Table Of Contents

What Is The Required Rate Of Return Formula?

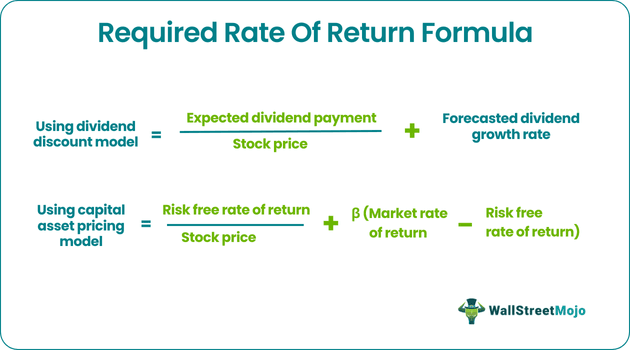

The formula for calculating the required rate of return for stocks paying a dividend is derived using the Gordon growth model. This dividend discount model calculates the required return for equity of a dividend-paying stock by using the current stock price, the dividend payment per share, and the expected dividend growth rate.

The required return equation utilizes the risk-free rate of return and the market rate of return, typically the benchmark index's annual return. On the other hand, calculating the required rate of return for stock not paying a dividend is derived using the Capital Asset Pricing Model (CAPM). The CAPM method calculates the required return by using the beta of security, which is the indicator of the riskiness of that security.

Key Takeaways

- Required rate of return is calculated by the Gordon growth model for dividend-paying stocks by analyzing stock price, dividend payment, and expected growth rate.

- Using beta, the required return is calculated using risk-free and market rates, benchmark indexes' annual returns, and CAPM for non-dividend equities.

- Understanding required return is crucial for investors as it influences investment choices, asset classification, and risk-based decision-making.

- Higher projected returns indicate more robust asset performance and aid in risk management and wise financial decisions.

Required Rate of Return Formula Explained

The required rate of return is also known as the minimum acceptable rate of return. It is the minimum amount of money that an investor can expect to earn if they put their money into any form of project or investment. Based on this calculation, the the investor decides whether to put the money in it or not.

When an individual or a company invest funds in a project or investment avenue, they accept to take some extent of risk associated with it. This return is the compensation received against taking that risk.

The formula for required rate of return depends on factors like risk free rate of return, market risk, risk related to tat specific project and the opportunity cost of foregoing other options. The risk-free rate is the return from government bonds with zero risk, which serves as a benchmark to identify the amount of compensation that an investor should expect depending on the time value of money.

The risk associated with investment in the broader market can also be considered as a benchmark, where the market volatility and economic conditions influence the overall market performance and in turn the returns on investments. However, the particular project or investment opportunity may also be prone to some risk inherent to it which are important considerations. It may also be company specific, related to its financial conditions, rules or legal terms. They influence the required rate of return. Thus, the rate is fixed after considering all the above.

There are some common The formula for required rate of return or methods that are commonly used to calculate this return.

The formula using the dividend discount model is represented as,

Required Rate of Return formula = Expected dividend payment / Stock price + Forecasted dividend growth rate

The formula using the CAPM method is represented as,

Required Rate of Return formula = Risk-free rate of return + β * (Market rate of return - Risk-free rate of return)

It is important to take informed financial decisions so that one can earn maximum return out of the money based on the policy of risk and return trade off.

How To Calculate?

Let us identify the various minimum required rate of return formula that are commonly used to calculate the required rate of return on an investment.

#1- Dividend Discount Model

For stock paying a dividend, the required rate of return (RRR) formula can be calculated by using the following steps:

Firstly, determine the dividend to be paid during the next period.

Next, gather the current price of the equity from the stock.

Now, try to figure out the expected growth rate of the dividend based on management disclosure, planning, and business forecast.

Finally, the required rate return is calculated by dividing the expected dividend payment (step 1) by the current stock price (step 2) and then adding the result to the forecasted dividend growth rate (step 3) as shown below,

Required rate of return formula = Expected dividend payment / Stock price + Forecasted dividend growth rate

#2 -CAPM Model

The minimum required rate of return formula for a stock not paying any dividend can be calculated by using the following steps:

Step 1: Firstly, determine the risk-free rate of return, which is the return of any government issues bonds such as 10-year G-Sec bonds.

Step 2: Next, determine the market rate of return, the annual return of an appropriate benchmark index such as the S&P 500 index. The market risk premium can be calculated by deducting the risk-free return from the market return.

Market risk premium = Market rate of return - Risk-free rate of return

Step 3: Next, compute the stock's beta based on its stock price movement vis-à-vis the benchmark index.

Step 4: Finally, the required rate of return formula finance is calculated by adding the risk-free rate to the product of beta and market risk premium (step 2) as given below,

The required rate of return formula = Risk-free rate of return + β * (Market rate of return - Risk-free rate of return)

Examples (with Excel Template)

Let’s see some simple to advanced examples to understand the calculation of the Required Rate of Return better.

Example #1

Let us take an example of an investor considering two securities of equal risk to include one of them in his portfolio.

Determine which security should be selected based on the following information:

Below is data for calculation of the required rate of return for Security A and Security B.

| Particulars | Security A | Security B |

|---|---|---|

| Expected Dividend | $10 | $8 |

| Current Stock Price | $160 | $100 |

| Forecasted Dividend Growth Rate | 5% | 4% |

The required return of security A can be calculated as,

Required return for security A = $10 / $160 * 100% + 5%

The required return for security A= 11.25%

The required return of security B can be calculated as,

Required return for security B = $8 / $100 * 100% + 4%

The required return for security B = 12.00%

Based on the given information, Security A should be preferred for the portfolio because its lower required return gave the risk level.

Example #2

Calculate the required rate of return formula finance based on the given information. Let us take an example of a stock with a beta of 1.75, i.e., it is riskier than the overall market. Further, the US treasury bond's short-term return stood at 2.5%, while the benchmark index is characterized by a long-term average return of 8%.

- Given, Risk-free rate = 2.5%

- Beta = 1.75

- Market rate of return = 8%

Below is data for the calculation of a required rate of return of the stock-based.

| Risk Free Rate | 2.50% |

| Beta of the Stock | 1.75 |

| Market Rate of Return | 8.00% |

Therefore, the required return of the stock can be calculated as,

Required return = 2.5% + 1.75 * (8% - 2.5%)

= 12.125%

Therefore, the required return of the stock is 12.125%.

Thus, the above examples give us an insight into how the investors who may be individuals or companies, determine the minimum amount of return that will justify the risk that they are taking while investing in various avenues. The examples help in understanding the evaluation process undertaken while deciding whether it is worth putting the money in an opportunity or there are better options for the same.

Relevance and Uses

The required rate of return has various important uses in the finance and investment analysis process. Given below are some common applications.

- It is important to understand the concept of the required return as investors use it to decide on the minimum amount of return required from an investment. Based on the required returns, an investor can decide whether to invest in an asset based on the given risk level.

- The required return for a stock with a high beta relative to the market should have been higher because it is necessary to compensate investors for the added risk associated with the investment. Also, an investor can use the required returns for ranking the assets and eventually make the investment as per the ranking and include them in the portfolio. In short, the higher the expected return, the better is the asset.

- Thus, it helps in investment evaluation and assessing the attractiveness of the opportunity. By comparing the projected return with the required return, it is possible to understand whether it go ahead with a financial decision or not.

- It helps companies estimate the cost of capital, which is the rate of return that will satisfy stakeholders and meet their expectations. It also helps in evaluating the possibility of merger and acquisition, determination of capital structure or assessing the viability of a project.

- The formula also helps in managing risk because the investor can identify the trade off between the risk and reward between different options and take informed financial decision.