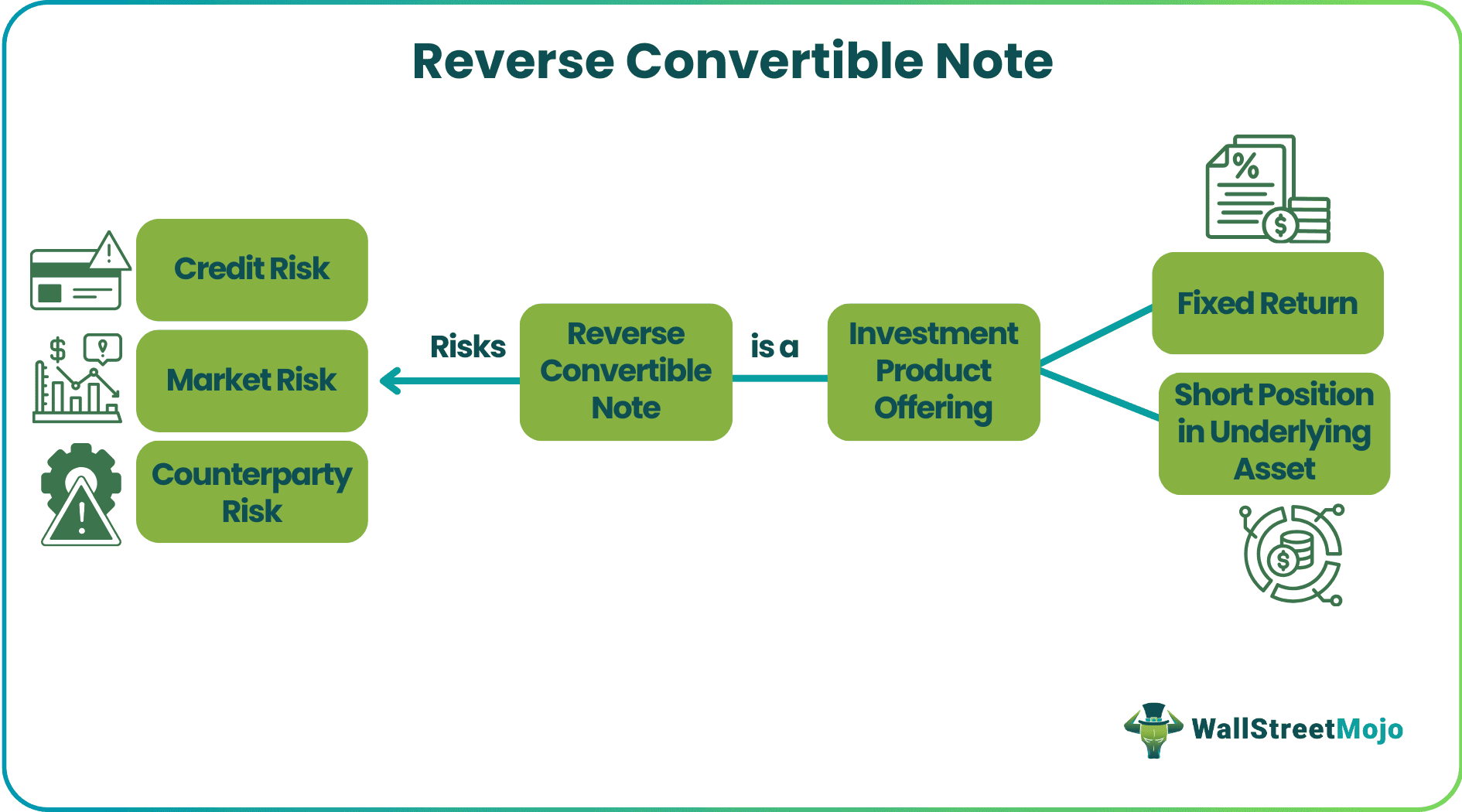

A Reverse Convertible Note (RCN) is a structured investment product that combines a bond with a short position in the underlying asset. The purpose of an RCN is to provide investors with an attractive yield while offering some downside protection if the underlying asset falls in value.

Its importance lies in its potential to offer higher yields than traditional bonds while providing some protection in volatile market conditions. The investor receives coupon payments from the bond but is also exposed to the downside risk of the underlying asset. Investors understand the risks involved, and they carefully evaluate the terms of the RCN before investing.

Key Takeaways

- Reverse Convertible Notes(RCN) offer potentially higher yields than traditional bonds but expose investors to the underlying asset risk, making them generally riskier.

- They provide some downside protection, but investors should carefully evaluate the terms and risks before investing.

- Such notes can be tailored to specific investment goals but are generally less liquid and more complex than traditional bonds.

- Investors should consider their financial situation, risk tolerance, and investment objectives before investing in RCNs.

Reverse Convertible Note Explained

A Reverse Convertible Note (RCN) is a structured investment product that offers investors a fixed return through coupon payments, similar to a bond while exposing them to the risk of the underlying asset. It's structured by combining a bond with a short position on the underlying asset, which means the investor is betting against the asset's price.

An RCN aims to provide investors with an attractive yield while offering some downside protection in case the underlying asset falls in value. It's considered an alternative to traditional bonds, as it offers potentially higher returns but also carries higher risk.

Examples

Let us have a look at the examples to understand the concept better.

Example #1

Consider that a trader buys an RCN with a notional value of $10,000. The RCN is linked to the price of XYZ stock, currently trading at $100 per share. The RCN has a maturity of one year and offers a coupon payment of 8% per annum.

If the price of XYZ stock remains above $80 per share throughout the term of the RCN, the trader will receive the full coupon payment of 8% per annum, which is $800 for the year. At maturity, the trader will receive the notional value of $10,000.

However, if the price of XYZ stock falls below $80 per share at any point during the term of the RCN, the investor will be exposed to the downside risk of the stock. For example, if the price of the stock falls to $60 per share at maturity, the trader will receive the notional value of $10,000 minus a loss of $2,000 (i.e., a 20% decline in the stock price from $100 to $80), resulting in a payout of $8,000.

Example #2

Consider that an investor purchases a $1,000 RCN with a term of one year and is linked to the performance of Company ABC's stock. The RCN pays a 5% annual coupon rate, which is higher than the current yield on ABC's stock. The RCN also has a knock-in feature. It means that if the stock falls by a certain percentage (e.g., 20%) during the year, the RCN will convert to shares of ABC's stock.

At maturity, the investor will receive the $1,000 principal back. Plus, the 5% annual coupon payment if the stock has not fallen by the knock-in percentage. However, if the stock has fallen by the knock-in percentage, the investor will receive shares of ABC's stock, which may be worth less than the original principal.

Benefits

Let us look at the benefits of investing in a Reverse Convertible Note:

- Potentially higher yields: RCNs can offer higher coupon payments than traditional bonds due to the additional risk involved.

- Some downside protection: RCNs can offer some downside protection if the underlying asset falls in value, which can help limit people's losses.

- Diversification: Investing in RCNs can be a way to diversify an investment portfolio, as RCNs can be linked to a range of underlying assets, such as stocks, commodities, or currencies.

- Tailored to specific investment goals: RCNs can be structured to suit the specific investment goals of an investor, such as targeting a particular level of yield or downside protection.

Risks

Let us look at the risks of investing in a Reverse Convertible Note:

- Credit risk: RCNs are typically issued by financial institutions, and there is a risk of default if the issuer becomes insolvent or unable to meet its obligations.

- Market risk: RCNs are linked to the price performance of an underlying asset, such as a stock or commodity, and are therefore exposed to market fluctuations. The trader may incur losses if the underlying asset's price falls significantly.

- Liquidity risk: RCNs may be less liquid than other investment products, which could make it difficult for traders to sell their investments before maturity.

- Counterparty risk: RCNs are typically sold over-the-counter (OTC), which means that the investor is exposed to the creditworthiness of the RCN.

- Complexity risk: RCNs are structured investment products and can be complex, which may make it difficult for people to understand the terms and risks involved.

Reverse Convertible Note vs Fixed Coupon Note

Reverse Convertible Note

- Combines a bond with a short position on the underlying asset

- Offers potentially higher yields than traditional bonds

- Exposes investors to the risk of the underlying asset

- Provides some downside protection if the underlying asset falls in value

- Can be tailored to specific investment goals

- Typically less liquid than traditional bonds

- Generally more complex and difficult to understand.

- Generally higher risk than traditional bonds

- Higher potential rewards but also higher potential losses

Fixed Coupon Note

- Purely a bond investment

- Offers a fixed rate of return throughout the term

- Offers no exposure to the underlying asset

- No downside protection

- Limited customization options

- More liquid than RCNs

- Generally simpler and easier to understand

- Generally lower risk than RCNs

- Lower potential rewards but also lower potential losses