Table Of Contents

What Is A Residential Mortgage?

A residential mortgage is a mortgage used to buy a residence. The residential property bought using the loan is the home where the borrower plans to live; in other words, the property is primarily for personal, family, or household purposes.

Buying a residence is one of life's happiest and most expensive things. So residential mortgages are boon to many people who don't have enough money to purchase a residence. Usually, the buyer has to provide a home loan down payment. When the mortgage is finalized, the buyer makes the down payment, a portion of the home's purchase price. It's a burden for most buyers, increasing with the general rise in home prices.

Table of contents

- What is residential mortgage?

- A residential mortgage refers to the mortgage used by an individual to buy a home where he plans to live.

- There are two kinds of interest rates charged on home mortgage loans: fixed interest rates, where interest rates remain unchanged throughout the tenure, and floating interest rates, where the interest rate keeps changing in line with the market scenarios.

- The buy-to-let (BTL) is different from it. The buy-to-let mortgage is used by landlords who want to buy property to rent it out.

Residential Mortgage Explained

The residential mortgage utilized by people to purchase home exists in different types, mainly based on interest types. The interest rates charged on the loans may be fixed, where the interest rate usually remains the same, or variable interest rates keep changing as per the market value. Variable interest rates or floating rates are a more viable option than fixed interest rates since the interest rates are generally lower. In this case, the borrower bears the risk if the interest rates increase or decrease.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Usually, the term of residential mortgage loans can range from 10 to 30 years, and it is the time fixed to pay off the debt via regular payments. The lender has the right to take ownership of the property once the borrower defaults; that is, the borrower stops making payments on the principal and the loan's interest amount. The lender can sell or dispose of the property to compensate for the loss.

When getting a home mortgage, the down payment is crucial. Lenders sometimes view the down payment quantity as the buyer's (borrower's) investment in the house. Therefore, it may impact the amount the buyer needs to borrow and whether the lender will demand that the buyer pays for private mortgage insurance (PMI). Conventionally the down payment is 20% of the purchase price, and buyers who pay less than 20% of the home's buying price need PMI. Additionally, it will affect the interest rate. The lender frequently offers a cheaper rate if the buyer can make a greater down payment and vice versa since the down payment symbolizes the investment in the house. A VA One-Time Close Construction Loan allows eligible veterans and active-duty service members to finance the construction and permanent mortgage of a new home with a single loan and one closing. This type of VA construction loan for building a home simplifies the process by combining the construction phase and long-term financing, often requiring no down payment and offering competitive VA-backed interest rates. It is specifically designed for owner-occupied residential properties and can be an efficient option for borrowers who want to build a custom home rather than purchase an existing one.

Requirements

The requirements to obtain a residential mortgage or loan are as follows:

- The person or the borrower obtaining the loan must submit their application of the financial history to the bank/ lender. It indicates that the borrower can make future payments on the loan.

- The professional at the lending institution checks the borrower's credit history and other things such as debt, assets, the flow of income, or cash and outflows.

- Based on the analysis, the lender or the bank guarantees the loan amount for the borrower.

- The next step is to fill out the mortgage application form and submit all the details and documents required by the lending agency. The borrower then receives the formal written document that he can take a home loan of a certain amount or less.

- The parties involved agree to the loan amount and other terms and put the property under consideration as collateral for the loan. It gives the authority to the lender to dispose of or sell off the property in case of defaults by the borrower on the repayment.

Examples

Let us look at residential mortgage examples to understand the concept better:

Example #1

Mr.X purchases a property worth $300,000 and pays a down payment of $30,000 (10% of the property's purchase price). The remaining principal amount of the residential mortgage is $270,000, and the fixed interest rate and principal will flow from Mr. X to the bank during the duration of the loan.

Example #2

An individual borrows $400,000 on a 30-year term to buy a house; his monthly principal and interest payments may be about $1500. Part of that $1500 will go toward the $400,000 the individual owes to his lender, and the rest will go to interest.

Residential Mortgage vs Buy-To-Let

- Residential mortgages are for individuals who want to buy residential property. In contrast, buy-to-let loans are given to landlords who want to purchase the property to rent it, and it will be an investment for the landlord.

- The interest rates on residential mortgages are less than on buy-to-let mortgages.

- Residential mortgages come under regulatory protections designed to minimize the lender's risk. However, buy-to-let mortgages are risky since the collateral is not the borrower's home.

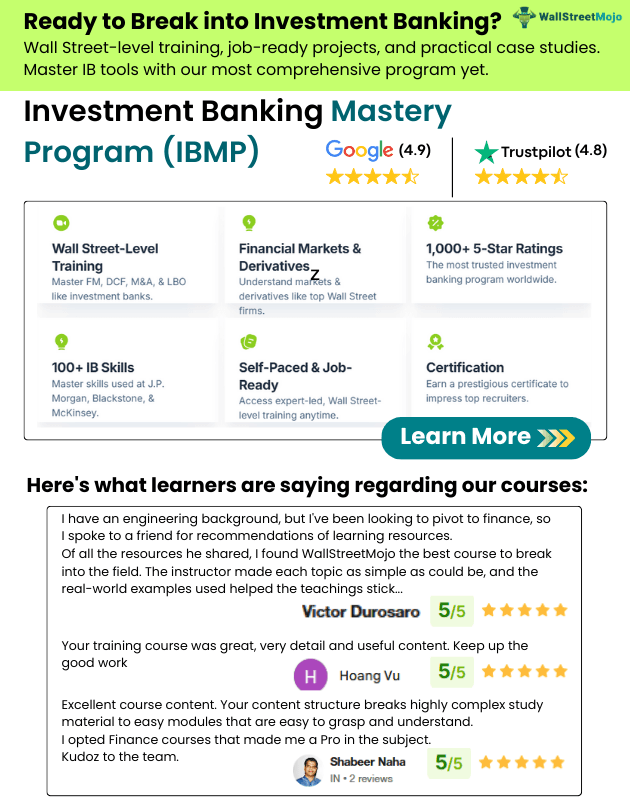

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

What is the most common residential mortgage?

The fixed-rate mortgage is the most common type of residential mortgage. Homeowners repay mortgages over a certain period at an agreed-upon interest rate. The common tenure or period for fixed-rate mortgages is 30 years.

What is the difference between residential and commercial mortgages?

A residential mortgage is a loan secured by a residential property, whereas a commercial mortgage is a loan secured by a commercial property. The former type is less risky since the loan is made based on the home as collateral, credit history, and the background verification of an individual's income sources. In contrast, commercial mortgages are much riskier since the loan payment is generally based on the income from the investments. In other words, the income obtained from the commercial mortgage is generally used to acquire, refinance, or redevelop commercial property.

What are residential mortgage-backed securities?

Residential mortgage-backed securities (RMBS) are a distinct type of debt-based securities backed by a large pool of residential mortgages. It is generally constructed by Fannie Mae, Freddie Mac, or a non-agency investment-banking firm. Investors' income is generated from the payment on these loans by the residential mortgage buyers (borrowers). Investing in it offer less risk and greater profitability to the investors; however, the investors are exposed to prepayment risk and credit risk.