Table Of Contents

What is Residual Income?

Residual income is a common concept used in valuation and can be defined as the excess return generated over the minimum rate of return which is often referred to as the cost of capital of the net income. Investing is considered a significantly efficient manner of creating residual income.

The income statement prepared traditionally was to reflect the owners or the shareholders the earnings available to them. Therefore, the statement of income depicts net profit after accounting for an interest expense for the debt cost of capital. There was no deduction for dividends or any other charges for the equity capital in the income statement.

Residual Income Explained

Residual income is the sum an individual has left with them after settling all outstanding personal debts and expenses. The residual income model helps lenders gauge the creditworthiness or the ability of a potential borrower to return the money provided as loans.

Even if borrowing or loans are out of the picture, it gives any individual an idea of their personal finance management. As in, despite making a considerable sum on a monthly basis, if the individual takes up too many loans or spends more than their financial bandwidth, their residual income would be an efficient indicator of the same.

Moreover, residual income explicitly accounts for the shareholder’s opportunity cost and hence subtracts the estimated cost of equity capital. The required rate of return on equity is the marginal cost of equity. The cost of equity can be considered as marginal cost as it shall represent the additional cost of equity, be it by selling more interests of equity or internally generated. This concept is the majority used in valuation when the residual income approach is preferred.

Formula

Residual Income Formula = Net Income of the Firm – Equity Charge

Where,

- Equity Charge = Cost of Equity Capital x Equity Capital

Revenue vs Income Explained in Video

How To Calculate?

Below is a step-by-step guide which shall ultimately give the individual a basis for their residual income tax.

Calculate the net income or net profit of the company, which can also be derived from the income statement of the company.

Calculate the cost of capital using various other methods like CAPM, Building block approach, Multi-model approach, etc.

Take the book value of the common equity from the balance sheet.

Multiply common equity value with the cost of capital computed in step 2.

Now Deduct the equity charge computed in step 4 from the net income that was derived in step 1, and the result will be Residual income.

This clearly shows the economic profit rather than just accounting profit.

Examples

Let us understand the residual income model in detail with the help of a few examples with calculations.

Example #1

MQR Inc. is a listed company. From publicly available records, the net income of the firm is $123,765. The Equity capital of the company is $1,100,000. Assuming, cost of capital of the firm is 10%, you are required to compute the residual income of the company.

Solution

Use the following data for calculation

- Net Income of Firm: 123765.00

- Equity Capital: 1100000.00

- Cost of Capital: 10.00%

We will now calculate equity charge, which is nothing but the cost of equity capital and equity capital, which is $1,100,000 x 10%, which is $110,000.

- Equity Charge = 110000.00

- Residual Income = Net Income of the firm – Equity Charge

- = 123765.00 - 110000.00

Example #2

Yes, a leasing Company, Inc. (YCI), is a mid-size company in terms of market capitalization, and as per public records, the firm has reported total assets of US$4 million and the capital structure of the firm is Fifty % with equity capital and Fifty % with debt. The company borrows at an average rate of 8 % before taxes, and the interest can be considered tax-deductible. Hence the post-tax cost of debt for the firm is 5.6 %. The firm has reported its EBIT, that is, earnings before interest and taxes of US$400,000, and the statutory income tax rate is 30 %. Net income for the firm is per below:

- EBIT of the firm - US$400,000

- Subtract: Interest Expense - US$140,000

- Income Before Tax - US$260,000

- Subtract: Income Tax - US$ 78,000

- Net Income of firm- US$182,000

You can presume that the cost of equity capital is 14 %. US$182,000 is an accounting profit, but was the firm’s profitability enough return for its shareholders? .You are required to compute the residual income approach.

Solution

One method for calculating the residual income is to subtract net income from an equity charge (In monetary terms, the cost of equity, which is the estimated one).We can calculate the charge on equity using the formula discussed.

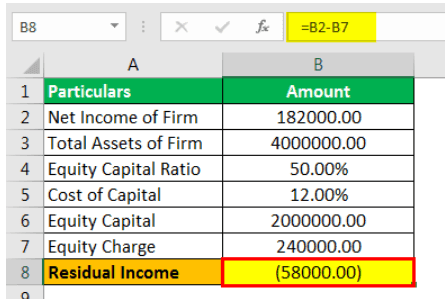

Use the following data for calculation

First, we need to calculate equity capital

Therefore, calculation of Equity Capital will be as follows,

Total Equity = US$4,000,000 x 50%

- Equity Capital = US$2,000,000

Therefore, calculation of Equity Charge will be as follows,

Equity Charge = Equity capital × Cost of equity capital

= US$2,000,000 × 12%

- Equity Charge = US$240,000.

Residual Income can be calculated using the below formula as,

Residual Income = Net Income of the Firm – Equity Charge

= US$182,000 - US$240,000

As seen from the negative economic profit, it can be concluded that YCI has not earned enough to cover the equity cost of capital. Although the company is profitable in an accounting sense from the economic sense, it is incurring a loss.

Example #3

A newly incorporated company appears to be a promising company to the investors and the shareholders. It had an equity capital ratio of 60% and 40% debt. The total assets of the firm are US$50,000,000. The Net Profit that was reported was US$4,700,500. Since the company was rated as risky, the cost of capital that was assigned to the firm was 16%. You are required to assess whether the company is making a profit in the economic sense?

Solution

One method for calculating the residual income is to subtract net income from an equity charge (In monetary terms, the cost of equity, which is the estimated one).

Use the following data for calculation

- Net income of Firm: 4700500.00

- Total Assets of Firm: 50000000.00

- Equity Capital Ratio: 60%

- Cost of Capital: 16%

First, we need to calculate equity capital

Therefore, calculation of Equity Capital will be as follows,

Total Equity = US$50,000,000 x 60%

- Equity Capital = US$30,000,000

Therefore, calculation of Equity Charge will be as follows,

Equity Charge = Equity capital × Cost of equity capital

= US$30,000,000 × 16%

- Equity Charge = US$4,800,000

Residual Income can be calculated using the below formula as,

Residual Income = Net Income of the firm – Equity charge:

= US$4,700,500 - US$4,800,000

As seen from the negative economic profit, it can be concluded that AEW has not earned enough to cover the equity cost of capital. Although the company is profitable in an accounting sense from the economic sense, it is incurring a loss.