Table Of Contents

What is Return on Net Assets (RONA)?

Return on net assets (RONA) is defined as the financial ratio of the net income earned by the business to the overall total of net fixed assets and net assets held by the business. The financial metric analyzes how much revenue a business can generate by employing specific assets for its business operations.

It further helps in analyzing how effectively the assets are utilized and deployed by the management and company to derive economic value for the business. In general terms, anything above 5% is considered a return on net assets ratio, and a ratio above 20% is considered outstanding.

Key Takeaways

- Return on net assets (RONA) is the financial ratio of the net income earned by the business to the total of net fixed assets and net assets held by the company.

- This financial metric determines a business's profitability based on its use of its assets. It analyzes the effectiveness of asset utilization and deployment by the management to create economic value for the company.

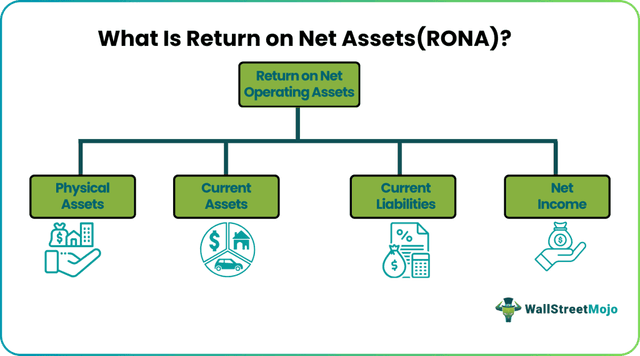

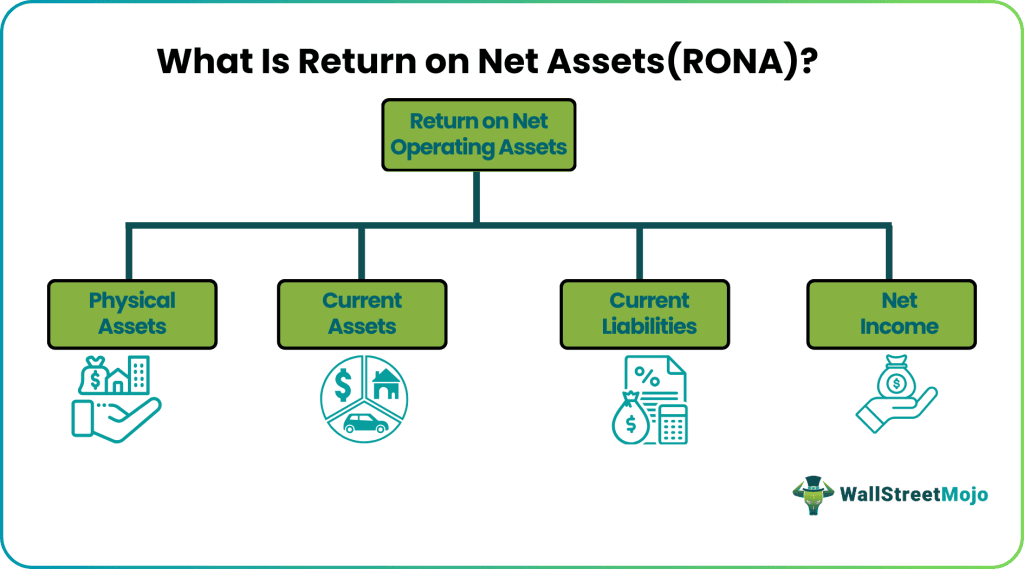

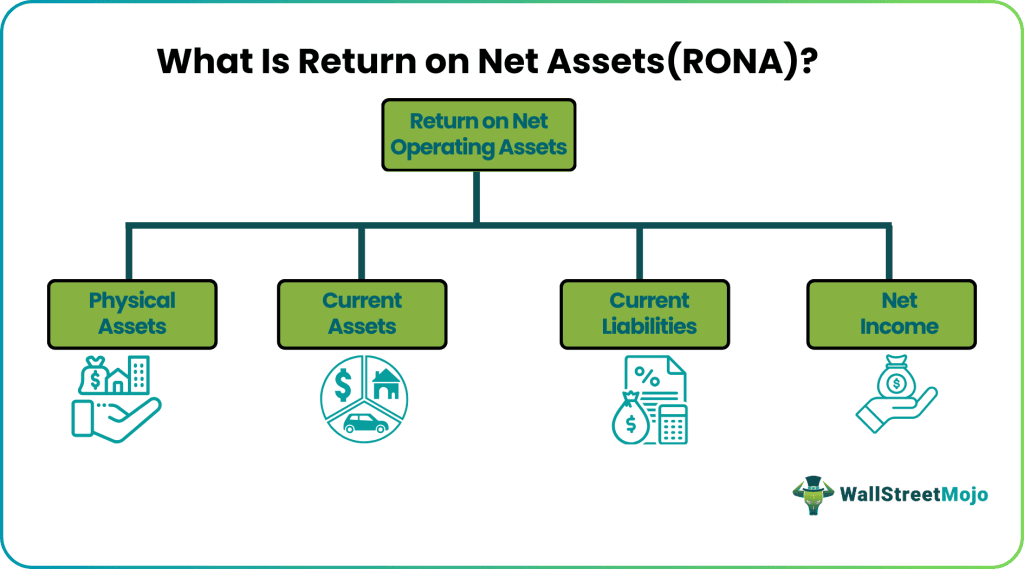

- The factors that make up Return on net assets include physical assets, current assets, liabilities, and net income.

Return On Net Assets Explained

Return on net operating assets or RONA is a ratio that defines the financial health of an organization. It relates the profitability of a business with its assets in totality.

Analysts, top management staff, and investors closely look at this number. They compare this ratio with the industry’s return on net assets benchmark to see if the company can generate better returns than other companies within the industry in comparison to their assets.

It shows how efficiently or inefficiently the management is using their resources. However, it is vital to understand that just this metric might not be the ideal way to judge the company’s profitability or potential to grow.

It is usually compared with other metrics that are widely used such as return on investment (ROI), cost of goods sold (COGS), earnings before interest, tax, depreciation, and amortization (EBITDA), and so on.

Therefore, Return on Net Assets is regarded as the performance metric, which compares the net income generated by the business over the physical assets utilized by the business. It helps analysts and business knowledge determine whether the company can drive an efficient business operation to generate good economic value.

The investors utilize this ratio to determine whether they would be able to earn good returns or not if they were to invest their money in the business.

Components

Let us understand the components of calculating the returns on net assets ratio through the discussion below.

#1 - Physical Assets

Physical assets are the fixed assets that the business employs in running business operations. These could be in the form of the production plant, machinery, business property, investment property, or equipment. These are non-current assets and can be found in the balance sheet section of the business.

#2 - Current Assets

Current Assets are the basic component of the networking capital of the business. These are composed of cash, marketable securities, and inventories. These are assets held by the business for the current financial year of the business.

#3 - Current Liabilities

The current liabilities are obligations that the business has to pay within 12 months or the current financial year of the business. They are composed of notes payable, account payable and the current portion of long-term debt, accruals, etc. These are deducted from the current assets to arrive at the networking capital, which can calculate the net asset return.

#4 - Net Income

Net income is defined as the residual income earned by the business. It is the end value a business gets when all the operational overheads, the cost of running a business are deducted from the revenue generated by the business. It can be found in the income statement section of the business.

Formula

Before dwelling deeper into the concept, let us understand the formula in detail to find the return on net assets benchmark through the detailed explanation below.

The return on net operating assets (Rona) formula can be determined using the time value of money relationship as described below:

Return on Net Assets = Net Income /

Here,

- PA represents the Physical Asset.

- CA represents the Current Assets

- CL represent s the Current Liabilities.

Examples

The concept of returns on net assets is a concept that is used widely and more commonly as it is generally perceived. Let us understand its implications and uses with the help of a few of examples.

Example #1

Suppose the company earns a net income of $560,000 during its business operations. The business additionally has net working capital of $200,000 and holds physical assets worth $1,000,000.

RONA can be determined as follows: –

- =$560000/($1000000+$200000)

- =0.467

Therefore, the company has generated a RONA of 0.467 from its business operations. This further means that the business cannot generate revenues properly and delivers adequate performance.

Example #2

Suppose the company earns a net income of $570,290 during its business operations. The business additionally has net working capital of $100,000 and holds physical assets worth $600,000.

RONA would be determined as follows: –

- =$570290/($600000+$100000)

- =$0.8147

Therefore, the company has generated RONA of 0.8147 from its business operations. This further means that the business can generate revenues properly and is delivering good performance and favorable returns for its owners.

Example #3

For its current financial year, a business generated a return on net assets of 0.867. Therefore, it could infer that the business employed its physical assets and the net working capital efficiently to drive value and net income of 87 cents approximately. It further means that the net income generated by the business equals 87% of the overall combined value of physical assets and the networking capital of the business.

Advantages

The concept’s wide use and acceptance is the proof for its viability. Therefore, let us discuss it deeper with the help of the points below that show us the advantages of the concept.

- It is useful for the manufacturing business as it helps them collect and maintain information on sales, assets, and operational costs at the plant level.

- It helps the investor know whether the business is a good investment option or not.

- A high ratio always signifies that the company is highly efficient in driving good business.

Disadvantages

Despite the advantages mentioned above, there are factors from the other end of the spectrum that prove to be a hassle or hurdle in the process. Let us understand the disadvantages through the points below.

- Since the metric is derived using fixed assets. Therefore, the method of depreciation employed by the business in determining the net fixed assets affects the comprehensive determination of return on net assets.

- A wrong depreciation method can severely skew the profitability ratio or RONA.

- Suppose the business earns loss from unusual and unpredictable events. It can also skew the return on operating assets metric since such losses would be adjusted to the net income and can, therefore, deliver an adverse impact on the value of the ratio.

- It does not account for intangible assets as it is eliminated from the calculations.

Significance

Let us understand the significance and the important points of the return on net assets benchmark through the discussion below.

- It helps the business determine its ability to create and derive value creation for the longer-term horizon.

- It helps the business determine how well they utilize physical and net assets.

- A high RONA is generally regarded as a favorable metric for the business.

- It is one of the comprehensive measures wherein net income is compared with the business's physical assets.

- If a business incurs significant one-time losses, then it can be adjusted to the net income earned by the business to derive the value of the return on net assets (RONA).