Table Of Contents

What Is Return On Investment (ROI)?

Return on Investment (ROI) is a metric used to assess how profitable an investment is. Calculating the figure helps evaluate an investment's performance and lets investors make an effective comparison between investment options to check which one is the most efficient.

The ROI allows individuals and businesses to observe the earnings from an investment against the expenditure on that investment. It is a financial ratio that lets businesses examine their position, depending on the returns their investments are likely to bear or have borne.

Key Takeaways

- Return on investment (ROI) exhibits the performance of an investment to help individuals and businesses check the gains and losses made out of it. The higher the value, the better it is.

- ROI is calculated using a simple formula, i.e., net income divided by the original capital investment cost.

- The calculation method classifies ROIs into four categories – net income, capital gain, total return, and annualized return.

- It is easy to calculate and simple to read, understand, and interpret.

Return on Investment Explained

Return on investment signifies the profits made and the losses incurred on a particular investment. With the help of the obtained ROI, businesses and individuals get a chance to crosscheck their portfolios to understand which investments worked well for them and which have proven to be the wrong option. Subsequently, APY calculations are used to check which deposit account is the most profitable or whether an investment will yield a good return.

ROIs intend to help investors learn how fruitful their investments have been. This allows them to assess their investment portfolio and be wise enough to make future investment decisions. In addition, they also let businesses validate their other expenses, which they make to achieve their business goals and objectives.

For example, if the profits garnered or losses incurred from investing in stocks is the ROI that helps individuals know where to invest the next time, the cost of advertising that helps generate leads and convert them into customers also acts as an investment. In the latter case, the number of leads generated and finally converted into consumers becomes the return on the investment made in advertising. In short, ROIs do not necessarily have a direct monetary value.

Types

ROI can be calculated using different methods. Depending on the versions used for calculation of return on investment equation, it is classified as – Net Income ROI, Capital Gain ROI, Total Return, and Annualized Return.

#1 – Net Income Method

ROI formula = (Net Income / Investment cost) * 100

#2 – Capital Gain Method

ROI Formula = (Current Share Price – Original Share Price) * 100 / Original Share Price

#3 – Total Return Method

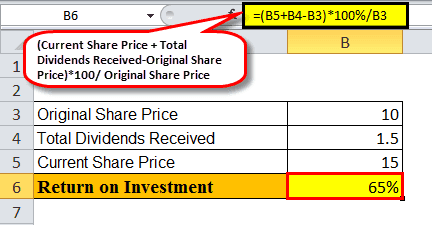

ROI Formula = (Current Share Price + Total Dividends Received – Original Share Price) * 100 /Original Share Price

#4 – Annualized ROI Method

ROI Formula = – 1

Formula

The formula used in company analysis to calculate return on investment is:

Factors

Let us study the factors that determine the concept of return on investment equation or influence the concept either directly or indirectly.

- The nature and type of investment or project has a huge impact of this concept. The return is compared with the amount that is invested, which means comparison with cost of research and development, marketing and sales, resource procurement, etc.

- There are various types of areas where funds can be invested. They can be huge projects, or financial instruments like stocks, bonds, mutual funds, commodities, real estate, and so on. Each of them exibit different kinds of return levels.

- The time horizon plays an important role too. Short term investments with high risk usually have high return on investment compared to long term ones. But if the investment is in an instrument which has very less fluctuation, then they yield good return even in long term

- The risks levels also play a role. The higher the risk, the more is the possibility or return but and lower risk has lower return.

- It is important to factor in the cost of investment because if the cost is very high, even a very good revenue will not yield good return since cost will eat away the revenue and reduce it.

- A good market condition where there is less fluctuations in terms of interest rates or exchange rates, less of changing tastes and preference of consumers, a stable political condition or no unforeseen contingencies, willhelp in achieving good returns on invetsments.

- A good and stable management is required for a business to generate good and high return on investment. If the management is skilled and experienced enough to frame useful strategies and plans for future growth by utilizing the resources in an optimum manner, it is possible for the business to generate good ROI.

Example

Let us understand the return on investment meaning better using the following example:

Suppose an investor invested $1000 in the bakery in 2020 and sold his stock in 2021 at $1200. The above formula helps calculate the ROI in this case:

- ROI Bakery = (1200-1000) * 100 / 1000 = 20%

Next, he also invested $2000 in the shoe business in 2020 and sold his stock in 2021 at $2800. So, the same formula lets calculate the ROI here:

- ROI Shoes_Business = (2800-2000) * 100 / 2000 = 40%

This is how the rate of return on investment allows one to identify the best investment option available. The above example makes clear that investors can book more profit in the Shoe business as the ROI is higher than that of the bakery business.

Importance

Let us analyse the importance of the concept of rate of return on investment in details.

- This is a very good method to analyse the performance of a company through evaluation of its profitability or return. The return is measured in comparison to cost of the investment.

- With clear understanding of the return levels, the management and stakeholders can take important financial decisions regarding investment or expansion. They can prioritize projects based on their calculated ROI.

- It helps in allocating resources in projects or areas of business that require most investments. So, resources are channelized in the right direction, ensuring optimum usage with minimum cost.

- ROI can be used as a great performance tool to assess how the company is performing and get an idea about its future prospects by monitoring the success levels of its various initiatives.

- As a communication tool, annual or monthly return on investment is very advantageous because the shareholders, investors and creditors use this metric to judge the financial strength of the business by gathering information from financial reports. This helps them to take investment decisions.

- Risk assessment is an integral part of any business. This metric acts as a guide to compare the potential return compared to the investment made in them.

Thus, the above are the importance of the concept due to which it is widely used in the financial market by all participants and is an integral part of a financial report.

Advantages & Disadvantages

While the highest or best return on investment indicates a better investment portfolio or efficient business, the poor ratio allows individuals and businesses to identify areas where they should not invest or spend. Though ROIs help to make better decisions, they are not a flawless approach. Here is a list of advantages and disadvantages that one must know of:

| Pros | Cons |

|---|---|

| Simple calculation | Manipulation risk exists |

| Easy to read and understand | Independent of the time factor |

| Helps compare the efficiency of firms and investments | |

| A common method of calculating returns | |

| Enables effective decision-making |

Return On Investment Vs Return On Invested Capital Vs Return On Equity

Returns can be calculated based on different parameters, which make them be called differently. Some such terms include return on investment (ROI), return on investment capital (ROIC), and return on equity (ROE). Though these terms signify the types of returns, the motive behind calculating them is different.

- ROI and ROIC are profitability ratios with different methods and factors for calculating returns. While the former measures the profits or losses incurred on a particular investment, the latter measures the portion of profits gathered by a company using invested capital from debt and equity providers. ROIC, in short, is a more specific measurement of returns.

- While ROI measures the return on the investment or other expenses a business or individual makes, ROE is the metric that helps firms understand how efficiently they use the money coming from their investors and shareholders to reap profits.

Return On Investment Vs Return On Assets(ROA)

Both the above are financial metrics that are frequently used as a profitability measure by companies and their stakeholders. However, there are some differences between them as follows:

- The former measures the investment or project’s efficiency level while the latter is used to measure the return that a business generates form it assets.

- In the case of the annual or monthly return on investment, the calculation involves dividing the net profit by the initial cost of the investment. In contrast, in the latter case, the net income is divided by the average total assets. However, both are expressed in the form of percentages.

- The former evaluates the profitability of the business or the project as a whole but the latter focusses on the asset utilization and how much profit or revenue the assets are able to generate.

- The main aim of the former is to assess how viable a project or investment is for the company, or whether it is profitable to invest in it for long term. But the main aim of the latter is to understand or evaluate the efficiency level of asset or resource utilization.

Thus, the above are some noteworthy differences the two concepts.