Table Of Contents

What Is A Retirement Income Calculator?

A retirement income calculator is a tool that helps calculate the amount that shall be available to an individual at the time of retirement while making savings and accumulating the same periodically.

The calculator helps compute the amount that one would receive on retirement. With the help of the calculator, individuals can check how much they should save to generate the required amount when they retire. The comparison in the amount one saves allows people to learn what amount to start saving for better retirement income.

Key Takeaways

- A Retirement Income Calculator is a tool that helps individuals estimate their future retirement income based on various factors such as savings, investments, expected returns, and retirement age.

- The calculator considers the individual's current income, savings contributions, expected investment growth, inflation, and other relevant parameters to project the potential income available during retirement.

- Retirement Income Calculators provide valuable insights into whether an individual's current savings and investment strategies are sufficient to meet their retirement goals or if adjustments need to be made to ensure a comfortable retirement.

How Does A Retirement Income Calculator Work?

The retirement income calculator is used to calculate the periodical amount that is available to the individual periodically. One needs to understand their expenses and what kind of life one wants to live post-retirement and accordingly plan for it.

The formula for calculating Retirement Income is as below:

Periodical Retirement Income is made and then calculated:

In case the investment is made at the beginning of the period:

Wherein,

- B is the amount already deposited

- I is the periodically fixed amount invested at regular intervals

- r is the rate of interest

- F is the frequency of interest is paid

- n is the number of periods for which savings shall be made.

A retirement income calculator can be used to calculate what amount shall be available to the individual when he saves an amount periodically and invests at a certain rate of return. One needs to plan what amount he requires, what number of years he is expecting to live after retirement and the income that he expects. This calculator shall be used to calculate the return earned on the investment made and how much amount shall be available on a monthly basis post-retirement.

There are many products wherein the individual can be invested and make a retirement plan. This depends upon the inflation rate, the number of years to retirement, the current tax rate, the retirement tax rate, the return earned before retirement, and the return earned after retirement. All these factors need to be considered before deciding to invest and fix it at a certain rate.

Revenue vs Income Explained in Video

How to Calculate?

One needs to follow the below steps in order to calculate the amount for Retirement.

Step #1 - Determine the initial balance or any amount that is set aside for retirement, as even that amount will be used to calculate the maturity amount.

Step #2 - Figure out the rate of interest that would be earned on the Pre-retirement age.

Step #3 - Now, determine the duration left from the current age until the age of retirement.

Step #4 - Divide the rate of interest by the number of periods the income that shall be paid. For example, if the rate paid is 4% and it compounds annually, then the rate of interest would be 4%/1, which is 4.00%.

Step #5 - Now use the formula that was discussed above for calculating the maturity amount of the Retirement Income, which is made at regular intervals.

Step #6 - The resultant figure will be the maturity amount that would include the income plus the amount contributed.

Step #7 - There could be tax liability at the time of retirement, which should be accounted for accordingly.

Step #8 - Now, after accounting for tax, one can divide the amount by a number of periods the individual is expecting to live during retirement.

Examples

Let us consider the following examples to see how the calculation is done using the retirement income calculator:

Example #1

Mr. A is currently aging 32 years and has been accumulating funds for his retirement. Currently, he has $10,500 in his retirement fund account. He has started depositing $800 per year for his retirement, and he would be paying a 15% tax on his investments. He would be earning 6.88% on his investment, and he plans to retire by the age of 65 years, and he considers living for 20 more years after his retirement.

Based on the given information, you are required to calculate the amount that Mr. A can withdraw on a monthly basis post his retirement.

Solution:

We are given the below details:

- B = $10,500

- I = Fixed amount deposited periodically, which is $8,00

- T = Tax rate is 15%

- r = Rate of interest, which is 6.88% pre-tax and is compounded annually and post-tax, it would be 6.88% x (1 – 0.15), which is 5.85%

- F = Frequency which is annually here, hence it will be 1

- n = number of years the Retirement Income proposed to be made will be different of retirement age less current age (65 – 32), which is 33 years.

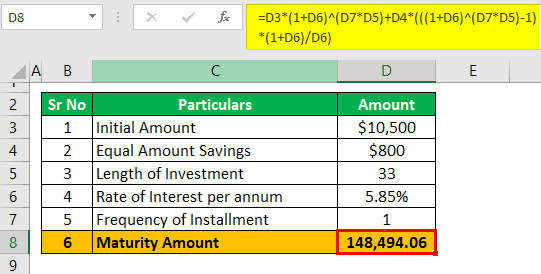

| Sr No | Particulars | Amount |

|---|---|---|

| 1 | Initial Amount | $10,500 |

| 2 | Equal Amount Savings | $800 |

| 3 | Length of Investment | 33 |

| 4 | Rate of Interest per annum | 5.85% |

| 5 | Frequency of Installment | 1 |

Now, we can use the below formula to calculate the maturity amount.

- = $10,500 x ( 1 + 5.85% )1 x 33 + $800 x

- = $148,494.06

- = $10,500 x ( 1 + 5.85% )1 x 33 + $800 x

- = $148,494.06

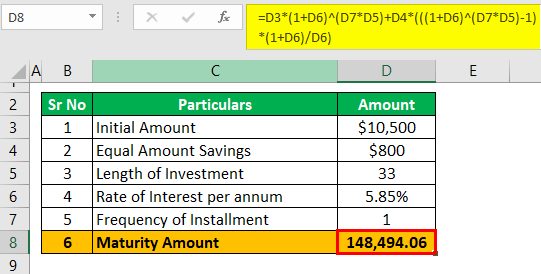

He estimates to survive for 20 years more during his retirement, and therefore, he would be receiving it for 20 x 12, which is 240 months, and per month retirement income would be $148,494.06 / 240, which is $618.73.

Mr. A can withdraw on a monthly basis after his retirement is $618.73

Example #2

Mr. Zee, who has 23 years left in his retirement, has started to plan for his retirement at the age of 66 years, and he estimates that he would outlive 25 years after he retires. His pre-retirement tax rate is 18% and his post-retirement tax is 10%. His investments, however, won’t be earning any return after he retires. He wishes to invest $500 every year in the retirement account and wishes to increase the amount by a rate of inflation every year. He wishes to withdraw monthly after his retirement and invest during the beginning of the year. His investment would earn 6.43%, and inflation on average per his expectations is 1%.

Based on the given information, you are required to calculate the amount that Mr. A can withdraw on a monthly basis post his retirement.

Solution:

We are given the below details:

- B = $0

- I = Fixed amount deposited periodically, which is $500

- T = Tax rate is 18%

- I = Inflation Rate is 1%

- r = Rate of interest, which is 6.43% pre-tax and is the nominal interest rate and is compounded annually and post-tax and post inflation rate it would be (6.43% -1.00%) x (1 – 0.18), which is 5.27%

- F = Frequency which is annually here, hence it will be 1

- n = number of years the Retirement Income proposed to be made will be different of retirement age less current age (66 – 43), which is 23 years.

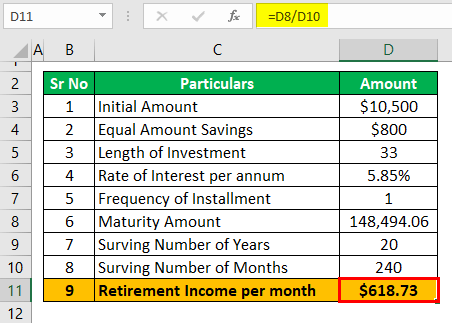

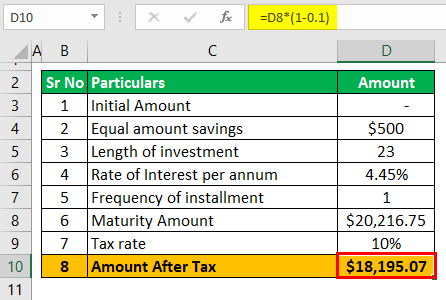

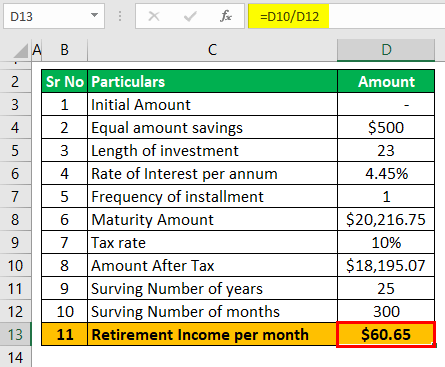

| Sr No | Particulars | Amount |

|---|---|---|

| 1 | Initial Amount | - |

| 2 | Equal amount savings | $500 |

| 3 | Length of investment | 23 |

| 4 | Rate of Interest per annum | 4.45% |

| 5 | Frequency of installment | 1 |

Now, we can use the below formula to calculate the maturity amount.

- = 0 x ( 1 + 4.45% )1 x 23 + 500 x

- = $20,216.75

Now at the time of retirement, the tax rate would be 10% and hence post-tax, it would be 20,216.75 x (1 – 0.10) which is $18,195.07

He estimates to survive for 25 years more during his retirement and therefore, he would be receiving it for 25 x 12, which is 300 months and per month retirement income would be $18,195.07 / 300 which is $60.65.

Mr. A can withdraw on a monthly basis post after his retirement is $60.65